Are you struggling with a charge off on your credit report? A charge off is a negative mark on your credit report that can hurt your credit score and make it difficult to get approved for loans or credit cards. However, there is a way to potentially remove this mark from your credit report through a goodwill letter.

A goodwill letter is a letter written to a creditor or collection agency asking them to remove a negative mark from your credit report as a gesture of goodwill.

The purpose of this letter is to explain your situation and ask for forgiveness for the negative mark. While there is no guarantee that a goodwill letter will be successful, it is worth a try to improve your credit score.

In this article, we will provide you with templates and examples of goodwill letters to remove charge offs.

These samples will make it easy for you to write your own letter and increase your chances of success. By following our tips and using our templates, you can take control of your credit report and improve your financial future.

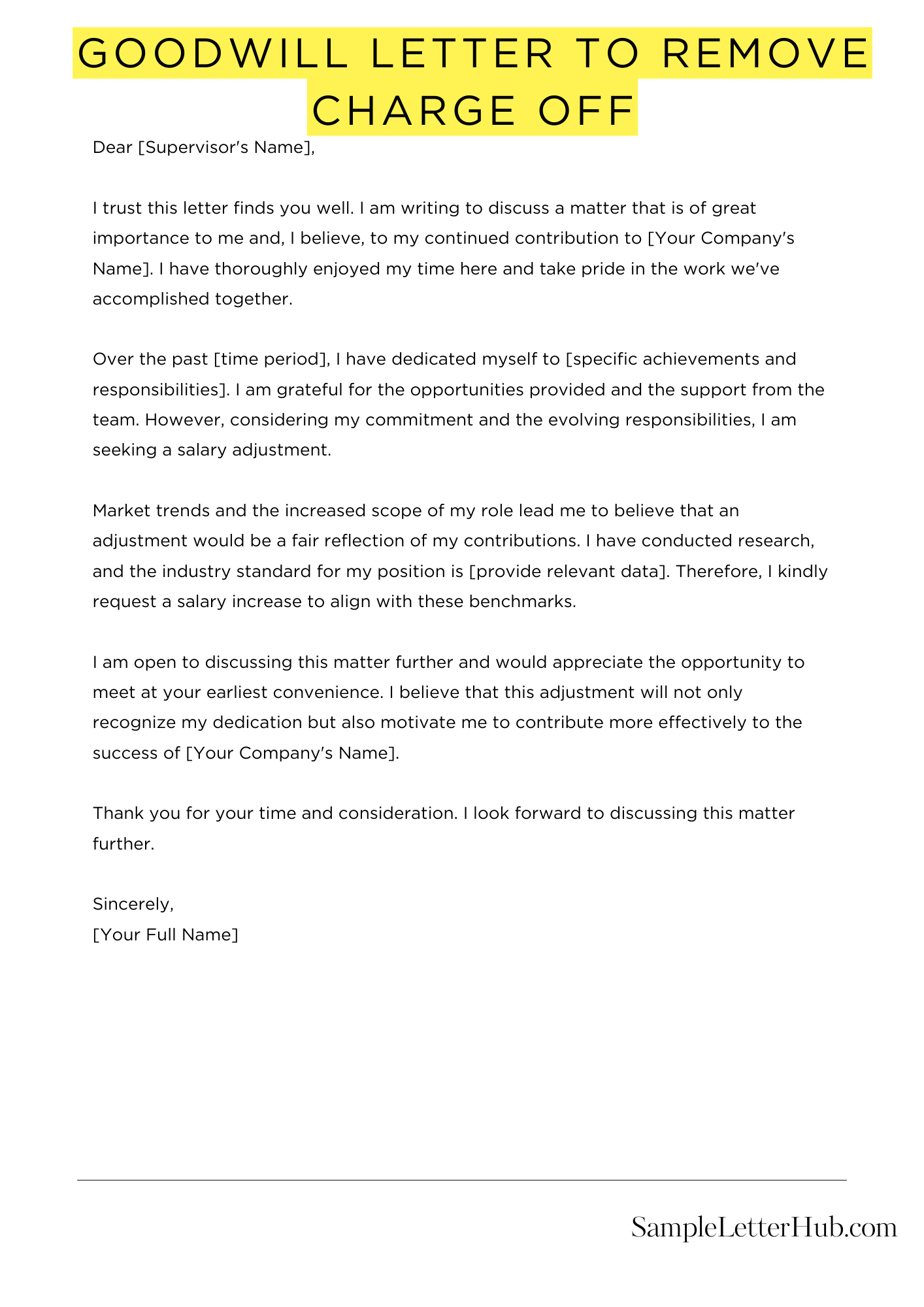

Goodwill Letter To Remove Charge Off

Dear [Creditor’s Name],

I hope this letter finds you well. I am writing to you regarding an account with your company, which is currently marked as a charge-off on my credit report. I understand that this negative entry impacts my creditworthiness and financial standing.

I want to bring to your attention that I have taken steps to improve my financial situation, and I am committed to resolving my outstanding debts. I acknowledge the past challenges that led to the charge-off, but I am now in a better position to fulfill my financial obligations.

I kindly request your consideration in granting a goodwill adjustment to remove the charge-off notation from my credit report. I assure you that I am dedicated to making amends for any past shortcomings and rebuilding my credit responsibly.

Removing this negative entry will significantly contribute to my efforts to achieve financial stability. I am eager to demonstrate my commitment to responsible financial management and would be grateful for your understanding and assistance in this matter.

I appreciate your time and consideration of this request. If needed, I am willing to provide any additional documentation or information to support my case. Thank you for your understanding, and I look forward to a positive resolution to this matter.

Sincerely,

[Your Full Name]

Goodwill Letter To Remove Paid Collections

Dear [Creditor’s Name],

I trust this letter finds you well. I am writing to you in regard to an account that was previously in collections with your company. I am pleased to inform you that I have successfully settled this debt, and it is now marked as “Paid” on my credit report.

I am reaching out to kindly request your consideration for a goodwill adjustment to remove the mention of this paid collection from my credit history. I understand the importance of a positive credit report, and I am committed to maintaining financial responsibility.

