Are you struggling to write a 10 Day Right To Redemption Letter? Don’t worry, we’ve got you covered! In this article, we will provide you with templates, examples, and samples to make it easy for you to write any letter that you need.

We understand that writing a letter can be a daunting task, especially when it comes to legal matters. That’s why we have compiled a variety of samples for you to choose from, so you can find the one that best suits your needs. We will also provide you with tips on how to write the letter effectively and efficiently.

Key points:

– We will share samples of 10 Day Right To Redemption Letter

– We will provide tips on how to write the letter effectively

– We will share the Do’s and Don’ts of writing this type of letter.

10 Day Right To Redemption Letter

Dear [Borrower’s Name],

We are writing this letter to inform you that you have a 10-day right to redemption period starting from the date of this letter. This right to redemption means that you have the opportunity to redeem your property by paying the full amount owed on your loan, including any interest, fees, and expenses.

As you may already know, your property was recently foreclosed upon due to non-payment of your mortgage loan. However, the right to redemption period provides you with a chance to reclaim your property and prevent it from being sold at a public auction.

During this 10-day period, we encourage you to take immediate action to pay off your loan in full. This will not only allow you to keep your property but also help you avoid any additional fees or expenses associated with the foreclosure process.

If you are unable to pay off your loan in full within the 10-day period, your property will be sold at a public auction. At this point, you will no longer have the right to redeem your property, and any remaining funds from the sale will be used to pay off your outstanding debt.

We understand that this may be a difficult and stressful time for you. However, we want to remind you that we are here to help you navigate through this process and answer any questions you may have.

Please do not hesitate to contact us if you need any assistance or have any questions regarding the right to redemption period.

Sincerely,

[Your Name]

[Your Company Name]

10 Day Right To Redemption Letter In Real Estate

Dear [Name of property owner],

I am writing to inform you that you have a 10-day right to redemption period for your property located at [Address of the property]. This right to redemption period begins on the date of the sale of the property at a foreclosure auction.

During this 10-day period, you have the right to redeem your property by paying the full amount of the outstanding mortgage debt, plus any additional costs and fees associated with the foreclosure process.

If you choose to exercise your right to redemption, please contact me as soon as possible to discuss the specific terms and conditions of the redemption process. Failure to redeem the property within the 10-day period will result in the transfer of ownership to the winning bidder at the foreclosure auction.

Please be aware that time is of the essence in this matter, and I strongly encourage you to act quickly to protect your property rights.

Sincerely,

[Your Name]

10 Day Right To Redemption Simple Letter

Dear [Lender],

I am writing to exercise my 10-day right to redemption under [state law/code]. As you are aware, my property [address] was foreclosed upon and sold at auction on [date].

I understand that under the law, I have the right to redeem the property by paying the full amount owed plus any additional fees and costs incurred by the foreclosure process. I am prepared to do so within the 10-day period allowed by law.

Please provide me with the exact amount owed, including any fees and costs, as well as instructions on how to make the payment. I would also appreciate a confirmation in writing that my redemption has been accepted and that the foreclosure has been cancelled.

Thank you for your prompt attention to this matter.

Sincerely,

[Your Name]

10 Day Statutory Right To Redemption Letter

Dear [Lender],

I am writing to exercise my 10-day statutory right to redemption under [state law]. As the borrower of the property located at [address], I am requesting the opportunity to redeem the property before any foreclosure sale takes place.

I understand that I have until [date] to redeem the property by paying the full amount of the outstanding debt, including any accrued interest, fees, and costs associated with the foreclosure process. I am willing and able to fulfill this obligation and redeem the property in full.

Please provide me with the necessary information and instructions on how to proceed with the redemption process. I would appreciate your prompt response and cooperation in this matter.

Thank you for your attention to this matter.

Sincerely,

[Your Name]

10 Day Right To Redemption In Mortgage Letter

Dear [Borrower],

As you are aware, you have defaulted on your mortgage loan and we have initiated foreclosure proceedings on your property. However, we want to inform you that you have a 10-day right to redemption period during which you may redeem your property by paying the full amount owed on your mortgage loan.

During this 10-day period, you have the opportunity to save your property from foreclosure and retain ownership. If you choose to exercise your right to redemption, you must pay the full amount owed on your mortgage loan, including any interest, fees, and costs associated with the foreclosure process.

