Life happens. Bills pile up. Sometimes, paying your property insurance on time can be tough. A property insurance payment extension request is a formal way to ask your insurer for more time. Its purpose is simple: to avoid policy cancellation and keep your home or property protected.

Need to request an extension? You’re in the right place! We’ll give you a helping hand. This article offers sample property insurance payment extension request letters. We’ve got templates and examples ready. These samples will guide you. Writing your letter will be a breeze.

Whether you’re struggling financially or just need a little extra time, these letter templates will help. Customize them to fit your situation. Protect your valuable property. Let’s get started crafting your payment extension request!

[Your Name/Your Company Name]

[Your Address]

[Your Phone Number]

[Your Email Address]

[Date]

[Insurance Company Name]

[Insurance Company Address]

Subject: Request for Extension of Property Insurance Premium Payment

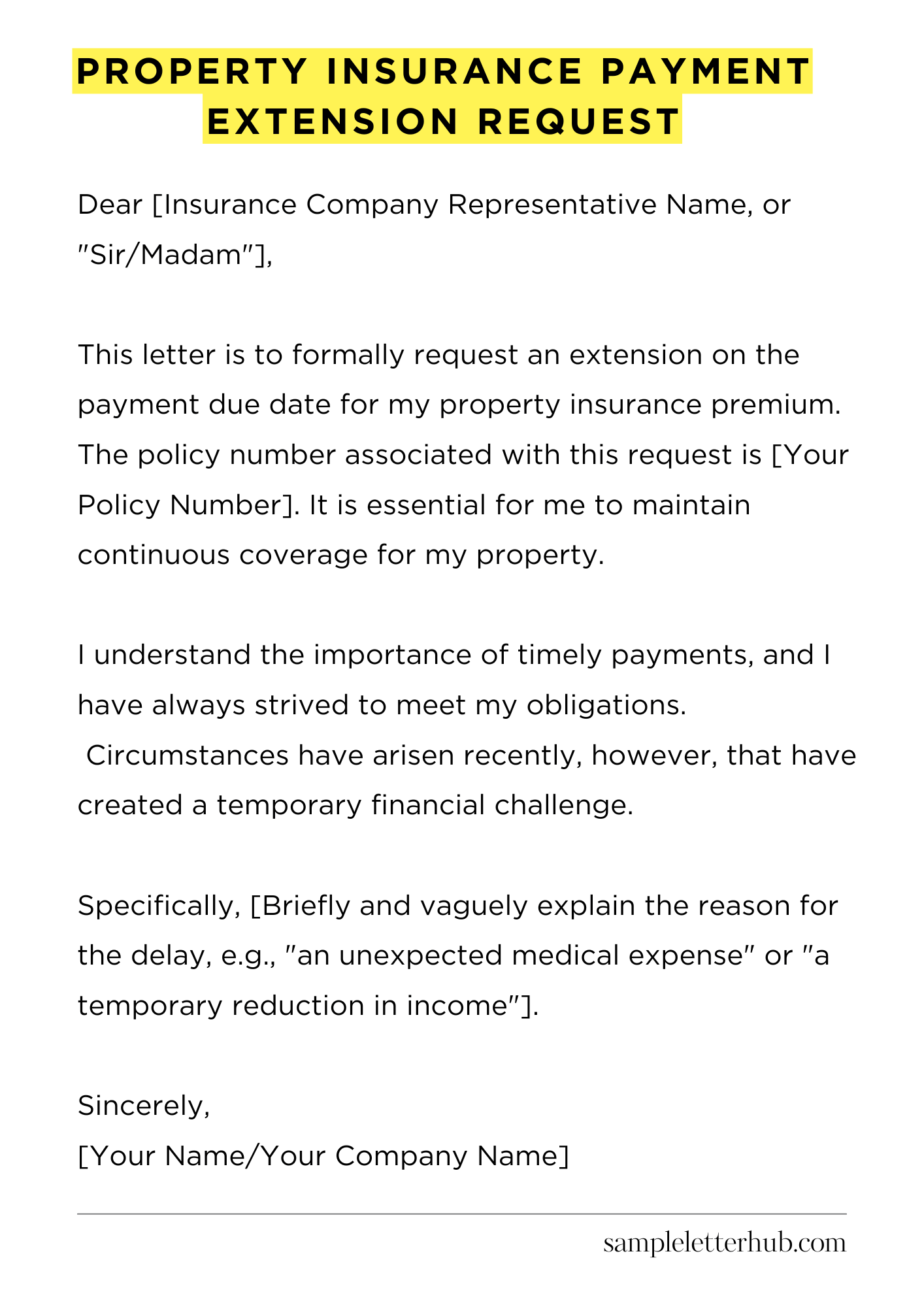

Dear [Insurance Company Representative Name, or “Sir/Madam”],

This letter is to formally request an extension on the payment due date for my property insurance premium. The policy number associated with this request is [Your Policy Number]. It is essential for me to maintain continuous coverage for my property.

I understand the importance of timely payments, and I have always strived to meet my obligations. Circumstances have arisen recently, however, that have created a temporary financial challenge.

