Dealing with insurance can be confusing. Sometimes, you need to know where your insurance claim stands. An insurance claim status request letter is the solution. This letter officially asks your insurance provider for an update on your claim. Its purpose is to get information about the progress of your claim.

Need to write this letter? Don’t worry, we’ve got you covered. We’ll provide you with several insurance claim status request letter samples. These examples will act as your guide. You can modify them to suit your needs.

We aim to simplify the process. Our claim status request letter templates will help. You’ll find different formats and phrases. Using these sample letters makes writing your letter easy. You can get the update you need quickly.

[Your Name/Company Name]

[Your Address]

[Your Phone Number]

[Your Email Address]

[Date]

[Insurance Company Name]

[Insurance Company Address]

Subject: Inquiry Regarding Claim Status – [Your Policy Number]

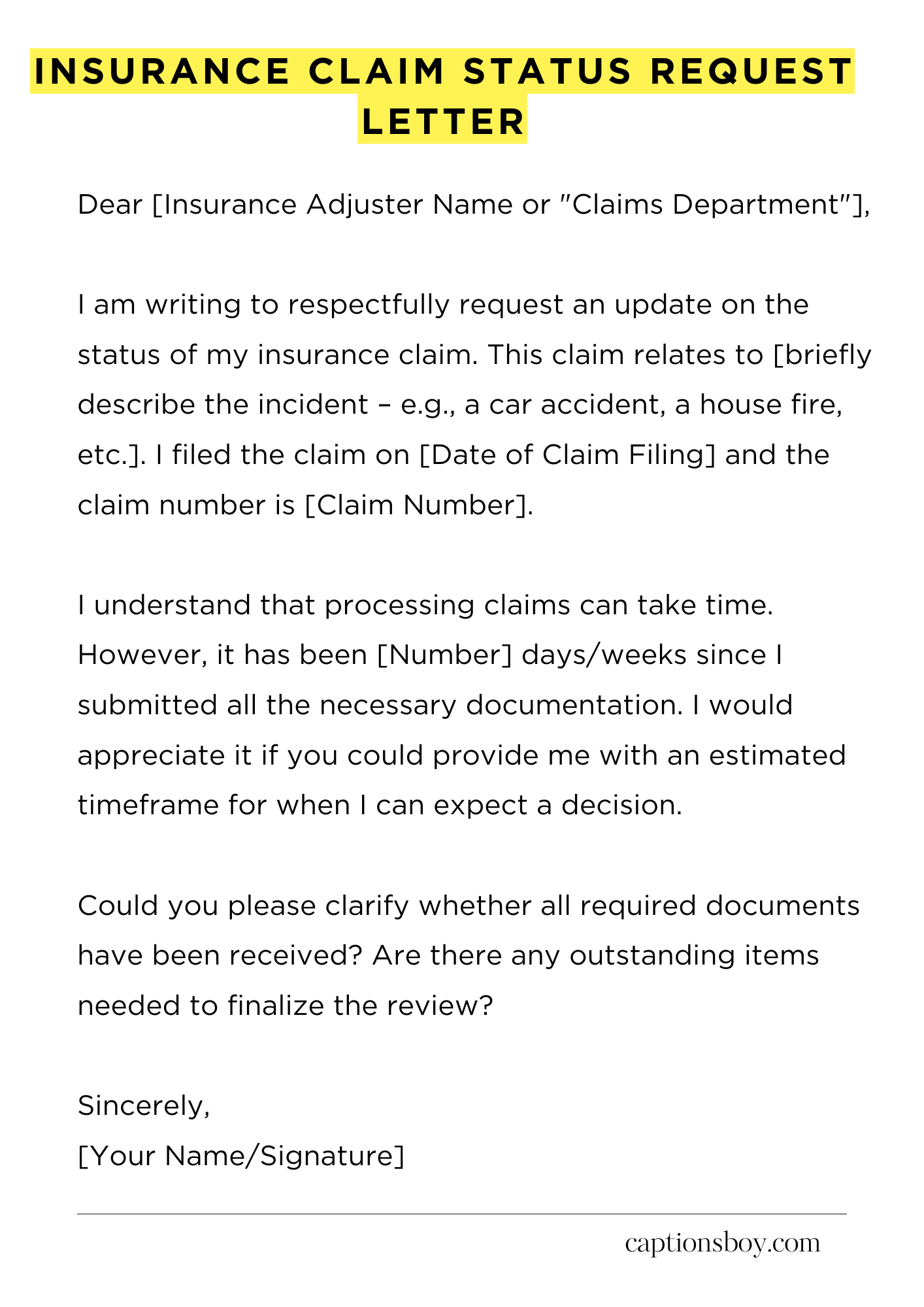

Dear [Insurance Adjuster Name or “Claims Department”],

I am writing to respectfully request an update on the status of my insurance claim. This claim relates to [briefly describe the incident – e.g., a car accident, a house fire, etc.]. I filed the claim on [Date of Claim Filing] and the claim number is [Claim Number].