If you do not exercise your right to redemption within the 10-day period, we will proceed with the foreclosure sale of your property. This means that your property will be sold at a public auction, and you will lose ownership of the property.

We encourage you to act quickly and seek legal counsel if necessary to determine your best course of action. If you have any questions or concerns regarding your right to redemption, please do not hesitate to contact us.

Sincerely,

[Lender]

10 Day Right To Redemption Letter Sample

[Your Name]

[Your Address]

[City, State ZIP Code]

[Date]

[Name of Lender]

[Address of Lender]

[City, State ZIP Code]

Subject: 10 Day Right to Redemption Letter

Dear [Lender’s Name],

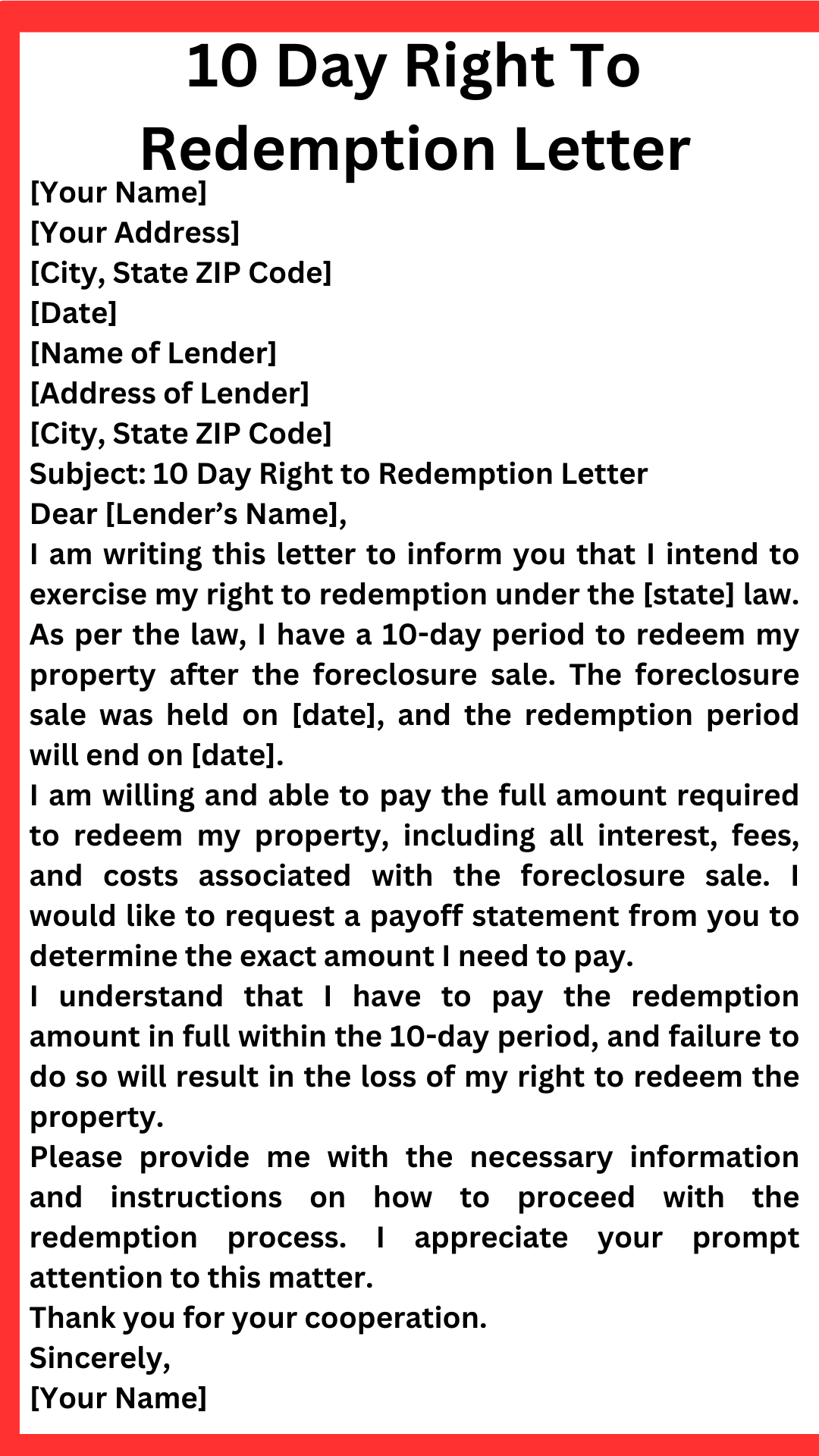

I am writing this letter to inform you that I intend to exercise my right to redemption under the [state] law. As per the law, I have a 10-day period to redeem my property after the foreclosure sale. The foreclosure sale was held on [date], and the redemption period will end on [date].