Specifically, [Briefly and vaguely explain the reason for the delay, e.g., “an unexpected medical expense” or “a temporary reduction in income”]. I understand this is an inconvenience, and I sincerely apologize for any disruption this might cause.

My current payment due date is [Original Due Date]. I would be grateful if you would consider extending the due date to [Requested New Due Date]. This extension would give me the necessary time to resolve my current financial situation. I am committed to making the full payment.

I would appreciate it if you could review my request. Please let me know if an extension is possible and what steps, if any, I need to take to facilitate the process.

Contacting me at your earliest convenience would be greatly appreciated. I can be reached by phone at [Your Phone Number] or by email at [Your Email Address]. Thank you very much for your understanding and cooperation in this matter.

Sincerely,

[Your Name/Your Company Name]

How to Write Property Insurance Payment Extension Request

Deciphering the Initial Phase: Grasping the Premise

A property insurance payment extension request is, fundamentally, a formal petition. Its purpose? To implore your insurer for a reprieve: an allowance of additional time to fulfill your premium obligations.

This is often necessitated by unforeseen financial exigencies or extenuating circumstances. Successfully navigating this process hinges on a precise and strategically crafted initial approach. The letter’s tone must be both professional and proactive, evincing a genuine commitment to maintaining your insurance coverage.

Formulating the Prolegomenon: Essential Components

Every effective request adheres to a standardized format. Begin by providing your full name, mailing address, and the policy number associated with your property insurance. Next, clearly state the date of the letter. Then comes the crux: the salutation. “Dear [Insurance Company Name] Claims Department” is a safe and professional choice. Remember this is the foundation.

Articulating the Core Request: Presenting Your Case

The body of your letter is where you articulate your need. Start by explicitly requesting an extension for your premium payment. Immediately follow with a lucid, factual explanation of why you require this grace period.

Be specific; vagueness is detrimental. Examples of compelling reasons encompass temporary job loss, unexpected medical expenses, or any event that critically impacts your finances. State the exact payment date you’re aiming for.

Navigating the Labyrinth: Providing Supporting Documentation

While your words are crucial, corroborating evidence fortifies your plea. Attach documentation that validates your hardship. This might include: recent bank statements, medical bills, unemployment verification, or any documents demonstrating the financial constraints you’re under. The more convincing your supporting materials, the better your chances of a favorable response.

Cultivating the Ambiance: Maintaining a Professional Tone

Your communication style can greatly affect the outcome. Maintain a respectful and professional tone throughout the letter. Avoid accusatory language or emotional outbursts. Instead, convey your situation with clarity and conciseness, demonstrating a sense of responsibility and a sincere desire to resolve the issue amicably. Consider using formal language, not slang.

The Epilogue: Closing and Formalities

Conclude your letter with a polite but firm closing. “Sincerely,” or “Respectfully,” are both suitable options. Include your full printed name and signature below your closing. Ensure you provide your contact information (phone number and email address) for ease of communication and so the receiver can reach you. Double-check all details before sending.

Disseminating the Missive: Submission and Follow-Up

Once finalized, send your letter to the appropriate department within the insurance company. This information will generally be listed in your insurance policy documents or on the company’s website.

Send your request via certified mail with return receipt requested. This provides proof of delivery and ensures a paper trail. Follow up, a week or so later, if you don’t receive a response. This demonstrates your commitment and keeps your request top-of-mind.

FAQs about Property Insurance Payment Extension Request

What is a property insurance payment extension request?

A property insurance payment extension request is a formal request made by a policyholder to their insurance provider, seeking additional time to pay their premium. This extension allows the policyholder to avoid potential policy cancellation due to late payment.

How do I request an extension for my property insurance payment?

The process for requesting an extension typically involves contacting your insurance provider directly. You can usually do this by phone, email, or through their online portal. Be prepared to provide your policy number and explain the reason for your inability to pay on time. The insurance company will then review your request and inform you of their decision.

What are the potential consequences of not paying property insurance on time?

Failure to pay your property insurance premium on time can lead to several negative outcomes. These include late fees, policy lapse (cancellation), and a gap in coverage.

A lapsed policy means you are not protected against financial losses resulting from covered events like fire, theft, or natural disasters. Additionally, a history of late payments can negatively impact your ability to secure future insurance coverage or may result in higher premiums.

What factors are considered when an insurance company reviews an extension request?

Insurance companies consider various factors when evaluating extension requests. These often include your payment history, the reason for the delay, the length of the requested extension, and the specific terms of your policy.

Some providers might be more lenient with long-standing, reliable customers. Providing documentation to support your reason for delay (e.g., a medical bill) can also strengthen your case.

What happens if my extension request is denied?

If your extension request is denied, you typically have a few options. You may need to pay the outstanding premium immediately to avoid policy cancellation.

You might also be able to explore payment plan options, if available, with your insurance provider. If you are unable to reach an agreement, it is essential to understand the policy’s cancellation terms and explore options for securing coverage elsewhere.

Related:

Resignation letter due to rude boss

Resignation letter moving to another state

Resignation letter due to illness of family member

Resignation letter due to study