Are you tired of seeing unwanted credit inquiries on your credit report? A Letter To Remove Credit Inquiries can help you get rid of them.

This letter is a formal request to the credit bureaus to remove any unauthorized inquiries from your credit report. Its purpose is to improve your credit score and increase your chances of getting approved for loans and credit cards.

In this article, we will provide you with templates, examples, and samples of Letter To Remove Credit Inquiries.

These templates will make it easy for you to write your own letter and customize it according to your needs. Whether you have one or multiple inquiries on your credit report, our templates will help you get rid of them quickly and efficiently.

By using our templates, you can save time and avoid the hassle of writing a letter from scratch. We understand that writing a formal letter can be intimidating, but with our easy-to-use templates, you can write a professional letter in no time.

So, let’s get started and remove those unwanted credit inquiries from your credit report!

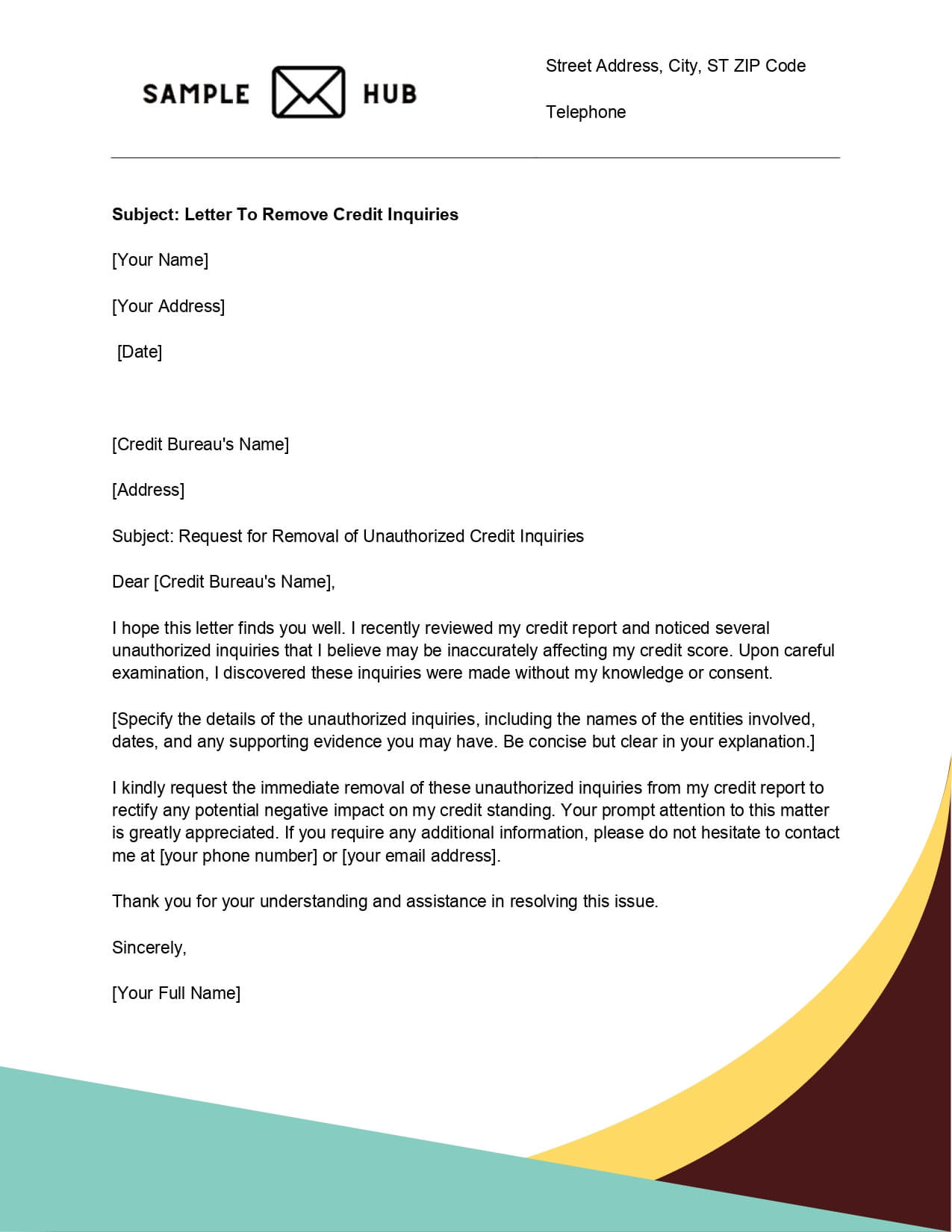

Letter To Remove Credit Inquiries

Dear [Creditor/Bureau Name],

I hope this letter finds you well. I am writing to you regarding the recent credit inquiries on my credit report. After reviewing my credit history, I noticed multiple inquiries that I believe may be inaccurately reported. I am reaching out to request the removal of these inquiries from my credit report.