While I acknowledge the past circumstances that led to the account being in collections, I have taken significant steps to improve my financial situation. Settling this debt is part of my commitment to achieving and maintaining financial stability.

I kindly ask for your understanding and goodwill in this matter. Removing the notation of this paid collection would greatly contribute to my efforts to rebuild my credit and demonstrate responsible financial management.

I appreciate your time and consideration of this request. If needed, I am willing to provide any documentation or information to support my case. Thank you for your understanding, and I look forward to a positive resolution to this matter.

Sincerely,

[Your Full Name]

Late Payment Dispute Letter

Dear [Creditor’s Name],

I hope this letter finds you well. I am writing to address a late payment notice I recently received regarding my account with your company. I am surprised by this notice as I believe all my payments have been made on time.

I have attached a copy of my payment records for the past few months for your reference. Upon reviewing these records, you will find that my payments were made within the stipulated time frame. It seems there might be an error or confusion, and I am confident we can resolve this matter amicably.

I understand the importance of maintaining a positive credit history, and I am committed to ensuring accurate and timely payments. I kindly request your assistance in investigating this matter and correcting any discrepancies in your records.

I appreciate your prompt attention to this issue. Please feel free to contact me if you need any additional information or clarification. I trust that we can quickly resolve this matter and continue our positive financial relationship.

Sincerely,

[Your Full Name]

Goodwill Letter To Remove Late Payments

Dear [Creditor’s Name],

I hope this letter finds you well. I am writing to request your understanding and goodwill in considering the removal of late payments associated with my account.

Over the course of our relationship, I have been a dedicated and responsible customer. However, due to unforeseen circumstances, I encountered challenges that temporarily affected my ability to make timely payments. As a result, late payments were recorded on my account.

I understand the importance of maintaining a positive credit history and take full responsibility for the late payments. I have since stabilized my financial situation and have consistently made on-time payments. I am reaching out to kindly request your assistance in removing these late payments from my credit report as a goodwill gesture.

I am committed to maintaining a positive and responsible financial profile, and having these late payments removed would greatly contribute to that effort. I truly appreciate your time and consideration in this matter.

