Need your insurance policy details? Sometimes, you need a copy. A letter requesting copy of insurance policy is the solution. It is a simple, written request. Its purpose is to obtain an official copy of your insurance policy.

This can be for various reasons. Maybe you lost your copy. Perhaps you need it for a claim. We understand writing these letters can be tricky. Don’t worry, we’ve got you covered.

Here, find ready-to-use letter requesting copy of insurance policy templates. We’ll share examples and samples. Use these to customize your own letter quickly. Get the information you need with ease. It’s time to craft the perfect letter!

[Your Name]

[Your Address]

[Your Phone Number]

[Your Email Address]

[Date]

[Insurance Company Name]

[Insurance Company Address]

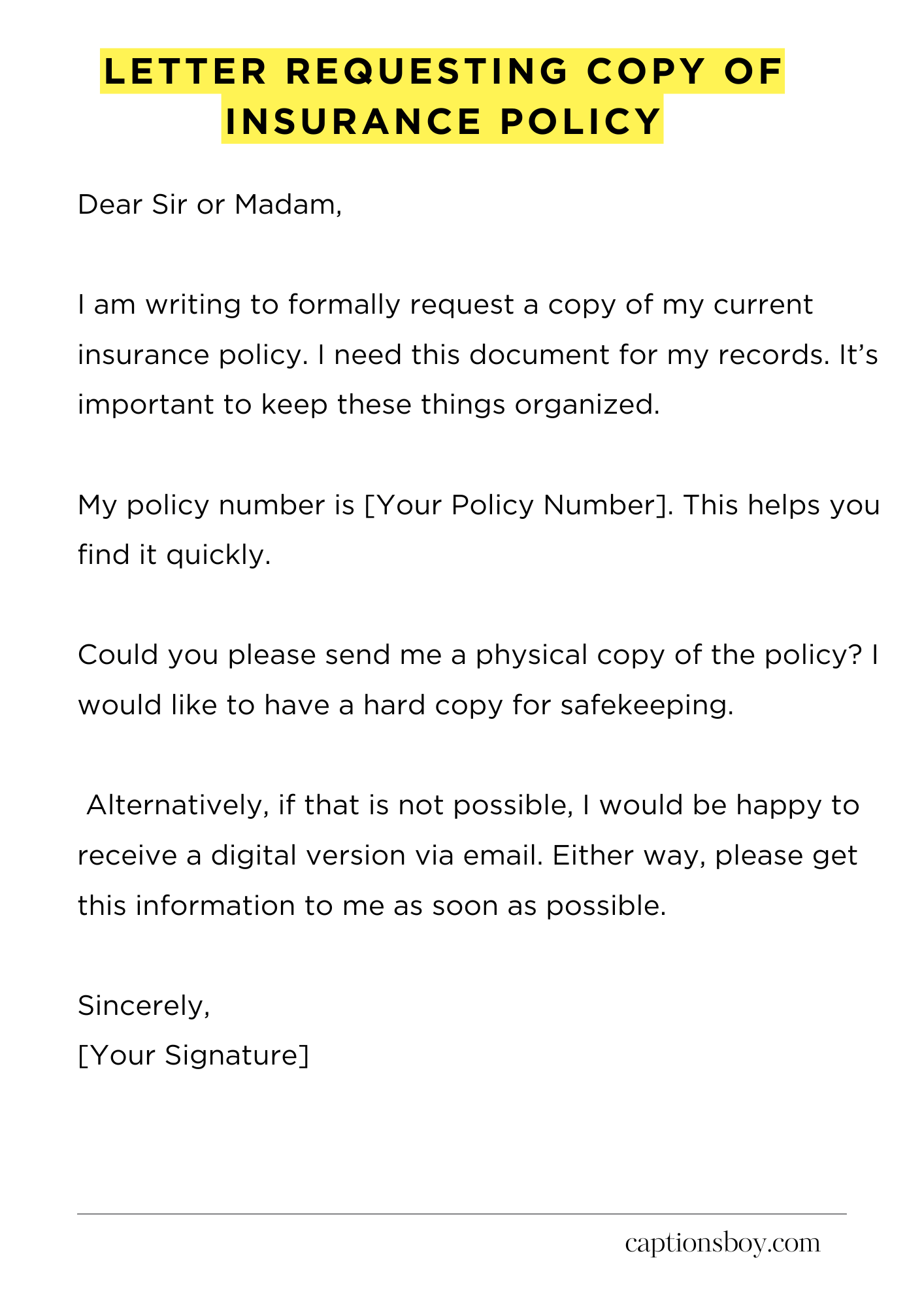

Dear Sir or Madam,

I am writing to formally request a copy of my current insurance policy. I need this document for my records. It’s important to keep these things organized.

My policy number is [Your Policy Number]. This helps you find it quickly.