I am willing and able to pay the full amount required to redeem my property, including all interest, fees, and costs associated with the foreclosure sale. I would like to request a payoff statement from you to determine the exact amount I need to pay.

I understand that I have to pay the redemption amount in full within the 10-day period, and failure to do so will result in the loss of my right to redeem the property.

Please provide me with the necessary information and instructions on how to proceed with the redemption process. I appreciate your prompt attention to this matter.

Thank you for your cooperation.

Sincerely,

[Your Name]

10 Day Homeowner Right To Redemption Letter

Dear [Lender],

I am writing to inform you that as the homeowner, I am exercising my right to redemption under [state] law. As per the law, I have 10 days from the date of the foreclosure sale to redeem my property by paying the full amount owed on the mortgage, plus any additional fees or costs.

I understand that the foreclosure sale took place on [date], and therefore, my deadline to redeem the property is [10 days from the sale date]. I am currently working to gather the necessary funds to redeem the property and will provide proof of payment as soon as possible.

I request that you provide me with the exact amount owed on the mortgage, including any additional fees or costs, as well as any instructions or requirements for redeeming the property. Please also let me know if there are any other steps I need to take in order to complete the redemption process.

Thank you for your attention to this matter. I look forward to working with you to redeem my property.

Sincerely,

[Your Name]

10 Day Right To Redemption Of Property Letter

Dear [Borrower],

This letter is to inform you that you have a 10-day right to redemption of your property. As per the terms of your loan agreement, you have defaulted on your loan payments, and the lender has initiated the foreclosure process.

However, you have the right to redeem your property within 10 days of receiving this notice by paying the full amount owed on the loan, including any interest, fees, and costs associated with the foreclosure process.

If you choose to exercise your right to redemption, please contact the lender as soon as possible to arrange payment. Failure to redeem the property within the specified time frame will result in the foreclosure sale of the property.

We encourage you to seek legal advice and explore all available options to avoid foreclosure and protect your property rights.

Sincerely,

[Lender]

10 Day Right To Redemption Letter Template

[Your Name]

[Your Address]

[City, State ZIP Code]

[Date]

[Name of Lender]

[Address of Lender]

[City, State ZIP Code]

Re: Right to Redemption Notice

Dear Sir/Madam,

I am writing this letter to exercise my right to redemption under [state law/code]. As per the law, I have the right to redeem my property from the foreclosure sale within ten days after the sale.

I am the owner of the property located at [property address]. The property was sold in a foreclosure sale on [date of sale] to [name of buyer]. I am now exercising my right to redeem the property by paying the full amount of the outstanding debt, including interest, fees, and any other expenses incurred by the lender.

I am enclosing a certified check for the total amount of the outstanding debt, which is [amount]. Please let me know the exact amount due and the procedure for redemption. I would appreciate it if you could provide me with a written statement of the amount due and the redemption procedure.

I understand that I have ten days from the date of this letter to redeem the property. I request that you provide me with a confirmation of the redemption and release of the lien on the property.

Thank you for your attention to this matter.

Sincerely,

[Your Name]

10 Day Right To Redemption Formal Letter

[Your Name]

[Your Address]

[City, State ZIP Code]

[Date]

[Name of Lender]

[Address of Lender]

[City, State ZIP Code]

Re: Right to Redemption Notice

Dear Sir/Madam,

I am writing this letter to inform you that I am exercising my right to redemption under the laws of [State] with respect to the property located at [Property Address]. As per the [State] law, I have a 10-day period to redeem the property by paying the full amount due on the property.

I understand that the redemption period will expire on [Date], and I am willing and able to pay the full amount due on the property, including any fees, interest, and costs associated with the foreclosure process.

Please provide me with the exact amount due on the property, including any fees, interest, and costs associated with the foreclosure process, so that I can make the necessary arrangements to pay the amount due within the 10-day period.

I would appreciate it if you could provide me with a written confirmation of the amount due on the property, as well as the instructions on how to make the payment.

Thank you for your attention to this matter.

