Filing an insurance claim can feel like a daunting task, especially when you are already dealing with the stress of an accident, medical emergency, or property damage. However, writing a formal Insurance Claim Request Letter is often the most critical step in getting the financial support you are entitled to.

This letter serves as a formal notification to your insurance provider that a specific event covered by your policy has occurred and that you are seeking reimbursement or direct payment.

Insurers require this document to establish a clear paper trail. It initiates the official administrative process, assigns a claim number to your case, and acts as a cover letter for your supporting documentation, such as police reports, medical bills, or repair estimates.

Without a well-drafted claim request letter, your settlement process could be delayed or even rejected due to a lack of clarity. Whether you are dealing with auto, health, or home insurance, understanding how to articulate the facts clearly is essential for a smooth claim settlement.

Insurance Claim Request Letter

An Insurance Claim Request Letter is a formal written statement sent by a policyholder to an insurance company. Its primary purpose is to inform the insurer of a loss or event that is covered under the existing insurance policy. While many companies now offer online portals for filing claims, a written letter remains a powerful tool, particularly for complex claims, appeals, or when submitting physical evidence.

The letter should be professional, concise, and factual. It must include your policy number, the date of the incident, a description of what happened, and a clear request for payment or repair authorization.

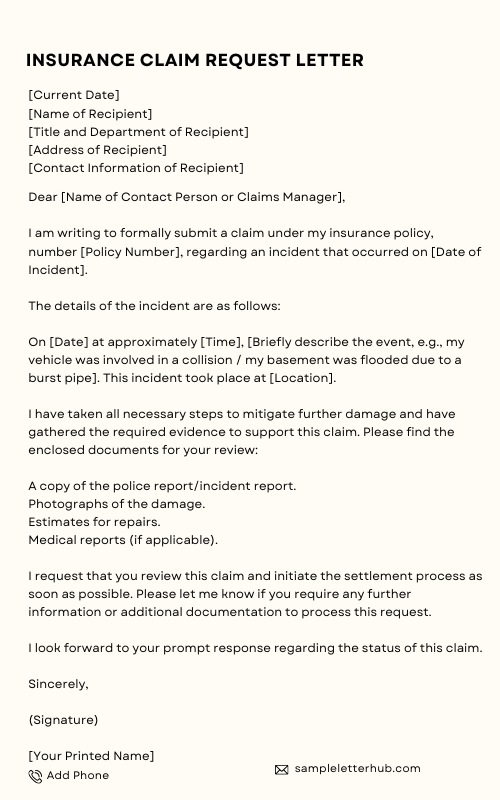

Below is a comprehensive example of how a standard claim letter should be structured.

[Your Name]

[Your Address]

[City, State, Zip Code]

[Your Phone Number]

[Your Email Address]

[Date]

[Name of Claims Manager or Department]

[Name of Insurance Company]

[Company Address]

[City, State, Zip Code]

Subject: Insurance Claim Request Letter for Policy No. [123456789]

Dear [Name of Contact Person or Claims Manager],

I am writing to formally submit a claim under my insurance policy, number [Policy Number], regarding an incident that occurred on [Date of Incident].

The details of the incident are as follows:

On [Date] at approximately [Time], [Briefly describe the event, e.g., my vehicle was involved in a collision / my basement was flooded due to a burst pipe]. This incident took place at [Location].

I have taken all necessary steps to mitigate further damage and have gathered the required evidence to support this claim. Please find the enclosed documents for your review:

- A copy of the police report/incident report.

- Photographs of the damage.

- Estimates for repairs.

- Medical reports (if applicable).

I request that you review this claim and initiate the settlement process as soon as possible. Please let me know if you require any further information or additional documentation to process this request.

I look forward to your prompt response regarding the status of this claim.

Sincerely,

(Signature)

[Your Printed Name]

Sample insurance claim letter

Dear Manager,

I am writing to formally request compensation for a loss covered under my policy, number [Policy Number]. On [Date], I experienced a theft at my residence located at [Address].

Upon returning home at [Time], I discovered that the back door had been forced open. Several valuable items, including a laptop and jewelry, were missing. I immediately contacted the local authorities, and a police report was filed (Case Number: [Case #]).

I have attached a list of the stolen items, their original purchase receipts, and a copy of the police report. I trust that this information is sufficient to process my claim under the theft protection clause of my policy.