Could you please send me a physical copy of the policy? I would like to have a hard copy for safekeeping. Alternatively, if that is not possible, I would be happy to receive a digital version via email. Either way, please get this information to me as soon as possible.

My name is [Your Full Name]. I hope this clarifies everything needed.

Thank you for your time and assistance with this request. I appreciate your prompt attention to this matter. I am looking forward to hearing from you soon!

Sincerely,

[Your Signature]

How to Write Letter Requesting Copy of Insurance Policy

Procuring a duplicate of your insurance policy can sometimes feel like navigating a bureaucratic labyrinth. However, a well-crafted letter can expeditiously clarify the process and obtain the document you require. This guide will illuminate the crucial components of such a letter, guaranteeing a swift and satisfactory outcome.

1. Your Salutation: Setting the Stage

The commencement of your missive sets the tone. Use a formal salutation. “Dear [Insurance Company Name] Customer Service,” or, if you know the name, “Dear Mr./Ms. [Last Name],” are appropriate. Avoid overly casual greetings; a professional commencement enhances your credibility from the get-go. Precision is paramount here.

2. Subject Line: Immediate Clarity

Don’t leave the recipient guessing. A clear subject line is critical. Something like “Request for Copy of Insurance Policy – Policy Number [Your Policy Number]” immediately informs the reader of the letter’s purpose. This small detail can dramatically improve processing time, ensuring your request is appropriately routed.

3. Providing Pertinent Information: The Crux of the Matter

This is where you furnish the vital data. Begin by stating your full name, address, phone number, and email address. Then, unequivocally state you are requesting a duplicate of your insurance policy. Include your policy number – this is essential – and specify the type of policy (e.g., auto, home, life). If applicable, list any additional insured parties or beneficiaries. Comprehensive information mitigates any potential for ambiguity.

4. Stating Your Reason: Justification for the Request

While not always mandatory, briefly stating why you need the copy can be beneficial. It helps the recipient to understand your situation. Options include: “For my records,” “To provide to a third party,” or “Because the original has been misplaced.” Providing a reason, where applicable, may expedite matters.

5. Delivery Preferences: Dictating the Delivery Method

Specify how you wish to receive the copy. Options include: “By mail to the address above,” “By email to [your email address],” or “Uploaded to my online portal.” Choosing a delivery method that is most convenient for you is important. Providing this information streamlines the process.

6. Closing and Formalities: Maintaining Professionalism

Conclude your letter with a formal closing such as “Sincerely,” or “Respectfully,” followed by your full name. If you are sending the letter by mail, consider adding a signature above your typed name. This is an indispensable touch in formal correspondence. A signature adds a layer of authenticity.

7. Proofreading and Sending: The Final Act

Before dispatching your letter, meticulously proofread it for any errors in grammar, spelling, or punctuation. Verify all the information you provided to minimize any misunderstandings. Double-check the recipient’s address if sending via postal mail. When you are certain your letter is flawless, send it. Subsequently, you must wait for the outcome.

FAQs about Letter Requesting Copy of Insurance Policy

What is the primary purpose of a letter requesting a copy of an insurance policy?

The primary purpose of a letter requesting a copy of an insurance policy is to formally request the insurance provider to send a duplicate of your policy document. This is often necessary when the original policy is lost, damaged, or simply misplaced. The letter serves as a written record of your request, providing a clear audit trail and essential details about your policy.

What essential information should be included in a letter requesting a copy of an insurance policy?

A well-crafted letter should include your full name, address, contact information, and policy number to help the insurance company identify your policy. You should also clearly state that you are requesting a copy of the policy. Specify the type of insurance (e.g., auto, home, life) and the date the policy was issued. If known, provide any additional relevant information like the insured’s name if different from your own, or the date the policy went into effect. If the original policy was lost, be sure to state that as well.

How should the letter requesting a copy of an insurance policy be delivered?

It’s advisable to send the letter using a method that provides proof of delivery, such as certified mail with return receipt requested or via email. This offers verification that your request was received by the insurance company. If sending via email, it’s recommended to retain a copy of the sent email along with a read receipt if one is received to keep records. Sending the letter via regular mail is also acceptable but less reliable than certified or recorded options.

How long does it typically take to receive a copy of an insurance policy after making a request?

The processing time can vary depending on the insurance company’s internal procedures and the volume of requests they are handling. However, it typically takes anywhere from a few days to a few weeks to receive a copy of your policy. For a faster response, confirm the preferred method for sending the request and provide email for the fastest turn around time.

Are there any associated fees for requesting a copy of an insurance policy?

Generally, insurance companies do not charge a fee for providing a copy of your policy, but this can vary. It’s always a good idea to check your policy documents or contact your insurance provider directly to inquire about any potential fees associated with requesting a duplicate. Some companies might only charge a fee for excessive requests within a specific period.

Related:

Resignation letter due to rude boss

Resignation letter moving to another state

Resignation letter due to illness of family member

Resignation letter due to study

Resignation letter due to long commute