Struggling to make your mortgage payments? You might need a mortgage insurance hardship letter. This hardship letter explains your financial difficulties. Its purpose is to request assistance from your mortgage lender or mortgage insurance provider.

Writing a hardship letter can feel overwhelming. Don’t worry, we’re here to help! We’ve prepared several mortgage insurance hardship letter templates, examples, and samples. Use them as a guide to craft your own compelling letter.

These sample hardship letters are designed to be easy to adapt. They cover different scenarios. Whether you’ve faced job loss, medical bills, or other challenges, we have you covered. Let these examples make it easy to write your hardship letter.

[Your Name]

[Your Address]

[Your Phone Number]

[Your Email Address]

[Date]

[Mortgage Lender’s Name]

[Mortgage Lender’s Address]

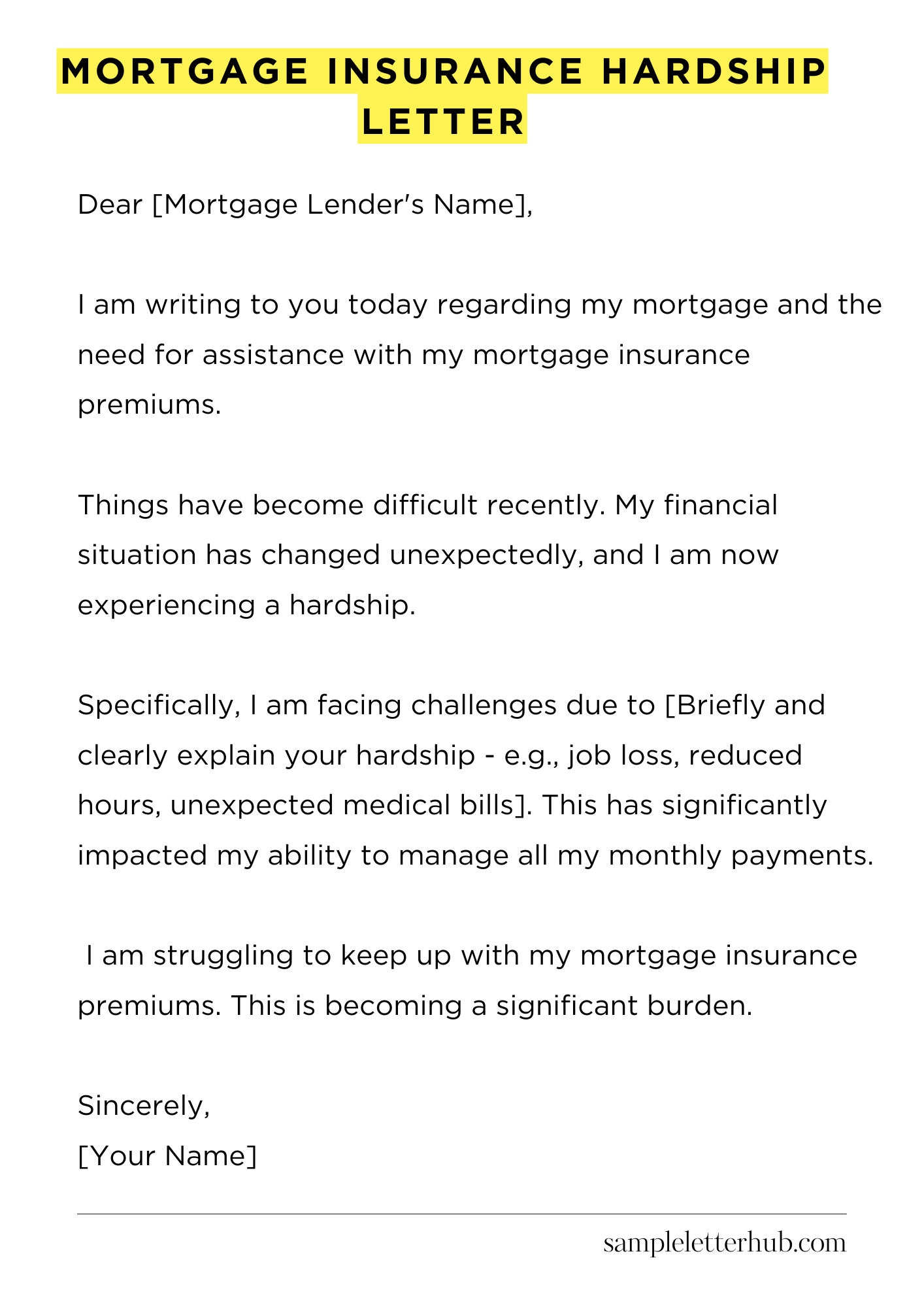

Dear [Mortgage Lender’s Name],

I am writing to you today regarding my mortgage and the need for assistance with my mortgage insurance premiums. Things have become difficult recently. My financial situation has changed unexpectedly, and I am now experiencing a hardship.

Specifically, I am facing challenges due to [Briefly and clearly explain your hardship – e.g., job loss, reduced hours, unexpected medical bills]. This has significantly impacted my ability to manage all my monthly payments. I am struggling to keep up with my mortgage insurance premiums. This is becoming a significant burden.

My current mortgage insurance premium is [State the amount of the premium]. I am requesting consideration for any options available to help me navigate this difficult period. I am looking for ways to avoid falling behind on my payments and to retain my home. I am eager to explore any programs that might offer some relief.

I would appreciate it if you could inform me about any possible hardship programs, temporary payment reductions, or other forms of assistance that I might be eligible for. I am committed to working with you to find a solution. I am dedicated to maintaining my home.