The unauthorized credit inquiries listed are negatively impacting my credit score, and I believe there might be an error in reporting. As a responsible consumer, I regularly monitor my credit report, and I am confident that these inquiries were not authorized by me. I have attached documentation supporting my claim for your review.

I kindly request a thorough investigation into this matter and prompt removal of the inaccurately reported inquiries from my credit report. I understand the importance of accurate credit reporting, and I believe resolving this issue will contribute to maintaining the integrity of my credit profile.

Enclosed with this letter, please find copies of relevant documents, including [list any supporting documents]. I appreciate your attention to this matter and your prompt resolution of the discrepancies in my credit report.

Thank you for your cooperation in ensuring the accuracy of my credit information. I look forward to a positive resolution of this matter. Please provide written confirmation once the investigation is complete and the inaccuracies have been corrected.

Sincerely,

[Your Full Name]

Remove Inquiries From Credit Report Letter

Dear [Creditor/Bureau Name],

I trust this letter finds you well. I am writing to address a matter concerning my credit report. After a careful review, I noticed multiple inquiries that may be affecting my credit score negatively. I am reaching out to request the removal of these inquiries from my credit report.

These inquiries seem to be inaccurately reported, and their presence is impacting my ability to secure favorable credit terms. As a responsible consumer, I regularly monitor my credit report, and I am confident that some of these inquiries were not authorized by me. Enclosed with this letter, you will find copies of relevant documents supporting my claim.

I kindly request a thorough investigation into this matter and the prompt removal of any inaccurately reported inquiries from my credit report. I understand the importance of accurate credit reporting and believe that rectifying this issue will contribute to maintaining the integrity of my credit profile.

Thank you for your attention to this matter. I appreciate your cooperation in ensuring the accuracy of my credit information. Please provide written confirmation once the investigation is complete, and any inaccuracies have been corrected.

Sincerely,

[Your Full Name]

Dispute Letter For Inquiries

Dear [Creditor/Bureau Name],

I hope this letter reaches you in good health. I am writing to formally dispute several inquiries listed on my credit report, which I believe are inaccurately reported and unauthorized. Upon reviewing my credit history, I noticed multiple inquiries that I did not authorize or recognize.

I am aware of the importance of accurate credit reporting, and I am concerned that these unauthorized inquiries are negatively impacting my credit score. As a responsible consumer, I regularly monitor my credit report, and it’s crucial to me that the information is accurate and reflective of my financial history.

Enclosed with this letter, you will find copies of supporting documents, including evidence that I did not authorize these inquiries. I kindly request a thorough investigation into this matter and the prompt removal of these inaccurately reported inquiries from my credit report.

Your cooperation in resolving this dispute is highly appreciated. I understand the legal obligations related to accurate credit reporting, and I trust that this matter will be handled with the utmost attention to detail.

Thank you for your prompt attention to this dispute. I look forward to receiving written confirmation once the investigation is complete and the inaccuracies have been corrected.

Sincerely,

[Your Full Name]

Letters To Dispute Credit Inquiries

Dear [Creditor/Bureau Name],

I trust this letter finds you well. I am writing to formally dispute several inquiries listed on my credit report, which I believe are inaccurately reported and unauthorized. Upon reviewing my credit history, I noticed multiple inquiries that I did not authorize or recognize.

I am aware of the importance of accurate credit reporting, and I am concerned that these unauthorized inquiries are negatively impacting my credit score. As a responsible consumer, I regularly monitor my credit report, and it’s crucial to me that the information is accurate and reflective of my financial history.

Enclosed with this letter, you will find copies of supporting documents, including evidence that I did not authorize these inquiries. I kindly request a thorough investigation into this matter and the prompt removal of these inaccurately reported inquiries from my credit report.

Your cooperation in resolving this dispute is highly appreciated. I understand the legal obligations related to accurate credit reporting, and I trust that this matter will be handled with the utmost attention to detail.

Thank you for your prompt attention to this dispute. I look forward to receiving written confirmation once the investigation is complete and the inaccuracies have been corrected.

Sincerely,

[Your Full Name]

Credit Letters To Remove Inquiries

Dear [Creditor/Bureau Name],

I hope this letter finds you well. I am writing to formally dispute several inquiries listed on my credit report, which I believe are inaccurately reported and unauthorized. Upon reviewing my credit history, I noticed multiple inquiries that I did not authorize or recognize.