Thank you for your understanding, and I look forward to a positive resolution. Please feel free to contact me if you require any additional information or documentation.

Sincerely,

[Your Full Name]

Letter To Creditors To Remove Late Payments

Dear [Creditor’s Name],

I hope this letter finds you well. I am writing to request your assistance in removing the late payments associated with my account from my credit report.

I have been a loyal customer, and I deeply value our relationship. Unfortunately, due to unforeseen circumstances, I faced challenges that affected my ability to make timely payments, resulting in the recording of late payments on my account.

I understand the importance of maintaining a positive credit history, and I take full responsibility for the late payments. Since then, I have taken steps to stabilize my financial situation and have consistently made on-time payments.

I kindly request your understanding and goodwill in considering the removal of these late payments from my credit report. Doing so would significantly contribute to rebuilding my positive credit history.

I appreciate your time and consideration in this matter. If needed, I am willing to provide any additional information or documentation to support my request. I value our relationship and hope for a positive resolution.

Sincerely,

[Your Full Name]

How to Write a Goodwill Letter to Remove Charge Off

If you have a charge off on your credit report, it can negatively impact your credit score and make it difficult to obtain credit in the future. However, there is a way to potentially remove the charge off from your credit report through a goodwill letter.

In this article, we will discuss how to write a goodwill letter to remove a charge off and increase your chances of success.

1. Understand the Purpose of a Goodwill Letter

A goodwill letter is a written request to a creditor or collection agency asking them to remove a negative item from your credit report. The purpose of a goodwill letter is to appeal to the creditor’s sense of compassion and understanding, and to request that they remove the negative item as a gesture of goodwill.

2. Gather Information

Before writing your goodwill letter, it is important to gather all the necessary information. This includes the name and address of the creditor or collection agency, the account number, and the date of the charge off. You should also review your credit report to ensure that all the information is accurate.

3. Start with a Polite Introduction

Begin your goodwill letter with a polite introduction, addressing the creditor or collection agency by name. Express your appreciation for their time and consideration, and explain that you are writing to request their assistance in removing a negative item from your credit report.

4. Explain the Circumstances

In the body of your letter, explain the circumstances that led to the charge off. Be honest and transparent, and provide any relevant details that may help the creditor understand your situation. For example, if you experienced a medical emergency or job loss that led to the charge off, explain how it impacted your ability to make payments.

5. Express Your Regret

Express your regret for the charge off and any negative impact it may have had on the creditor or collection agency. Explain that you are committed to improving your financial situation and that removing the negative item from your credit report would greatly assist you in achieving your goals.

6. Request Their Assistance

In the final paragraph of your letter, request the creditor or collection agency’s assistance in removing the negative item from your credit report. Be clear and concise in your request, and express your gratitude for their consideration.

7. Follow Up

After sending your goodwill letter, it is important to follow up with the creditor or collection agency to ensure that they received your request and are considering it. You may also want to follow up with a phone call.

FAQs About Goodwill Letter to Remove Charge Off

1. What is a goodwill letter?

A goodwill letter is a written request to a creditor or lender asking them to remove a negative item from your credit report as a gesture of goodwill.

2. How does a goodwill letter work?

A goodwill letter works by appealing to the creditor or lender’s sense of compassion and understanding. You explain your situation and ask them to remove the negative item as a gesture of goodwill.

3. What should I include in my goodwill letter?

Your goodwill letter should include a clear explanation of your situation, an apology for any mistakes you may have made, and a request for the creditor or lender to remove the negative item from your credit report.

4. How do I address my goodwill letter?

You should address your goodwill letter to the specific person or department responsible for handling credit disputes or credit reporting issues.

5. What should I do if my goodwill letter is denied?

If your goodwill letter is denied, you can try sending another letter or consider other options such as credit counseling or debt settlement.

6. How long does it take for a goodwill letter to work?

The timeline for a goodwill letter to work can vary depending on the creditor or lender’s response time and policies. It may take several weeks or even months to see a change in your credit report.

7. Can a goodwill letter guarantee the removal of a charge off?

No, a goodwill letter cannot guarantee the removal of a charge off. However, it can increase your chances of success and improve your relationship with the creditor or lender.

Related: