Ever waited for an insurance claim payment? It can be frustrating. A letter to check pending insurance claim is your tool. Its purpose? To politely inquire about the status of your claim. It helps speed up the process.

Feeling unsure how to write such a letter? You’re not alone. Don’t worry, we’ve got you covered. We’re sharing several ready-to-use letter to check pending insurance claim templates. Use our sample letters for ease.

Our goal is to make it simple. We offer different insurance claim letter examples. Need a template for a health insurance claim? We have it. Perhaps a car insurance claim? Find the perfect fit.

[Your Name/Company Name]

[Your Address]

[Your Phone Number]

[Your Email Address]

[Date]

[Insurance Company Name]

[Insurance Company Address]

Subject: Inquiry Regarding Pending Insurance Claim – [Claim Number if applicable]

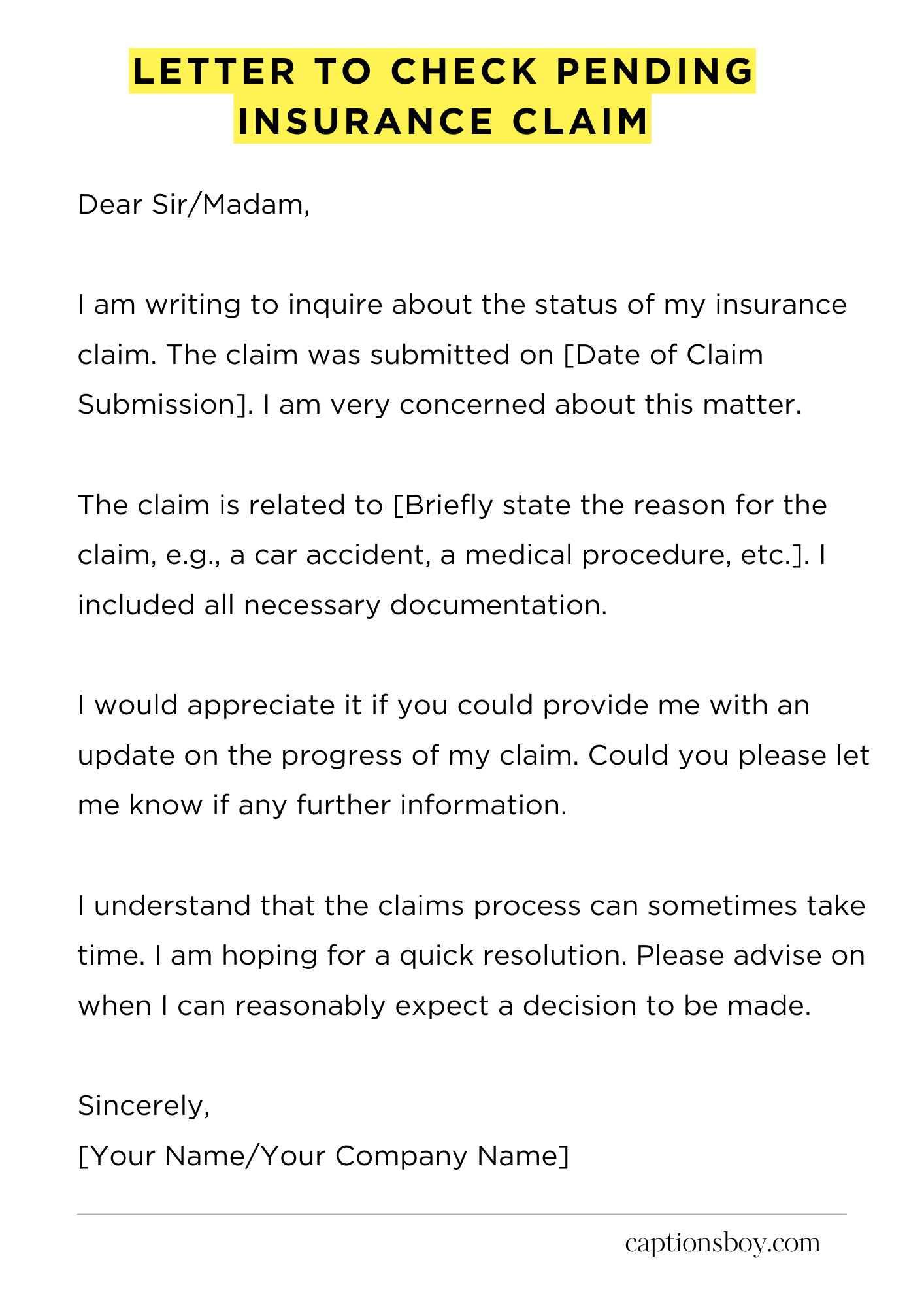

Dear Sir/Madam,

I am writing to inquire about the status of my insurance claim. The claim was submitted on [Date of Claim Submission]. I am very concerned about this matter.

The claim is related to [Briefly state the reason for the claim, e.g., a car accident, a medical procedure, etc.]. I included all necessary documentation with my initial submission. It included everything you could need to make a decision.

I would appreciate it if you could provide me with an update on the progress of my claim. Could you please let me know if any further information or action is required from my end? This is very important to me.

I understand that the claims process can sometimes take time. I am hoping for a quick resolution. Please advise on when I can reasonably expect a decision to be made.

I look forward to hearing from you soon. Your prompt attention to this matter would be greatly appreciated. Thank you very much for your time and assistance.

Sincerely,

[Your Name/Your Company Name]

How to Write Letter to Check Pending Insurance Claim

Navigating the labyrinthine process of an insurance claim can often feel like traversing a bureaucratic jungle. One of the most effective tools in your arsenal for expediting this process is a well-crafted letter. This communication serves as an official request for an update, ensuring your claim is not languishing in administrative limbo. Below is a comprehensive guide to composing a letter that compels action.

1. Crafting the Initial Salutation

Begin with a professional and appropriate salutation. It’s crucial to address the letter to the correct recipient, typically the Claims Department or the assigned claims adjuster. Terms like “Dear Sir/Madam” can be utilized if a specific name is unavailable. If you have the adjuster’s name, personalization, such as “Dear Mr./Ms. [Last Name],” demonstrates meticulousness.

2. Explicitly Identifying the Claim

Immediately state the purpose of your letter: to inquire about the status of a pending insurance claim. Provide all pertinent details, including your policy number, claim number, date of the incident or loss, and a concise description of the event. This upfront information helps the recipient quickly locate and understand your claim’s context. Your clarity will save both of you time.

3. Detailing the Claim’s History

Briefly recount the history of your claim. This includes when you initially filed the claim, what supporting documentation you’ve already submitted (e.g., police reports, medical records, invoices), and any prior communication you’ve had with the insurance company regarding this claim. This section provides a convenient chronological narrative for the adjuster, potentially eliminating the need to search through their records extensively.

4. Articulating Your Specific Inquiry

Clearly state what information you are seeking. Are you looking for an estimated timeframe for a decision? Do you need clarification on any missing documentation? Perhaps you want a detailed explanation for any delays. Frame your inquiry directly and with specific questions. Avoid ambiguity; you need concrete answers.

5. Providing Contact Information and Assertive Tone

Reiterate your contact information, including your full name, address, phone number, and email address. This ensures the adjuster can easily reach you with updates. Maintain a professional yet assertive tone throughout the letter. While politeness is essential, don’t hesitate to subtly indicate that you expect a timely response. Show that you are proactive.

6. The Appropriate Closing Salutations

End the letter with a formal closing such as “Sincerely,” “Respectfully,” or “Yours faithfully” (if you began with “Dear Sir/Madam”). After the closing, leave space for your handwritten signature. Below your signature, type your full name. If you are sending via email, it is okay to have your name in the email body itself.

7. The Diligent Follow-Up

After sending your letter, keep a copy for your records. Consider sending the letter via certified mail with return receipt requested, to get proof of delivery. If you do not receive a response within a reasonable timeframe (typically two to three weeks, but this can vary), initiate a follow-up. This reinforces your commitment to your claim and emphasizes the need for a resolution. Persistent diligence may be needed.

FAQs about Letter to Check Pending Insurance Claim

What information should I include in a letter to check on a pending insurance claim?

When writing a letter to inquire about a pending insurance claim, it’s crucial to include specific and detailed information. This typically includes your full name, address, policy number, claim number (if available), date of the incident or loss, and a clear explanation of what happened. You should also reiterate the specific details of the claim, such as the type of loss (e.g., property damage, medical expenses), and any supporting documentation that you’ve already submitted. Ensure you provide your contact information, including a phone number and email address, so the insurer can easily reach you. Finally, you should politely request an update on the status of your claim and a timeframe for a response or resolution.

How do I find the correct address to send a letter to my insurance company?

The correct mailing address for your insurance company can usually be found in several places. The easiest method is to consult your insurance policy documents, as they often contain the relevant address for claim submissions or general correspondence. You can also visit your insurance company’s website; most companies provide a “Contact Us” or “Claims” section where the mailing address is listed. If you still have trouble, you can call your insurance company’s customer service line and ask for the appropriate mailing address for claims inquiries.

What is the typical timeframe for an insurance company to respond to a letter inquiring about a pending claim?

While there isn’t a universally mandated timeframe, insurance companies are generally expected to respond to claim inquiries in a timely manner. The exact time can vary depending on the jurisdiction, the complexity of the claim, and the insurance company’s internal processes. In many cases, you can anticipate an acknowledgement of receipt of your letter within a few weeks, and a more substantive response with an update on your claim within a month or two. However, be aware that some states have laws or regulations dictating the maximum response time. If you haven’t received a response within a reasonable period (e.g., 30-60 days), it’s advisable to follow up with your insurance company again.

What should I do if I don’t receive a response to my letter within a reasonable timeframe?

If you don’t hear back from your insurance company within the expected timeframe, you should take proactive steps to follow up. First, try contacting the company by phone or email, referencing your original letter and the claim details. Keep a record of all communications. If you’re not getting a satisfactory response through these channels, consider sending a follow-up letter, preferably via certified mail with return receipt requested. This provides proof that the insurance company received your correspondence. You might also want to contact your state’s insurance regulatory agency to report your concerns and seek assistance in resolving the claim.

Can I submit a letter to check on my pending insurance claim via email?

Many insurance companies now accept claim inquiries and updates via email. However, always verify your insurance company’s specific policies on email submissions. You can usually find this information on their website, in your policy documents, or by contacting their customer service. If email submission is permitted, make sure to include all of the necessary details as you would in a physical letter, such as your policy number, claim number, and a clear explanation of the situation. Always keep a copy of your email correspondence as a record. While email offers a more convenient way to communicate, ensure that the company acknowledges receipt and provides a tracking number if available. For crucial or time-sensitive communications, it’s often advisable to use certified mail to ensure proof of delivery.

Related:

Resignation letter due to rude boss

Resignation letter moving to another state

Resignation letter due to illness of family member

Resignation letter due to study

Resignation letter due to long commute