Need to understand your insurance coverage? A “Request for Insurance Coverage Summary Letter” is your go-to document. It’s a formal request. You ask your insurance provider for a summary. The summary outlines your policy details. This includes covered benefits and limits. It helps clarify what your insurance actually covers.

Writing this letter might seem tricky. Don’t worry, you are at the right place. We’ve got you covered. This article offers helpful resources. We’ll share request for insurance coverage summary letter templates. You’ll find examples and samples. Use them to craft your own perfect insurance coverage summary request. Get your hands on these sample letters today.

We aim to simplify the process. Our goal is to make it easy for you. You can easily adapt the letters to your needs. This way, you can clearly communicate with your insurance company. Writing a letter to request an insurance summary is easy with these examples. So, let’s dive in!

[Your Name/Your Company Name]

[Your Address]

[Your Phone Number]

[Your Email Address]

[Date]

[Insurance Company Name]

[Insurance Company Address]

Subject: Request for Insurance Coverage Summary

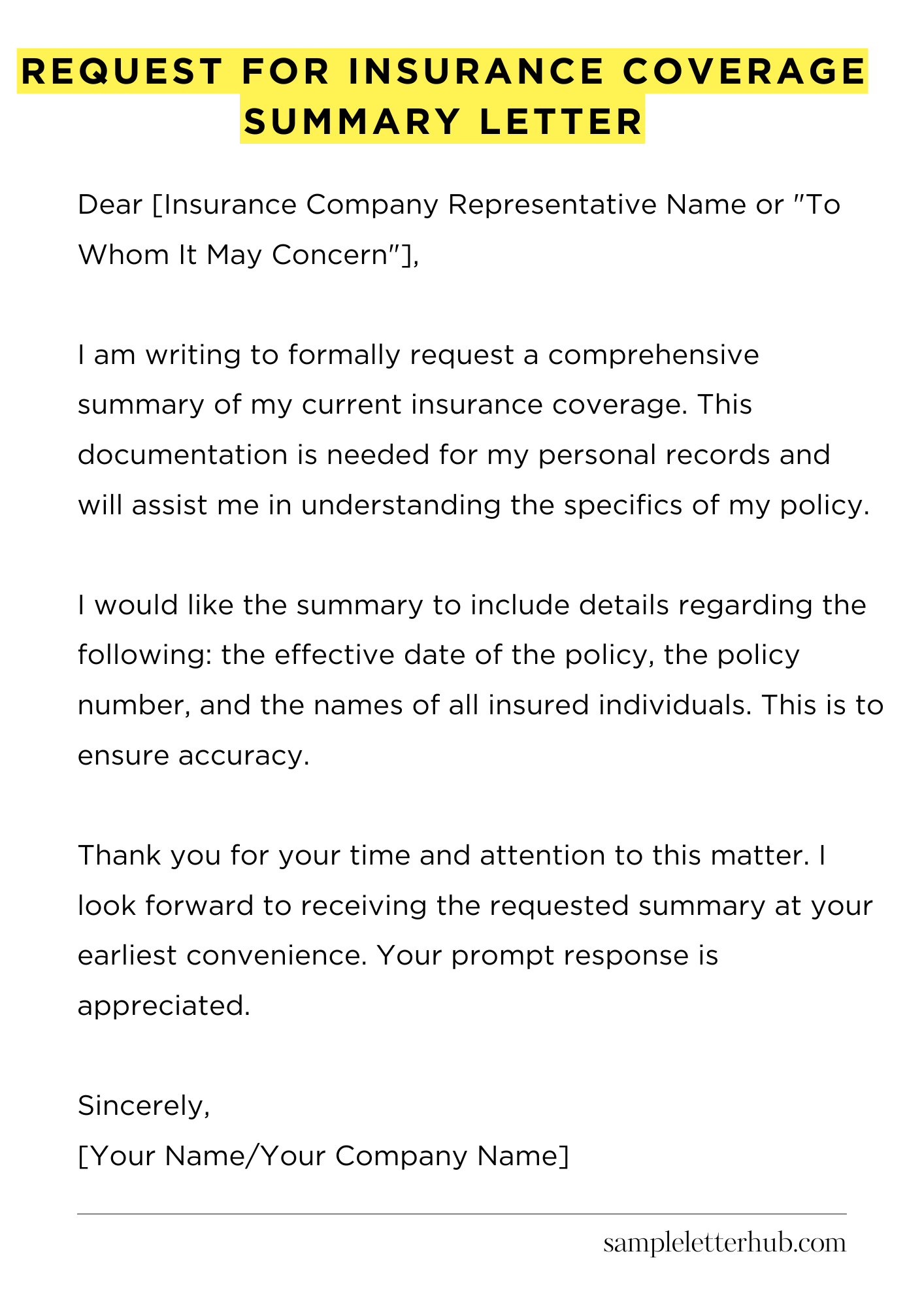

Dear [Insurance Company Representative Name or “To Whom It May Concern”],

I am writing to formally request a comprehensive summary of my current insurance coverage. This documentation is needed for my personal records and will assist me in understanding the specifics of my policy. It’s important to be informed.

I would like the summary to include details regarding the following: the effective date of the policy, the policy number, and the names of all insured individuals. This is to ensure accuracy. Please also provide clear information about the type of coverage I have.

Specifically, I need a breakdown of the coverage limits, deductibles, and any specific exclusions that apply to my plan. Such detail is necessary for informed decision-making. The information should cover all aspects of my policy, including any riders or additional coverage options. It is really helpful to have everything in one place.

If possible, I would appreciate receiving this summary in a clear and easy-to-understand format. An electronic copy would be most convenient, but a hard copy sent via mail would also be acceptable. Please let me know if there are any associated fees for this service. I’d like to be prepared.

Thank you for your time and attention to this matter. I look forward to receiving the requested summary at your earliest convenience. Your prompt response is appreciated.

Sincerely,

[Your Name/Your Company Name]

How to Write Request for Insurance Coverage Summary Letter

Crafting a compelling request for an insurance coverage summary is a crucial skill. A well-constructed letter guarantees clarity and efficiency in obtaining the information you require. This guide will walk you through the essential steps, ensuring your request is both effective and easily understood.

1. Initiate: The Salutation and Recipient Details

The commencement of your missive is paramount. Begin with a formal salutation, such as “Dear [Insurance Provider Name],” or “To Whom It May Concern.” Subsequently, meticulously state the full name of the insurance company and the specific department you are addressing. Accuracy here is vital for prompt processing of your request. Always ascertain the correct title and addressee; a misdirected letter can endure bureaucratic delays.

2. The Core Tenet: Subject Line and Policy Identification

Your subject line must unequivocally announce the purpose of the communication. Utilize a concise and explicit subject line; for example, “Request for Insurance Coverage Summary – [Policy Number].” Immediately after the salutation, specify the pertinent policy information. Include the policy number, type of insurance (e.g., auto, home, health), and the insured party’s name. This eliminates any ambiguity and enables the insurer to promptly access the relevant files.

3. Delineate Your Precise Needs

Articulate your specific requirements in a clear and concise manner. Explicitly state that you are requesting a comprehensive summary of your insurance coverage. Be precise: specify the dates for which you need the summary. Do you need details on deductibles, policy limits, or covered perils? The more granular your request, the more accurately the insurer can provide the information. Make your needs evident to avoid the common mistake of a convoluted request.

4. Enclose Supporting Documentation (If Applicable)

Depending on the insurance provider’s requirements, you may need to include supporting documentation. If you’ve undergone a name change, a copy of the legal document reflecting the alteration might be necessary. Also, depending on the nature of the request, a copy of your driver’s license, passport, or any document which validates your identity may need to be enclosed. Always comply with the stipulations of the insurer; this expedites the process. Ensure copies are legible and securely attached.

5. The Conclusion: Express Gratitude and Provide Contact Details

Conclude your letter with a professional and appreciative closing, such as “Thank you for your prompt attention to this matter.” Include your full name, mailing address, phone number, and email address. This ensures that the insurer can easily contact you if they have any questions or need further clarification. Correct contact information reduces the possibility of miscommunication and delays.

6. The Art of Review: Proofreading and Editing

Before dispatching your letter, subject it to a rigorous review. Scrutinize the text for grammatical errors, spelling mistakes, and factual inaccuracies. Check for clarity and conciseness, making sure your message is easily understandable. A polished letter reflects professionalism and significantly improves the likelihood of a positive outcome. Seek a second opinion if possible – another set of eyes often catches issues that you may miss.

7. Delivery and Documentation: Sending the Letter and Keeping Records

Choose your delivery method wisely. Certified mail with return receipt requested is highly recommended, as it provides proof of delivery. Alternatively, you can use the mail services which provide delivery confirmation to keep an evidence of delivery. Make a copy of the letter and any attached documentation for your records. Keeping a comprehensive record is prudent; should any disputes arise later, you will have irrefutable proof of your request.

FAQs about Request for Insurance Coverage Summary Letter

What information is typically included in an insurance coverage summary letter?

An insurance coverage summary letter generally includes key details about your insurance policy. This can encompass the policyholder’s name, the insurance company’s name, the policy number, the effective dates of coverage, and a brief overview of the types of coverage provided (e.g., medical, dental, vision, life, etc.). It may also specify the deductibles, co-pays, and coverage limits for each type of benefit.

How do I request an insurance coverage summary letter?

To obtain an insurance coverage summary letter, you’ll typically need to contact your insurance provider directly. This can be done via phone, through their online portal or website, or by sending a written request. You will usually need to provide your policy number and may be asked to verify your identity. Check your insurance company’s website or policy documents for specific instructions on how to request this letter.

Why would I need an insurance coverage summary letter?

There are several reasons why you might need an insurance coverage summary letter. It’s often required when you are enrolling in a new health plan or if you are switching health insurance providers. You might also need it when dealing with healthcare providers, for instance when coordinating benefits with other insurance coverage you may have. Additionally, the letter may be needed for legal, financial, or tax purposes, for example, to verify coverage or for documentation relating to medical expenses.

How long does it take to receive an insurance coverage summary letter?

The timeframe to receive an insurance coverage summary letter can vary depending on the insurance company and the method of request. For online requests, you might be able to download it immediately, or receive it within a few business days. Requests made by phone or mail could take longer, perhaps one or two weeks. You can inquire about the expected processing time when you make your request.

Is there a cost associated with requesting an insurance coverage summary letter?

In most instances, insurance companies provide coverage summary letters without any charge. However, it’s always a good idea to confirm with your insurance provider whether a fee applies, particularly if you are requesting multiple copies or if the letter requires extensive customization. Check your policy documentation or contact your insurer directly to clarify any potential costs.

Related:

Resignation letter due to rude boss

Resignation letter moving to another state

Resignation letter due to illness of family member

Resignation letter due to study

Resignation letter due to long commute