I am aware of the importance of accurate credit reporting, and I am concerned that these unauthorized inquiries are negatively impacting my credit score. As a responsible consumer, I regularly monitor my credit report, and it’s crucial to me that the information is accurate and reflective of my financial history.

Enclosed with this letter, you will find copies of supporting documents, including evidence that I did not authorize these inquiries. I kindly request a thorough investigation into this matter and the prompt removal of these inaccurately reported inquiries from my credit report.

Your cooperation in resolving this dispute is highly appreciated. I understand the legal obligations related to accurate credit reporting, and I trust that this matter will be handled with the utmost attention to detail.

Thank you for your prompt attention to this dispute. I look forward to receiving written confirmation once the investigation is complete and the inaccuracies have been corrected.

Sincerely,

[Your Full Name]

How to Write a Letter to Remove Credit Inquiries

Credit inquiries can have a significant impact on your credit score. These inquiries occur when a lender or creditor checks your credit report to determine your creditworthiness. While some inquiries are necessary, too many inquiries can lower your credit score and make it difficult to obtain credit in the future. Fortunately, you can remove unauthorized or inaccurate inquiries from your credit report by writing a letter to the credit bureau. Here’s how to write a letter to remove credit inquiries.

1. Understand the Types of Credit Inquiries

Before you write a letter to remove credit inquiries, it’s essential to understand the types of inquiries that appear on your credit report. There are two types of inquiries: hard inquiries and soft inquiries. Hard inquiries occur when you apply for credit, such as a credit card or loan. Soft inquiries occur when a creditor checks your credit report for pre-approval or when you check your own credit report. Only hard inquiries affect your credit score, and they remain on your credit report for two years.

2. Review Your Credit Report

The first step in writing a letter to remove credit inquiries is to review your credit report. You can obtain a free copy of your credit report from each of the three major credit bureaus: Equifax, Experian, and TransUnion. Look for unauthorized or inaccurate inquiries that you want to dispute. Make a note of the creditor’s name, the date of the inquiry, and the type of inquiry.

3. Gather Supporting Documentation

To support your dispute, gather any documentation that proves the inquiry was unauthorized or inaccurate. This may include letters from the creditor stating that they did not authorize the inquiry, receipts showing that you did not apply for credit, or any other evidence that supports your claim.

4. Write a Letter to the Credit Bureau

Once you have identified the unauthorized or inaccurate inquiries and gathered supporting documentation, it’s time to write a letter to the credit bureau. Your letter should include the following information:

– Your name and address

– The date of the letter

– The name of the credit bureau

– A statement that you are disputing the inquiry

– The reason for the dispute

– The creditor’s name, the date of the inquiry, and the type of inquiry

– A request to remove the inquiry from your credit report

– Any supporting documentation

FAQs About Letter to Remove Credit Inquiries

1. What are credit inquiries, and why do they matter?

Credit inquiries are records of when a lender or creditor checks your credit report. They matter because too many inquiries can negatively impact your credit score and make it harder to get approved for credit in the future.

2. How can I find out how many credit inquiries I have?

You can request a free copy of your credit report from each of the three major credit bureaus (Equifax, Experian, and TransUnion) once per year. Your credit report will show all of the inquiries made on your credit history.

3. Can I remove credit inquiries from my credit report?

Yes, you can request to have unauthorized or inaccurate inquiries removed from your credit report. However, legitimate inquiries made by lenders or creditors cannot be removed.

4. How do I write a letter to request the removal of credit inquiries?

Your letter should include your name and contact information, a list of the inquiries you want removed, and an explanation of why they are unauthorized or inaccurate. You should also include any supporting documentation, such as proof of identity theft or a dispute with a creditor.

5. What is the process for disputing credit inquiries?

You can dispute credit inquiries online, by phone, or by mail. The credit bureau will investigate your dispute and notify you of the results within 30 days.

6. How long does it take for credit inquiries to be removed from my credit report?

If the credit bureau determines that the inquiries are unauthorized or inaccurate, they will remove them from your credit report within a few days. However, it may take up to 30 days for the changes to be reflected on your credit score.

7. Will removing credit inquiries improve my credit score?

Removing unauthorized or inaccurate credit inquiries can improve your credit score if they were negatively impacting it. However, legitimate inquiries made by lenders or creditors are a necessary part of the credit application process and cannot be removed.

Related:

- Physician Retirement Letter To Patients ( 5 Samples )

- Property Management Letter To Owners ( 5 Samples )

- Change Of Ownership Letter To Vendors ( 5 Samples)

- Letter To Extend Maternity Leave ( 5 Samples)

- Authorization Letter For Minor To Travel Without Parents (5 Samples)