I have attached [List any supporting documents – e.g., bank statements, proof of unemployment, medical bills] as documentation. These documents provide further insight into my current financial circumstances. I am available to discuss this matter further at your earliest convenience. You can reach me by phone at [Your Phone Number] or by email at [Your Email Address]. Please contact me.

Thank you for your time and understanding. I look forward to hearing from you soon. I hope to resolve this soon.

Sincerely,

[Your Name]

How to Write Mortgage Insurance Hardship Letter

Crafting a compelling mortgage insurance hardship letter is a crucial step in navigating a difficult financial situation. It is your opportunity to articulate your predicament and provide evidence supporting your claim for mortgage relief. Here’s a concise guide to help you compose a potent letter that resonates with your lender.

1. Understand the Premise of the Hardship Letter

Firstly, the letter’s fundamental purpose is to persuade your mortgage insurance provider of your inability to meet your financial obligations. This requires a crystal-clear articulation of your hardship. It demands demonstrable evidence of a significant life event that has directly and negatively impacted your ability to service your mortgage.

2. Pinpoint the Significant Life Event

Every hardship letter hinges on the specific catalyst that led to your predicament. Was it a job loss, a medical emergency, a divorce, or a natural disaster? Whatever the case, pinpoint the exact precipitating factor.

A detailed account of the event is essential. It serves as the narrative spine of your letter. Provide chronologically sound details about the event. This might involve dates, names, and relevant financial repercussions.

3. Detail the Fiscal Repercussions

Beyond simply stating your hardship, you must delineate its financial ramifications. How has this event affected your income? Have your expenses skyrocketed? What percentage of your income is now being consumed by your mortgage?

Substantiate your claims with concrete data. Include copies of pay stubs, bank statements, medical bills, or any other financial records that fortify your position. The more comprehensive your supporting documentation, the stronger your case.

4. Explain the Mitigation Strategies Undertaken

Show your lender that you have not passively accepted your financial woes. Detail the steps you’ve taken to mitigate the situation. Have you explored alternative employment options? Are you utilizing a budget?

Have you sought credit counseling? Demonstrate your proactive approach to resolving the issue. It reinforces your commitment to resolving the issues.

5. Specify the Desired Relief

It is vital to explicitly state the relief you are seeking from your lender. Are you requesting a temporary forbearance, a loan modification, or another form of assistance? Be precise in your requests.

This ensures clarity and streamlines the evaluation process. Clearly define the terms of the relief you need to overcome your difficulties.

6. Compose with Professionalism and Empathy

The tone of your letter should be both professional and empathetic. While it’s acceptable to express your genuine distress, avoid excessive emotion or blame. Maintain a respectful tone.

Proofread meticulously to avoid any grammatical errors or typos. Proper grammar shows respect. It should reflect your seriousness and commitment to resolving the issue. Your letter must be concise and easily understandable.

7. Enclose Supporting Documentation and Submit

Finally, compile all supporting documentation alongside your letter. This includes pay stubs, bank statements, medical bills, and any other evidence that corroborates your claims. Make sure to keep copies of everything. Ensure to send the letter via certified mail with a return receipt requested. This provides proof of delivery.

Follow up with your lender to confirm receipt and inquire about the status of your request. This helps to make sure that everything is proceeding smoothly.

FAQs about Mortgage Insurance Hardship Letter

What is a Mortgage Insurance Hardship Letter?

A Mortgage Insurance Hardship Letter is a formal document written by a homeowner to their mortgage lender or servicer. It outlines the specific circumstances that have caused or are expected to cause financial difficulty, leading to the inability to meet mortgage payment obligations.

This letter is typically submitted as part of a loss mitigation application, aiming to explore options like loan modification, forbearance, or other programs to avoid foreclosure.

What Information Should I Include in My Hardship Letter?

Your hardship letter should comprehensively detail the hardship you are experiencing. This includes the specific event that caused the financial difficulty (e.g., job loss, medical expenses, divorce). Explain when the hardship started, how it has impacted your income, and what steps you’ve taken to address the situation.

Provide supporting documentation such as pay stubs, bank statements, medical bills, or separation agreements to substantiate your claims. Be honest, factual, and clear about the challenges you face.

What is the Purpose of a Mortgage Insurance Hardship Letter?

The primary purpose of a hardship letter is to convince your lender or mortgage servicer to consider options to help you avoid foreclosure. It is a crucial component of your loss mitigation application. By clearly explaining your circumstances, you give the lender the information they need to evaluate your situation and determine if you qualify for assistance programs.

The goal is to demonstrate that you are committed to resolving the issue and that you have a reasonable expectation of being able to resume mortgage payments in the future, if given the opportunity.

When Should I Submit a Mortgage Insurance Hardship Letter?

You should submit a hardship letter as soon as you anticipate or begin experiencing financial difficulties that might affect your ability to make your mortgage payments. It’s best to act proactively rather than waiting until you are significantly behind on payments.

Contact your lender or servicer immediately to understand their loss mitigation process and what documents they require. Submitting the letter promptly increases your chances of qualifying for assistance before the situation worsens.

What Happens After I Submit My Hardship Letter?

After submitting your hardship letter, your lender or servicer will review it along with any supporting documentation. They will assess your financial situation and determine if you qualify for any loss mitigation options.

This process may involve requesting additional information. The lender will then communicate their decision, which could include loan modification, forbearance, or other solutions. It is crucial to respond promptly to any requests for information and to fully understand the terms of any assistance offered.

Related:

Resignation letter due to rude boss

Resignation letter moving to another state

Resignation letter due to illness of family member

Resignation letter due to study