A home insurance hardship letter is a plea. It’s a formal written request. Its purpose? To explain why you can’t pay your home insurance premium on time. This letter aims to convince your insurance provider. They might offer temporary payment relief.

Dealing with financial struggles is tough. You need help sometimes. We understand the need for simplicity. That’s why we’re here. We are offering home insurance hardship letter templates. Also, we’ll provide examples of hardship letters for insurance. They can help you craft your own letter.

Need to write an insurance hardship letter? You’re in the right place! We’ve made it easy. We’ll give you different samples. You can personalize them for your specific situation. This will help you to seek assistance with your homeowners insurance.

[Your Name]

[Your Address]

[Your Phone Number]

[Your Email Address]

[Date]

[Insurance Company Name]

[Insurance Company Address]

Dear [Insurance Company Representative Name],

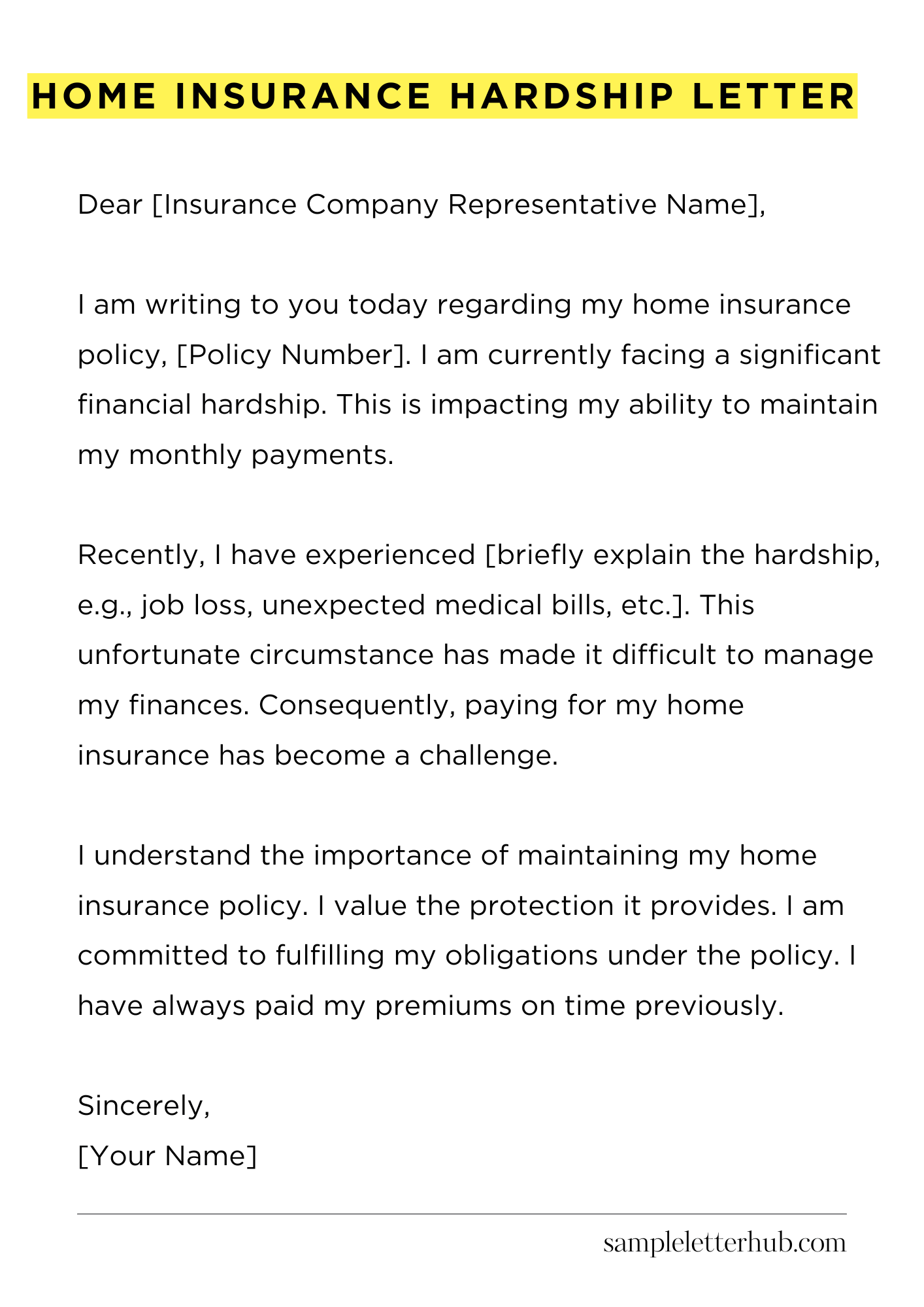

I am writing to you today regarding my home insurance policy, [Policy Number]. I am currently facing a significant financial hardship. This is impacting my ability to maintain my monthly payments.

Recently, I have experienced [briefly explain the hardship, e.g., job loss, unexpected medical bills, etc.]. This unfortunate circumstance has made it difficult to manage my finances. Consequently, paying for my home insurance has become a challenge. The situation has created an unexpected burden.

I understand the importance of maintaining my home insurance policy. I value the protection it provides. I am committed to fulfilling my obligations under the policy. I have always paid my premiums on time previously.

I would be extremely grateful if you would consider offering some form of assistance. Perhaps a temporary reduction in my monthly payments would be possible. Alternatively, exploring a payment plan might be beneficial. I am willing to discuss various options. I am open to any solutions that will help me keep my policy active.

I have attached supporting documentation, such as [list any supporting documents, e.g., bank statements, unemployment verification, etc.]. These documents will help to illustrate my current financial situation. I hope this will give you a better understanding of my circumstances.

Thank you for your time, understanding, and willingness to help. I look forward to hearing from you soon to discuss this matter further. I appreciate your attention to this important issue.

Sincerely,

[Your Name]

How to Write Home Insurance Hardship Letter

Life throws curveballs, and sometimes, those curveballs dent our finances. If you’re struggling to keep up with your home insurance premiums, a hardship letter can be a lifeline. This missive is a formal plea to your insurer, requesting leniency or alternative payment arrangements due to unforeseen circumstances. It’s a vital tool, and here’s how to wield it effectively.

1. Initiate with Formality: The Salutation and Dateline

Begin with a properly formatted salutation. Address the letter to the appropriate department or individual at your insurance company. Research the correct recipient beforehand; addressing it to a specific person demonstrates attentiveness. Always include the date you are penning this missive. This establishes a temporal context for your situation.

2. Explicate the Predicament: Stating the Issue

Immediately and concisely state the purpose of your letter: to request hardship relief. Subsequently, delineate the nature of your financial woes. Be candid, providing a clear and comprehensive account of the factors contributing to your predicament. Was it a job loss? Unexpected medical bills? A natural disaster? Details lend credence to your request.

3. Present the Precedent: Offer Supporting Documentation

A bare assertion of hardship carries little weight. To fortify your claim, include supporting documentation. This could encompass medical bills, termination notices, bank statements, or any other paperwork that substantiates your claims.

Make legible copies of the documents and meticulously reference them within the body of your letter; this is crucial for establishing your case. This act underscores your claim of fiscal restraint.

4. Enumerate the Imperative: Propose a Solution

Don’t just highlight the problem; propose a solution. What specific form of assistance are you seeking? Could you request a temporary reduction in premiums? A deferred payment plan? Be realistic and specific. Offering a clear, viable solution demonstrates proactivity and a commitment to resolving the issue.

5. Illustrate the Impact: Convey the Consequences

Explain the potential repercussions if your insurance coverage is cancelled. What will happen if your home isn’t protected? Will you be exposed to catastrophic financial ruin? Detail the potential fallout of non-payment.

This part focuses on the urgency and necessity of your plea. Paint a picture of the potentially disastrous situation in the absence of assistance.

6. Affirm the Assertion: Demonstrate Commitment

Express your unwavering commitment to maintaining your insurance coverage. Reiterate your intention to meet your financial obligations once your hardship abates. This illustrates your good-faith efforts. Include a sincere expression of gratitude for their consideration.

7. Conclude with Closure: The Signature

Conclude your letter with a formal closing, such as “Sincerely” or “Respectfully.” Sign the letter and print your full name. Include your contact information – phone number and email address – to facilitate communication.

Proofread the entire letter meticulously before sending it. Then, transmit your missive via certified mail with a return receipt requested. This ensures proof of delivery and provides a definitive record of your communication.

FAQs about Home Insurance Hardship Letter

What is a home insurance hardship letter, and why is it needed?

A home insurance hardship letter, also known as a financial hardship letter, is a formal document you submit to your home insurance provider explaining your financial difficulties. It outlines the reasons why you’re struggling to pay your premiums, such as job loss, medical expenses, or other unforeseen circumstances.

The purpose is to request assistance, which might include a temporary payment plan, a reduction in premiums, or a delay in cancellation.

What information should be included in a home insurance hardship letter?

Your letter should clearly state your policy number and the specific financial hardship you’re experiencing. Provide detailed explanations, supporting documentation (like layoff notices, medical bills, or bank statements), the dates the hardship started, and how it impacts your ability to pay.

It should also specify the type of assistance you’re seeking (e.g., payment plan, premium reduction) and the timeframe needed. Be honest and straightforward in your presentation.

What are the possible outcomes after submitting a home insurance hardship letter?

The insurance company will review your letter and supporting documentation. Possible outcomes include approval of a payment plan, a temporary premium reduction, or a hold on policy cancellation.

They might also deny your request if your circumstances don’t meet their hardship criteria or the provided documentation isn’t sufficient. Be prepared to negotiate and explore alternatives, as each insurance provider will have different policies.

How can a home insurance hardship letter help prevent policy cancellation?

By proactively communicating your financial difficulties, a hardship letter can prevent your home insurance policy from being canceled due to non-payment. Insurance companies are often willing to work with policyholders facing temporary financial challenges to keep the policy active.

A canceled policy can make it difficult and expensive to obtain future coverage. The letter is a chance to show good faith and maintain coverage.

Are there alternatives to a home insurance hardship letter?

Yes. If you’re struggling to pay your premiums, consider options like reviewing your policy for potential discounts (e.g., bundling with other insurance), increasing your deductible (which will lower your premium but increase out-of-pocket costs if you file a claim), or shopping around for a cheaper home insurance policy.

You could also seek financial counseling or assistance programs to improve your overall financial situation. Explore all options available to you.

Related:

Resignation letter due to rude boss

Resignation letter moving to another state

Resignation letter due to illness of family member

Resignation letter due to study