Please guide me on the next steps required to finalize this claim settlement.

Sincerely,

[Your Name]

Claim request letter format

Dear Manager,

Please accept this letter as a formal notification of a claim regarding my policy, number [Policy Number]. I am requesting reimbursement for expenses incurred due to a covered event.

To assist with the processing of my claim, I have outlined the key details below:

- Date of Incident: [Date]

- Location: [Location]

- Description of Event: [Brief description, e.g., Storm damage to roof]

- Estimated Cost of Repair: $[Amount]

I have enclosed the assessment report from a certified contractor and photographs of the damage. I kindly request that you review these documents and verify the coverage.

I am available to discuss this matter further and can provide additional information if needed. Thank you for your assistance in resolving this matter efficiently.

Sincerely,

[Your Name]

Insurance claim letter template

Dear Manager,

Reference: Claim against Policy Number [Insert Policy Number]

I am writing to report a claim regarding [insert type of incident, e.g., an accident/illness/loss] that occurred on [Date].

The circumstances regarding the incident are as follows: [Insert a clear, 2-3 sentence description of what happened]. As a result of this incident, I have sustained damages/losses totaling approximately $[Insert Amount].

In support of my claim, I have attached the following proof:

- [Document 1]

- [Document 2]

- [Document 3]

Please treat this letter as a formal insurance claim request. I would appreciate a confirmation of receipt and an estimated timeline for when an adjuster will be assigned to my case.

Sincerely,

[Your Name]

Vehicle insurance claim letter

Dear Manager,

I am writing to file a claim under my auto insurance policy, number [Policy Number], following a traffic accident involving my vehicle, a [Year, Make, Model].

The accident occurred on [Date] at [Location/Intersection]. While I was stopped at a red light, my vehicle was struck from behind by another driver. The third-party driver’s details and insurance information are included in the attached police report (Report #12345).

My vehicle has sustained significant damage to the rear bumper and trunk. I have already obtained two repair estimates from authorized workshops, which are enclosed with this letter.

I request that you dispatch a surveyor to inspect the vehicle so that repairs can commence immediately. I am anxious to have my vehicle back on the road and appreciate your quick attention to this vehicle insurance claim.

Sincerely,

[Your Name]

Health insurance claim request

Dear Manager,

I am writing to submit a claim for medical expenses incurred during my recent hospitalization. My health insurance policy number is [Policy Number].

I was admitted to [Name of Hospital] on [Date] for [Name of Procedure/Diagnosis]. I was discharged on [Date] following successful treatment. As per the hospital’s policy, I settled the bills out of pocket and am now seeking reimbursement in accordance with my policy terms.

Attached to this letter, please find:

- Original Discharge Summary

- Final Hospital Bill and breakdown of charges

- Pharmacy and lab test receipts

- Prescriptions signed by the attending physician

Please process this health insurance claim request and remit the reimbursement to my registered bank account. If any further medical records are required, please let me know immediately.

Sincerely,

[Your Name]

Property damage claim letter

Dear Manager,

I am filing a claim under my Homeowner’s Insurance Policy, number [Policy Number], regarding damage sustained to my property located at [Address].

On [Date], a severe storm passed through the area, causing a large tree branch to fall onto my garage roof. This has resulted in structural damage to the roof and water damage to the interior ceiling.

I have taken immediate temporary measures to cover the hole and prevent further water intrusion, as per the policy guidelines. I have attached photographs of the damage before and after these temporary repairs, along with an estimate from a licensed roofing contractor for the permanent restoration.

Please advise on the next steps for this property damage claim. I am ready to schedule a visit for an adjuster to verify the extent of the loss.

Sincerely,

[Your Name]

Insurance claim follow-up letter

Dear Manager,

I am writing to follow up on the status of my insurance claim, which was submitted on [Date of Original Letter].

The claim is regarding [brief description, e.g., water damage to my kitchen], and serves under policy number [Policy Number]. It has now been [Number] weeks since I submitted all required documentation, and I have not yet received an update regarding the settlement or the appointment of an adjuster.

Please inform me of the current status of this claim. If there are any missing documents or outstanding issues holding up the process, kindly let me know immediately so I can rectify them.

I look forward to a prompt resolution to this matter.

Sincerely,

[Your Name]

Claim request letter for medical reimbursement

Dear Manager,

Subject: Request for Medical Reimbursement – Policy [Policy Number]

I am submitting this request for the reimbursement of medical expenses totaling $[Amount]. These expenses were incurred for [Physiotherapy/Dental/Specialist Consultation] treatments received between [Start Date] and [End Date].

Although this provider is out-of-network, my policy covers [Percentage]% of these costs after the deductible. I have attached the itemized invoices from the provider, proof of payment, and the completed claim form required by your department.

Please review these documents and process the reimbursement check to my mailing address.

Thank you for your efficient handling of this medical reimbursement claim.

Sincerely,

[Your Name]

Insurance claim appeal letter

Dear Manager,

I am writing to formally appeal the denial of my claim regarding [Incident] (Claim Number: [Claim #]), which I received notice of on [Date of Denial Letter].

Your letter stated that the claim was denied due to [Reason for Denial, e.g., lack of evidence/policy exclusion]. However, I believe this decision was made in error. I have reviewed my policy document, specifically section [Section Number], which states that this type of loss is indeed covered.

Furthermore, I have enclosed additional documentation that was not included in my initial request:

- A witness statement clarifying the timeline of events.

- Additional photos showing the damage was not pre-existing.

I respectfully request that a supervisor review this claim and the new evidence provided. I am confident that this clarifies the situation and validates my request for coverage.

Sincerely,

[Your Name]

How to Write an Insurance Claim Request Letter

Writing an effective insurance claim letter is not just about complaining; it is about documenting facts to ensure you get paid. A messy or vague letter can lead to questions, delays, or denials. Follow this step-by-step guide to ensure your letter is professional and effective.

- Review Your Policy First

Before you start writing, read your policy document. Understand your coverage limits, deductibles, and the specific time frame within which you must file a claim. Knowing the specific language of your policy helps you align your letter with what the insurer needs to hear.

- Gather All Necessary Information

You cannot write a convincing letter without facts. Gather your policy number, the date and time of the incident, photos, police report numbers, and contact information for any witnesses. Having this data ready makes the writing process faster and ensures accuracy.

- Use a Professional Tone

Even if you are frustrated, your tone must remain objective and formal. Avoid using emotional language or accusations. Stick to the facts. A clear, polite letter is more likely to be processed quickly by a busy claims adjuster.

- Be Specific and Concise

Do not write a novel. State exactly what happened, when it happened, and what you are asking for. Use bold text for critical details like the policy number or the total amount being claimed. Bullet points are excellent for listing damaged items or attached documents.

- Include a Call to Action

Always end your letter by stating what you expect to happen next. Whether you want a surveyor to visit, a check to be mailed, or a confirmation email, state it clearly. This puts the ball in the insurer’s court.

- Proofread and Keep Copies

Typos regarding dates or dollar amounts can be disastrous. Double-check everything. Finally, never send your only copy of the evidence. Send copies of receipts and reports, and keep the originals and a copy of the letter for your own records.

FAQs

What is the time limit for sending an insurance claim letter?

Most insurance policies have a specific “statute of limitations” or time window for filing a claim. This can range from 30 days to one year depending on the type of insurance (health vs. auto) and the provider. It is crucial to check your specific policy documents or contact your agent immediately after the incident to ensure you do not miss the deadline.

Can I send my claim letter via email?

Yes, most modern insurance companies accept and even prefer claims via email or through their digital portals. If sending via email, ensure the subject line is clear (e.g., “Claim Request – Policy #12345”) and attach all documents as PDF files. However, for legal or high-value claims, sending a physical copy via certified mail is recommended to prove receipt.

What should I do if my claim is rejected?

If your claim is rejected, do not give up. Read the rejection letter carefully to understand the specific reason for the denial. It could be a simple clerical error or a missing document. You have the right to write an appeal letter (as shown in the samples above) providing new evidence or clarifying the situation to have the decision reviewed.

Do I need to include original receipts with my letter?

Generally, you should never send original receipts unless specifically asked, because documents can get lost in the mail or office shuffle. Send high-quality photocopies or scans of your receipts, police reports, and medical bills. Keep the originals in a safe place in case the insurance company audits the claim.

Is a handwritten letter acceptable?

While a handwritten letter is legally valid, it is strongly discouraged. Handwritten letters can be difficult to read, which may lead to misunderstandings or delays in processing your claim request. A typed, printed, and signed letter looks more professional and ensures that all policy numbers and figures are legible.

Related:

Letter to Terminate Insurance Policy