A Health Insurance Hardship Letter is a formal document. Its purpose is to explain difficult circumstances. This letter asks for an exemption from health insurance requirements. It helps individuals facing financial or other challenges.

We understand navigating the complexities of health insurance hardship letters can be tricky. That’s why we’re here to help. This article provides hardship letter samples and templates. They are designed to make writing your own letter easier.

Need to draft a hardship letter for health insurance? We’ve got you covered. Get ready to find various hardship letter examples. They will assist you in creating a strong and effective letter.

[Your Name/Your Company Name]

[Your Address]

[Your Phone Number]

[Your Email Address]

[Date]

[Insurance Company Name]

[Insurance Company Address]

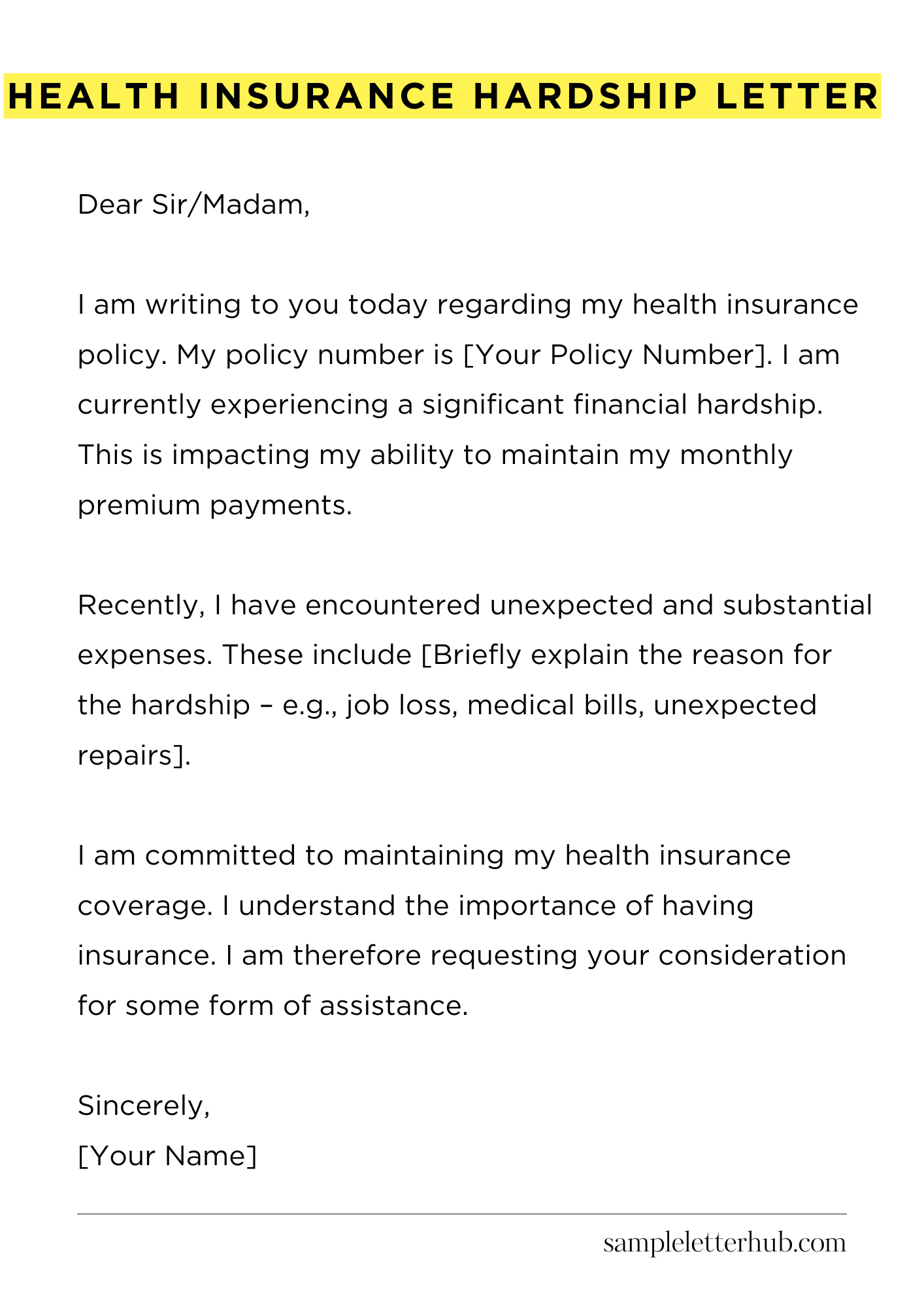

Dear Sir/Madam,

I am writing to you today regarding my health insurance policy. My policy number is [Your Policy Number]. I am currently experiencing a significant financial hardship. This is impacting my ability to maintain my monthly premium payments.

Recently, I have encountered unexpected and substantial expenses. These include [Briefly explain the reason for the hardship – e.g., job loss, medical bills, unexpected repairs]. These circumstances have put a considerable strain on my financial resources. It’s become very difficult to manage all my obligations.

