Need your insurance policy documents? You’ll need a “Letter to Request Insurance Policy Documents.” This is a formal way to ask your insurance company for copies. Its purpose is to officially request important policy information. You can retrieve important documents with it.

Writing this letter can seem tricky. Don’t worry, we’re here to help. This article provides examples. We will offer ready-to-use letter templates. You can easily adapt these for your needs.

These sample letters simplify the process. They cover various situations. Whether you need your auto, home, or health insurance, we’ve got you covered. Craft the perfect letter to insurance company with ease.

[Your Name/Your Company Name]

[Your Address]

[Your Phone Number]

[Your Email Address]

[Date]

[Insurance Company Name]

[Insurance Company Address]

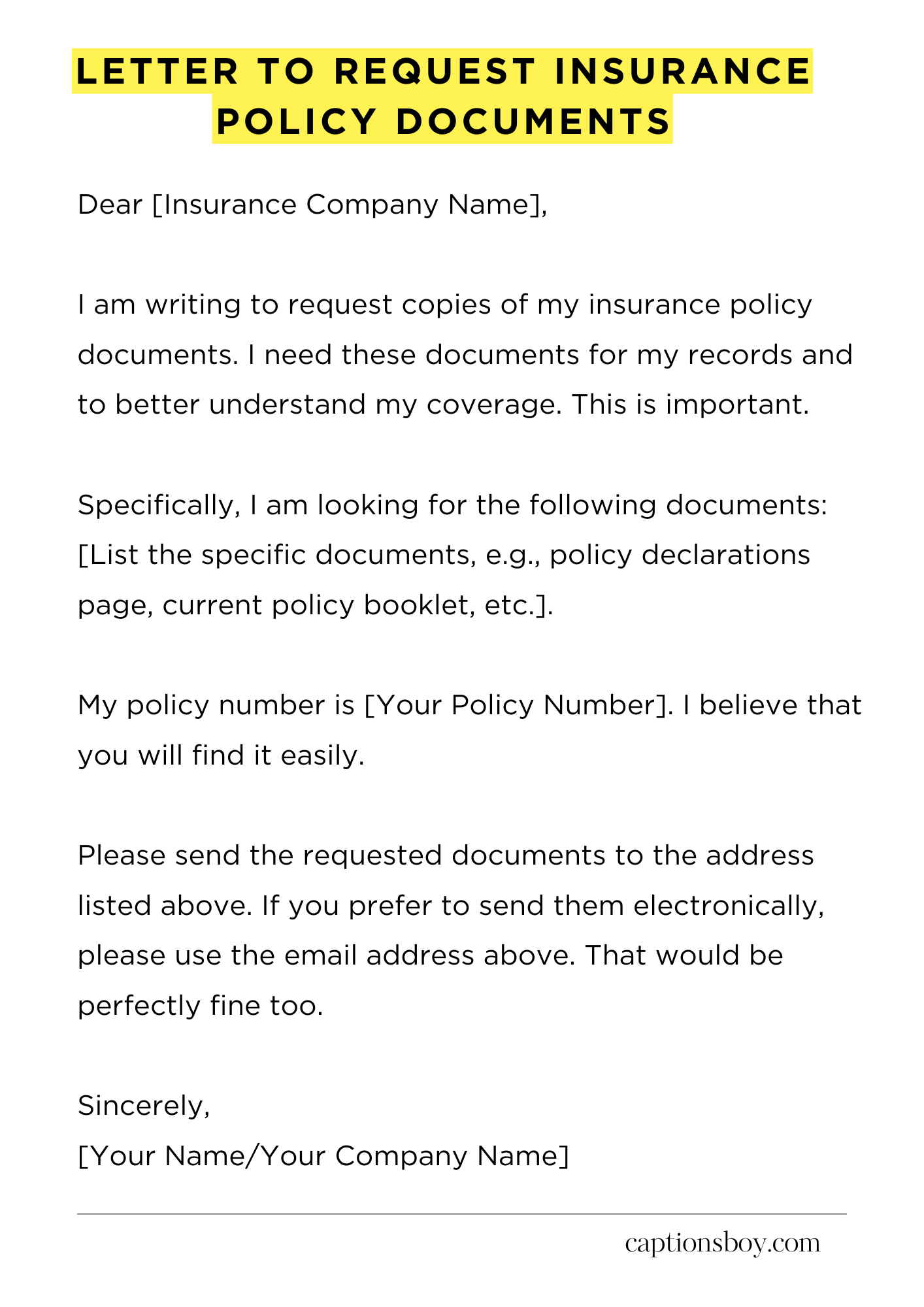

Dear [Insurance Company Name],

I am writing to request copies of my insurance policy documents. I need these documents for my records and to better understand my coverage. This is important.

Specifically, I am looking for the following documents: [List the specific documents, e.g., policy declarations page, current policy booklet, etc.]. It is vital that I have these details.

My policy number is [Your Policy Number]. I believe that you will find it easily.

Please send the requested documents to the address listed above. If you prefer to send them electronically, please use the email address above. That would be perfectly fine too.

I would appreciate it if you could send these documents as soon as possible. Please let me know if you require any further information from me. Time is of the essence.

Thank you for your assistance. I look forward to hearing from you soon.

Sincerely,

[Your Name/Your Company Name]

How to Write a Letter to Request Insurance Policy Documents

Securing your insurance policy documentation is a pivotal step. Sometimes, you need to navigate the process of requesting copies. It’s not a Herculean task, but proper execution is critical. This guide provides a succinct, step-by-step approach to crafting a proficient request letter. Let’s explore how to go about it:

1. Commence with the Header: The Salutation and Dateline

Your missive should begin with a formal salutation. Address it to the relevant department or a specific individual if known (e.g., “Claims Department” or the agent’s name). Always include the current date at the top of the letter, directly beneath your address and contact information. Ensure meticulous accuracy.

2. Subject Line: Clarity is Paramount

A crystal-clear subject line will streamline processing. State explicitly, “Request for Insurance Policy Documents.” This expedites the identification of the letter’s purpose, ensuring swift attention.

3. Identify Yourself: The Nomenclature

Introduce yourself thoroughly. Start by providing your full legal name, address, and contact details. Then, meticulously add your policy number. This data is indispensable for verification and retrieving the correct files.

4. Specify Your Request: The Corpus of the Letter

This is where you articulate your specific needs. Concisely state which documents you require. Do you need a copy of the original policy, the declarations page, or perhaps endorsements? Be precise. If you’re requesting multiple documents, enumerate them clearly. This will remove ambiguity.

5. Explain Your Rationale: The Underpinning

While not always mandatory, briefly explain why you need the documents. Maybe you lost your originals, or you need them for a legal or financial proceeding. Providing a brief explanation can often expedite the process and lend context. Be transparent and concise.

6. Offer a Means of Contact and Delivery: The Logistics

Specify how you wish to receive the documents. Indicate whether you prefer electronic delivery (PDF format is common) or physical mail. Include your email address and postal address for swift dispatch. You might also add, “Kindly contact me if any further information is needed”. Your responsiveness can quicken the whole process.

7. The Conclusion: Formalities and Closure

Conclude your letter with a formal closing, such as “Sincerely,” or “Respectfully,” followed by your full name and signature (if sending a physical copy). Double-check for any typographical errors. This meticulous finishing touch demonstrates your professionalism and facilitates a positive interaction.

FAQs about Letter to Request Insurance Policy Documents

What information should I include in a letter requesting insurance policy documents?

Your letter should clearly state your name, address, and contact information. You should also specify the type of insurance policy (e.g., auto, home, health) and the policy number, if known. Include the dates of the policy coverage and explicitly request copies of the specific documents you need, such as the policy declaration, terms and conditions, or any endorsements.

Where should I send the letter requesting my insurance policy documents?

The letter should be sent to the insurance company or the insurance agent who manages your policy. You can usually find the correct mailing address on your insurance statements, policy documents, or the insurance company’s website. If sending via mail, consider sending it via certified mail with return receipt requested to provide proof that the insurance company received your letter.

How long does it typically take to receive the requested insurance policy documents?

The timeframe can vary depending on the insurance company’s processes and the type of documents requested. However, it’s generally a good idea to allow at least 15-30 business days for the insurance company to process your request and mail the documents. Some companies may offer electronic delivery, which can speed up the process.

What happens if I don’t know my policy number?

If you don’t know your policy number, that’s okay. In your letter, provide as much identifying information as possible, such as your full name, date of birth, address, and the approximate dates of when the policy was active. Include any other details that might help the insurance company locate your policy, such as the make and model of a car for auto insurance or the address of your property for homeowners insurance.

Can I request insurance policy documents electronically?

Yes, many insurance companies offer the option to request and receive policy documents electronically. Check the insurance company’s website or contact them directly to inquire about this option. Electronic delivery is usually faster and can provide you with immediate access to your policy documents.

Related:

Resignation letter due to rude boss

Resignation letter moving to another state

Resignation letter due to illness of family member

Resignation letter due to study

Resignation letter due to long commute