I understand that processing claims can take time. However, it has been [Number] days/weeks since I submitted all the necessary documentation. I would appreciate it if you could provide me with an estimated timeframe for when I can expect a decision on my claim. Any information you can give me would be greatly appreciated.

Could you please clarify whether all required documents have been received? Are there any outstanding items needed to finalize the review? I am eager to get a resolution to this matter as soon as possible. It is important to me, especially given the circumstances.

If you require any further information from my end, please do not hesitate to contact me at your earliest convenience. You can reach me by phone or email, both listed above. Thank you very much for your time and attention to this. I look forward to hearing from you soon.

Sincerely,

[Your Name/Signature]

How to Write Insurance Claim Status Request Letter

Navigating the insurance landscape can feel like charting unknown waters. One crucial step in this process involves requesting updates on your submitted claims. Knowing how to draft an effective insurance claim status request letter is paramount for efficient communication and a prompt resolution.

1. Pre-Letter Reconnaissance: Gathering the Intel

Before you even begin to consider the prose, you need to collect all pertinent information. Locate your policy number; this is your key identifier. Gather the claim number (if you have it), the date of the incident or loss, and the contact information for the claims adjuster. This meticulous pre-writing phase will prevent unnecessary delays and ensure the adjuster can swiftly access your records.

2. Subject Line Sovereignty: Commanding Attention

The subject line is your opening gambit, the first thing the recipient sees. Make it clear, concise, and compelling. Consider options like: “Claim Status Request – Policy # [Your Policy Number]” or “Urgent Inquiry Regarding Claim # [Your Claim Number]”. A well-crafted subject line is your digital handshake, signaling the letter’s purpose instantly.

3. Salutation Strategies: Etiquette and Appropriateness

How you address the recipient sets the tone. Use a professional salutation. “Dear Mr./Ms./Mx. [Adjuster’s Last Name]” is always a safe and respectful bet, provided you know their name. If you are unsure of the adjuster’s name, “To Whom It May Concern” is acceptable, though less personalized. Maintaining a tone of civility is crucial.

4. The Body Politic: Articulating Your Request

This is where you make your case, your central argument. State your purpose clearly and directly in the first paragraph. Briefly reiterate the facts of the claim, including the date of the incident, type of claim, and any relevant details. Then, politely but firmly request an update on the status of your claim. Specify what information you are seeking – e.g., the current stage of the assessment, expected timeframe for resolution, or any outstanding requirements. Succinctness is the soul of this section; avoid unnecessary jargon.

5. Documentation Demystification: Supporting Evidence

If you haven’t already submitted supporting documentation, consider including a brief mention of it. This might include police reports, medical records, or repair estimates. If you are sending it separately, state that it is being sent under separate cover to avoid any ambiguity. If necessary, you may also want to indicate that you are attaching your supporting documentation with the letter to provide the recipient with all the required resources.

6. The Concluding Couplet: Politeness and Professionalism

End your letter with a polite and proactive closing. Express your anticipation for a prompt response. Include your contact information (phone number and email address) again, so the adjuster can easily reach you. Some examples are: “Thank you for your time and attention to this matter. I look forward to hearing from you soon,” or “I appreciate your prompt attention to this claim. Please contact me at [your phone number] or [your email address].”

7. Proofreading Protocols: Polishing Your Prose

Before dispatching your letter, proofread it meticulously. This is the final and often overlooked step, but it is critically important. Check for grammatical errors, typos, and any inconsistencies in the information provided. Ensure the language is professional and courteous. A well-edited letter demonstrates your commitment and credibility. Re-read the letter; it is always useful.

FAQs about Insurance Claim Status Request Letter

What information should I include in my insurance claim status request letter?

Your letter should include your full name, address, policy number, claim number (if you have it), the date of the incident or loss, a clear request for the claim status, and any specific questions you have. It’s helpful to include contact information, such as your phone number and email address, for ease of communication.

Who should I address the insurance claim status request letter to?

The letter should be addressed to the specific insurance company and ideally, to the claims department or the claims adjuster handling your case. If you have the adjuster’s name, include it. If not, address it to the general claims department or the appropriate department for your type of insurance (e.g., auto, home).

How should I send the insurance claim status request letter?

While postal mail is generally accepted, consider sending your letter via certified mail with return receipt requested to provide proof of delivery. Alternatively, many insurance companies accept requests via email or through their online portals. Check your insurance company’s website or policy documentation for preferred methods of communication.

What should I do if I don’t receive a response to my request letter?

If you don’t receive a response within a reasonable timeframe (e.g., two to four weeks), follow up with the insurance company. You can call the claims department, send another letter (perhaps referencing the previous one), or explore other communication channels like email or their online portal. Keep a record of all your communications.

Can I request the claim status on behalf of someone else?

Yes, but you’ll likely need to provide documentation demonstrating your authority to do so. This could be a power of attorney, a legal guardianship document, or evidence of your relationship to the insured party (e.g., for a minor). Contact the insurance company beforehand to inquire about their specific requirements for third-party requests.

Related:

Resignation letter due to rude boss

Resignation letter moving to another state

Resignation letter due to illness of family member

Resignation letter due to study

Resignation letter due to long commute