I am committed to maintaining my health insurance coverage. I understand the importance of having insurance. I am therefore requesting your consideration for some form of assistance. This could be in the form of a temporary reduction in my premium payments. Alternatively, perhaps a payment plan could be arranged.

I have attached supporting documentation to help demonstrate my financial situation. This includes [List the documents you’ve included – e.g., bank statements, proof of unemployment, medical bills]. These documents clearly illustrate the current challenges I am facing. I am happy to provide further documentation if needed.

I would greatly appreciate it if you would review my situation. Please contact me at your earliest convenience to discuss potential solutions. I am available by phone or email. I look forward to hearing from you soon.

Thank you for your time and understanding.

Sincerely,

[Your Name]

How to Write Health Insurance Hardship Letter

Navigating the labyrinthine world of health insurance can be challenging. When financial straits hinder your ability to meet premium payments, a well-crafted hardship letter becomes your advocate. It is a crucial tool.

1. Understanding the Imperative

Before you even begin, it is paramount to understand the core purpose. A hardship letter is not just a plea; it’s a formal declaration outlining circumstances that severely impact your capacity to pay. The purpose is to request assistance. It will show empathy to your insurer.

2. Decoding Eligibility Criteria

Each insurance provider possesses specific guidelines. Scrutinize your policy documents. Determine the types of hardships they recognize. Common examples encompass unexpected medical expenses, job loss, or a substantial reduction in income. Make sure you meet the criteria.

3. Structuring Your Narrative: The Art of Penning the Letter

The structure is important. A compelling hardship letter usually follows a conventional format. Start with your personal details and policy information. This should always include the date. Next, transition into a concise explanation of the hardship. Quantify the impact on your finances.

Be clear, precise, and devoid of ambiguity. The last part is the action you are seeking from your insurer. This includes a clear and reasonable request. For example, a temporary reduction in premiums or a payment plan.

4. Articulating the Predicament: Crafting the Content

Clarity is the cornerstone of effective communication. Employ plain language. Avoid jargon. But, you should always be professional. Start with a succinct statement of your current situation. Follow this with a detailed account of the hardship. Provide specific dates. Supply supporting documentation, like medical bills or termination notices. Honestly relay the economic impact.

5. Assembling Supporting Documentation: The Proof of the Pudding

Your letter is only as strong as the evidence. Gather all pertinent documentation. This may encompass medical bills, invoices, bank statements, or proof of unemployment. Make copies and submit them along with your letter. Verify the accuracy. A well-documented claim substantially increases your prospects of success.

6. Composing the Closing Plea: Seeking Relief

End your letter with a clear and concise request. Be specific about the type of assistance you seek. Show flexibility, if possible. Include your contact information. Express gratitude for their consideration. This will show you in a better light.

7. Polishing and Dispatching: The Final Expedition

Before sending, meticulously proofread your letter. Check for grammatical errors and ensure clarity. Consider having a second pair of eyes review it. Deliver the letter via certified mail or another method that provides proof of receipt. Keep a copy for your records. Good luck!

FAQs about Health Insurance Hardship Letter

What is a Health Insurance Hardship Letter and Why Do I Need One?

A health insurance hardship letter, also known as a hardship exemption, is a document you submit to the Health Insurance Marketplace (Healthcare.gov) to request an exemption from the Affordable Care Act’s (ACA) individual mandate penalty.

This letter explains why you were unable to obtain or afford health insurance and faced significant financial or personal difficulties. You may need one to avoid owing a penalty when you file your taxes, if you qualified for a hardship exemption.

What are the Common Reasons for Qualifying for a Hardship Exemption?

Common reasons include experiencing homelessness, eviction or facing eviction, having a utility shut-off notice, being the victim of a domestic violence, experiencing a natural disaster, facing significant financial troubles, or having a family member who needed extensive medical care that resulted in substantial medical debt.

Other reasons could include a death in the family or a significant unexpected increase in your health insurance premiums that you could not afford.

How Do I Write a Compelling Health Insurance Hardship Letter?

Your letter should be clear, concise, and factual. Begin by stating the purpose of the letter: to request a hardship exemption. Provide a detailed explanation of your specific hardship, including dates, financial amounts (if applicable), and any supporting documentation (e.g., bills, eviction notices, medical records).

Be honest and thorough, but avoid unnecessary emotional language. Be sure to include your name, address, Social Security number, and Marketplace account information if you have one. If you are applying for a specific category of hardship, specify which one.

What Supporting Documents Do I Need to Include with My Letter?

Supporting documentation varies depending on your hardship. Examples include proof of homelessness (e.g., letter from a shelter), eviction notice, utility shut-off notice, medical bills, debt collection notices, court documents related to domestic violence, and documentation of a natural disaster. Gather any evidence that supports your claims to strengthen your application.

Where Do I Submit My Health Insurance Hardship Letter?

You typically submit your hardship letter to the Health Insurance Marketplace (Healthcare.gov) online, by mail, or through a Navigator or other Marketplace-certified assister. You can find instructions on how to submit your letter on the Healthcare.gov website. Remember that depending on the type of exemption, you may receive a confirmation number.

Related:

Resignation letter due to rude boss

Resignation letter moving to another state

Resignation letter due to illness of family member

Resignation letter due to study