A hardship letter for financial difficulty is a written explanation. It’s a formal request. You tell a lender about your current money problems. The goal is to get help. This could be lower payments. It might be a temporary break.

This article has you covered. We’ll share hardship letter templates. We also have hardship letter examples. Need a financial hardship letter sample? Look no further! We’ve got them all. These samples make writing easy.

Need a hardship letter? Want to avoid mistakes? We provide help. You can adapt these hardship letter samples. This will help you write your own letters. Get the relief you deserve.

[Your Name/Your Address]

[Your City, Postal Code]

[Your Email Address]

[Your Phone Number]

[Date]

[Recipient’s Name/Title]

[Recipient’s Company/Organization]

[Recipient’s Address]

[Recipient’s City, Postal Code]

Dear [Recipient’s Name],

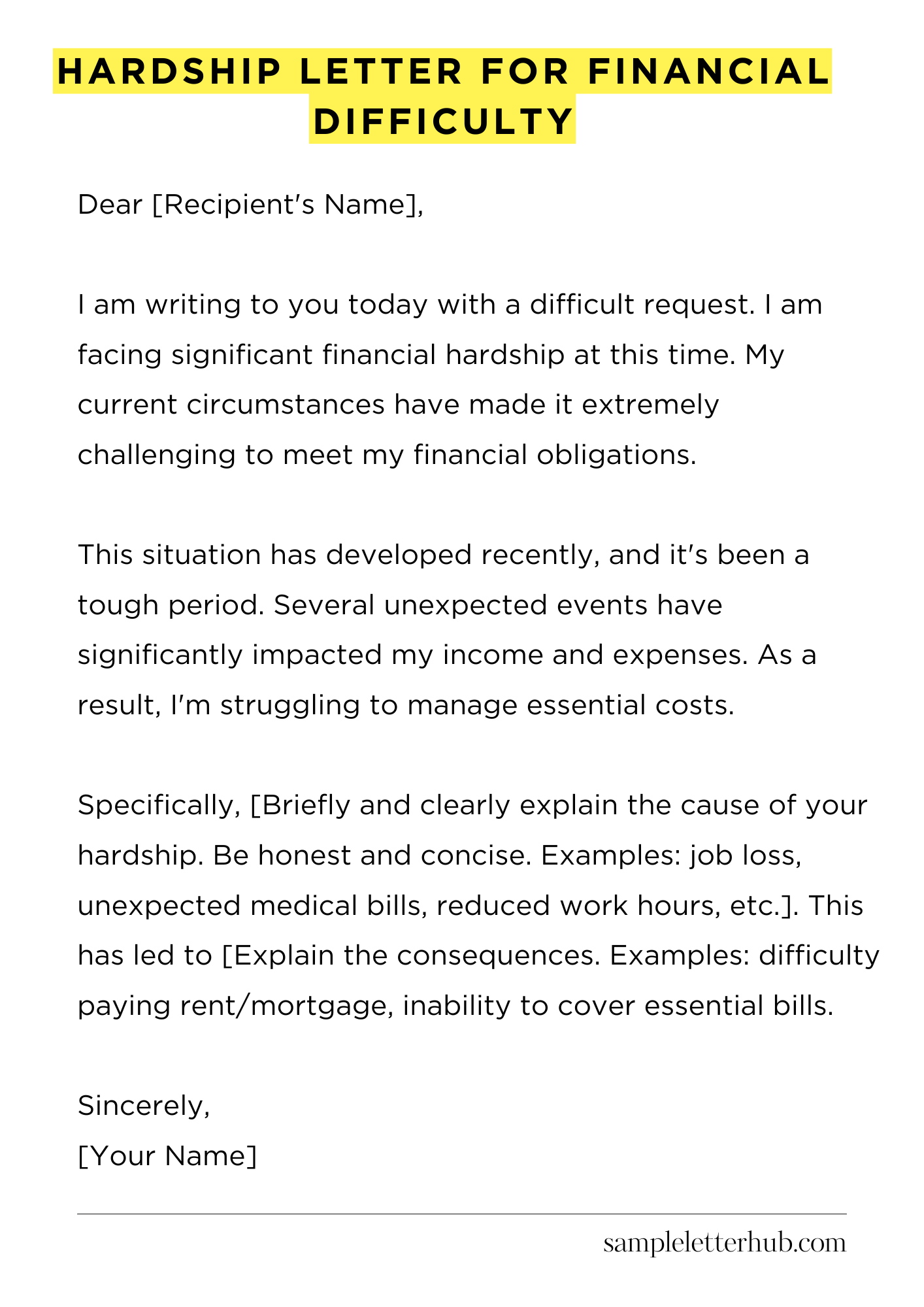

I am writing to you today with a difficult request. I am facing significant financial hardship at this time. My current circumstances have made it extremely challenging to meet my financial obligations.

This situation has developed recently, and it’s been a tough period. Several unexpected events have significantly impacted my income and expenses. As a result, I’m struggling to manage essential costs.

Specifically, [Briefly and clearly explain the cause of your hardship. Be honest and concise. Examples: job loss, unexpected medical bills, reduced work hours, etc.]. This has led to [Explain the consequences. Examples: difficulty paying rent/mortgage, inability to cover essential bills, debt accumulation, etc.]. This is a concerning situation.

I have already taken several steps to mitigate the situation. I have been carefully reviewing my budget and have cut back on all non-essential spending. I am also actively looking for [Explain any actions taken.

Examples: additional work opportunities, seeking financial counseling, negotiating with creditors, etc.]. These actions are important steps in addressing this challenge.

I am requesting [Clearly state what you are requesting. Examples: a payment plan, a temporary reduction in payments, a waiver of fees, an extension on a deadline, etc.]. Any assistance you could offer would be greatly appreciated and would provide significant relief during this difficult time. This would make a real difference.

I am committed to resolving this situation and becoming financially stable again. I am confident that with a little help, I can navigate these challenges. I am available to discuss my situation in more detail and provide any necessary documentation. Thank you for considering my request. I truly appreciate your understanding and support.

Sincerely,

[Your Name]

How to Write Hardship Letter for Financial Difficulty

Navigating financial straits is a daunting ordeal. Sometimes, conveying your struggles through a written missive, a hardship letter, is the most judicious approach. This guide will walk you through the process of composing a compelling and effective letter to articulate your financial predicament.

1. Understanding the Purpose: Why Pen a Hardship Letter?

The genesis of a hardship letter lies in a specific need: to beseech forbearance or relief from a creditor, lender, or other institution. Whether you’re seeking to defer payments, renegotiate terms, or even stave off foreclosure, the letter serves as your formal plea.

It’s a structured narrative outlining your challenges, demonstrating your commitment to resolve the issue, and proposing a viable resolution. It is your opportunity to formally state your case.

2. Pre-requisites: Assembling Your Ammunition

Before you even begin drafting, gather the necessary documentation. This is your evidentiary arsenal. Compile proof of income (pay stubs, tax returns), bank statements, and any bills or invoices showcasing your financial obligations.

You must also include documents illustrating your hardship, such as medical bills, layoff notices, or property damage assessments. The more robust your supporting evidence, the more persuasive your letter will be.

3. The Salutation and Introduction: Setting the Stage

Begin with a formal salutation: “Dear [Creditor/Lender Name]”. Immediately state the purpose of your letter. This sets the tone, clearly identifying what the recipient can expect.

Briefly introduce yourself, your account information, and the reason for writing. For example: “I am writing to you today regarding my mortgage account… due to unforeseen circumstances…” The intro should be short but impactful.

4. Detailing Your Predicament: Painting the Picture

This is the crux of your letter. Provide a detailed, chronologically sound account of your financial hardship. Be candid and transparent. Explain the specific events that have precipitated your situation.

Use concrete examples. Include dates, amounts, and any other pertinent details. Avoid embellishment, keeping your language factual and unemotional. Stick to the facts like a hawk.

5. The Proposed Resolution: Offering a Way Forward

Don’t just present the problem; propose a solution. What assistance are you seeking from the recipient? Are you requesting a temporary payment reduction, a modified repayment schedule, or a complete forbearance?

Be specific and realistic. Outline your plan to remedy the situation and resume fulfilling your financial obligations once your hardship subsides. This demonstrates your genuine intent to repay the debt.

6. The Concluding Remarks: Solidifying Your Plea

In your closing, reiterate your gratitude for the recipient’s consideration. Reiterate your contact information. Express your commitment to cooperating in resolving the matter. Indicate your willingness to provide further documentation. End with a professional closing, such as “Sincerely,” or “Respectfully,” followed by your full name and signature.

7. Polishing and Dispatch: Perfection Before Submission

Before dispatching your letter, meticulously proofread it for grammar, spelling, and clarity. Ensure your tone is respectful and professional throughout. Verify that all information is accurate and that your supporting documentation is attached.

Send the letter via certified mail, return receipt requested, to ensure proof of delivery. This is your final chance to make a strong impression.

FAQs about Hardship Letter for Financial Difficulty

What is a Hardship Letter for Financial Difficulty and Why is it Needed?

A hardship letter for financial difficulty is a formal document written to a lender, creditor, or other relevant party explaining the financial challenges a borrower is facing.

It outlines the specific circumstances that have led to the current financial strain, such as job loss, medical expenses, or unexpected repairs. The purpose is to request assistance, such as modified loan terms, forbearance, or debt forgiveness, based on the documented hardship.

What Information Should I Include in a Hardship Letter?

A comprehensive hardship letter should include a clear explanation of the hardship experienced, detailing the events, their impact on your finances, and how they have affected your ability to meet your financial obligations.

It should also include supporting documentation such as pay stubs, bank statements, medical bills, or unemployment documentation. Be sure to provide specific dates and amounts to substantiate your claims. Also, mention the assistance you are seeking from the recipient, such as a temporary payment reduction or a revised repayment schedule.

How Do I Structure a Hardship Letter Effectively?

The structure of a hardship letter should be clear and concise. Begin with a formal greeting, followed by a brief introduction stating the purpose of the letter. Then, detail the specific hardship, providing dates, events, and their financial impact.

Clearly state the specific assistance you are requesting. Close with a statement of your commitment to repaying the debt or resolving the situation, and offer any additional information the recipient may need. Proofread the letter carefully before submitting it.

What Supporting Documentation Should I Include?

The type of supporting documentation required depends on the nature of the hardship. For job loss, include termination letters and unemployment benefits information. For medical expenses, provide medical bills and insurance statements.

For other hardships, such as natural disasters, include relevant documentation such as insurance claims or repair estimates. It’s essential to include any documentation that validates the information stated in the hardship letter.

What are the Possible Outcomes of Submitting a Hardship Letter?

The outcomes of submitting a hardship letter can vary. The lender or creditor may offer various forms of assistance, such as loan modification, forbearance, reduced payments, or even debt forgiveness.

In some cases, the request may be denied. Factors that influence the outcome include the nature of the hardship, the borrower’s credit history, and the specific policies of the lender. It’s crucial to follow up on the letter and maintain open communication with the recipient.

Related:

Resignation letter due to rude boss

Resignation letter moving to another state

Resignation letter due to illness of family member

Resignation letter due to study