Sincerely,

[Your Name]

How to Write 10 Day Right To Redemption Letter

Introduction

Writing a 10-day right to redemption letter can be a daunting task, especially if you have never done it before. However, with a little guidance, you can write a letter that is clear, concise, and effective in protecting your rights. In this article, we will guide you through the process of writing a 10-day right to redemption letter.

What is a 10-day right to redemption letter?

A 10-day right to redemption letter is a legal document that is sent to a borrower who is in default on their mortgage. The letter gives the borrower 10 days to pay the outstanding balance on their mortgage and avoid foreclosure. If the borrower fails to pay the outstanding balance within the 10-day period, the lender can proceed with foreclosure proceedings.

Why is it important to write a 10-day right to redemption letter?

Writing a 10-day right to redemption letter is important because it can help you avoid foreclosure. If you are in default on your mortgage, the lender may initiate foreclosure proceedings. However, if you write a 10-day right to redemption letter and pay the outstanding balance within the 10-day period, you can avoid foreclosure and keep your home.

How to write a 10-day right to redemption letter

When writing a 10-day right to redemption letter, it is important to include the following information:

1. Your name, address, and contact information

2. The lender’s name, address, and contact information

3. The date of the letter

4. A statement that you are in default on your mortgage

5. The amount of the outstanding balance on your mortgage

6. A request for a 10-day right to redemption

7. A statement that you intend to pay the outstanding balance within the 10-day period

Tips for writing a 10-day right to redemption letter

When writing a 10-day right to redemption letter, it is important to keep the following tips in mind:

1. Be clear and concise in your writing

2. Use simple language that is easy to understand

3. Provide all necessary information, including your name, address, and contact information

4. Be polite and professional in your tone

5. Make sure to send the letter via certified mail to ensure that it is received by the lender

Conclusion

Writing a 10-day right to redemption letter is an important step in protecting your home from foreclosure. By following the tips outlined in this article, you can write a letter that is clear, concise, and effective in protecting your rights. Remember to be polite and professional in your tone, and to send the letter via certified mail to ensure that it is received by the lender.

Mistakes to Avoid When You Write 10 Day Right To Redemption Letter

Introduction

A 10-day right to redemption letter is a legal document that allows a borrower to reclaim their property after it has been sold in a foreclosure sale. This letter is a crucial piece of communication that requires careful consideration and attention to detail. Unfortunately, many people make mistakes when drafting this letter, which can lead to legal complications and further financial burdens. In this article, we’ll explore some common mistakes to avoid when writing a 10-day right to redemption letter.

Mistake #1: Failing to Understand the Purpose of the Letter

The first and most crucial mistake to avoid is failing to understand the purpose of the 10-day right to redemption letter. This letter is a legal document that allows a borrower to reclaim their property after it has been sold in a foreclosure sale. It is essential to understand the legal implications of this letter and ensure that it is drafted correctly to avoid any legal complications.

Mistake #2: Using Inaccurate Information

Another common mistake is using inaccurate information in the 10-day right to redemption letter. This can include incorrect dates, property information, or legal terms. It is essential to double-check all information before submitting the letter to ensure that it is accurate and up-to-date.

Mistake #3: Failing to Include Key Information

A 10-day right to redemption letter must include specific information, such as the borrower’s name, address, and contact information, the property address, and the date of the foreclosure sale. Failing to include this information can result in the letter being rejected or delayed, which can lead to further legal complications.

Mistake #4: Using Inappropriate Language

When drafting a 10-day right to redemption letter, it is essential to use appropriate language. Avoid using slang or informal language, as this can make the letter appear unprofessional and may lead to it being rejected. Instead, use formal language and legal terminology to ensure that the letter is taken seriously.

Mistake #5: Failing to Seek Legal Advice

Finally, one of the most significant mistakes to avoid when writing a 10-day right to redemption letter is failing to seek legal advice. This letter is a legal document that has significant legal implications. It is essential to consult with an attorney before drafting the letter to ensure that it is legally sound and meets all necessary requirements.

Conclusion

In conclusion, a 10-day right to redemption letter is a crucial piece of communication that requires careful consideration and attention to detail. By avoiding these common mistakes, you can ensure that your letter is legally sound and meets all necessary requirements. Remember to seek legal advice and double-check all information before submitting the letter to avoid any legal complications.

Related:

120 Days Notice To Terminate Employment Letter (10 Samples)

14 Day Letter To Demand Baltimore (10 Samples)

14 Day Letter To Landlord (10 Samples)