Are you struggling to pay off your debts? Have you ever heard of a goodwill letter to a collection agency? A goodwill letter is a written request to a collection agency asking them to remove negative information from your credit report.

The purpose of this letter is to appeal to the agency’s sense of compassion and understanding, and to ask them to make an exception for you.

In this blog article, we will provide you with templates, examples, and samples of goodwill letters to collection agencies.

Our goal is to make it easy for you to write a letter that will help you improve your credit score and financial situation. Whether you’re dealing with medical bills, credit card debt, or other types of debt, a goodwill letter can be a powerful tool in your arsenal.

By using our templates and examples, you can customize your letter to fit your specific situation and increase your chances of success.

We understand that dealing with debt can be stressful and overwhelming, but we’re here to help you navigate the process and achieve your financial goals. So, let’s get started and write that goodwill letter to your collection agency today!

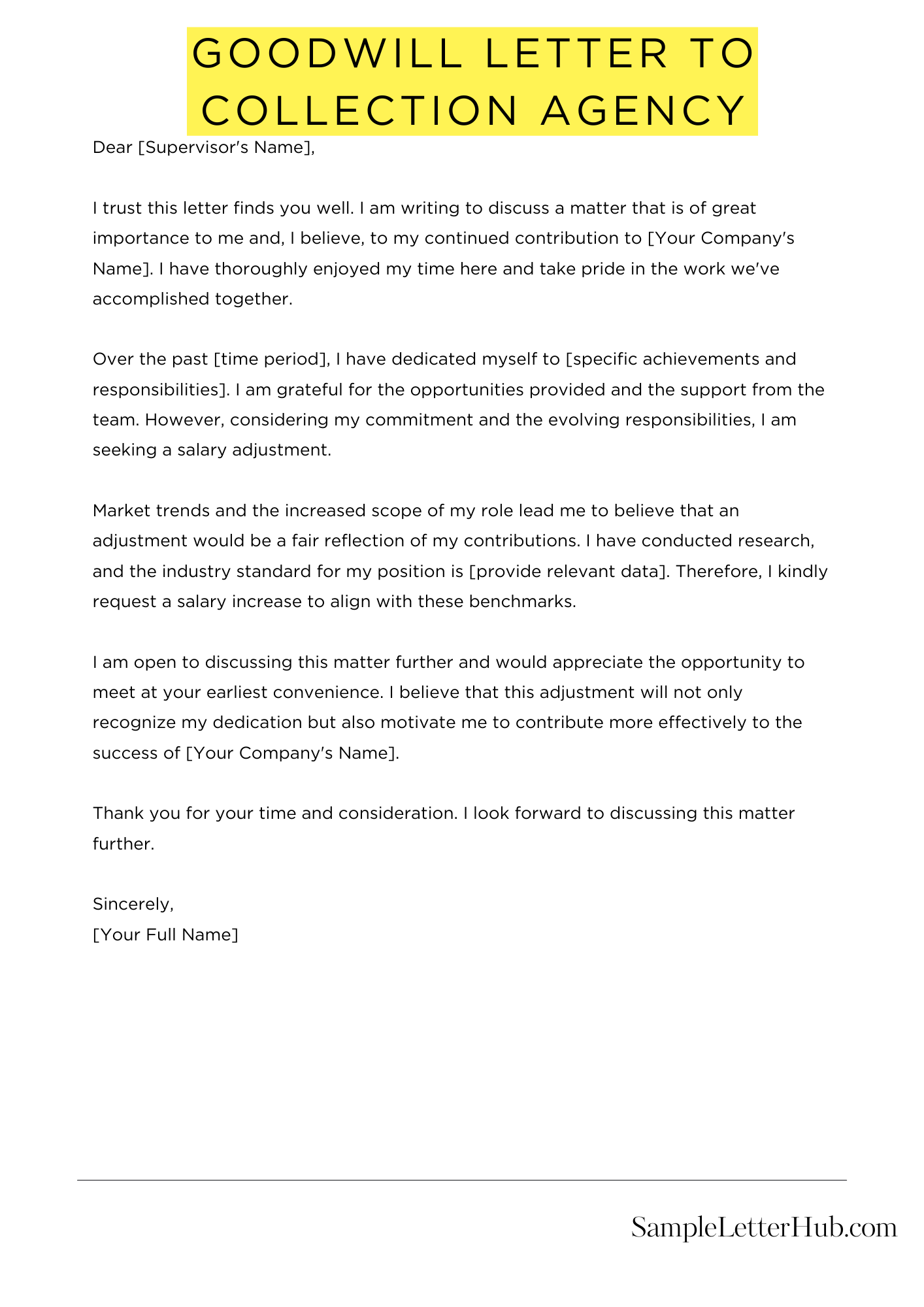

Goodwill Letter To Collection Agency

I hope this letter finds you well. I am writing to address the matter of an outstanding debt that I have with your agency. I understand the importance of meeting financial obligations, and I am committed to resolving this matter responsibly.

Unfortunately, due to unforeseen circumstances, I encountered financial difficulties that led to the inability to meet the agreed-upon terms. I want to assure you that this was not a result of negligence but rather an unfortunate turn of events.

I am currently taking active steps to improve my financial situation and work towards repaying the outstanding amount. I believe in the significance of maintaining a good credit history, and I am committed to rectifying this situation in a timely manner.

Considering the circumstances, I kindly request your understanding and goodwill in working with me to find a reasonable resolution. I am open to discussing a revised payment plan or exploring options that could help in settling this debt amicably.

Your cooperation and flexibility in this matter are greatly appreciated. I am confident that with your understanding, we can find a solution that is fair and feasible for both parties involved.

Thank you for your time and consideration. I look forward to resolving this matter promptly and appreciate your cooperation in helping me regain financial stability.

Sincerely,

[Your Name]

Goodwill Letter To Remove Paid Collections

I trust this letter finds you well. I am writing to express my gratitude for your assistance in resolving the past collection account associated with my name. I recently settled the outstanding balance, and I am writing to request your cooperation in removing the paid collections entry from my credit report.

The settlement of this account is a significant step toward financial responsibility and stability. I understand the importance of a positive credit history, and I am committed to rebuilding my financial standing. The resolution of this matter reflects my dedication to meeting my financial obligations and maintaining a favorable credit profile.

I kindly request your consideration in updating the credit reporting agencies with the accurate and current information regarding the paid collections account. Your support in removing the negative entry would greatly contribute to my efforts in rebuilding my credit and securing a more stable financial future.

I appreciate your understanding and cooperation in this matter. If required, I am more than willing to provide any documentation or additional information to facilitate the process. Your assistance in this regard will have a lasting positive impact on my financial well-being.

Thank you for your time and consideration. I look forward to your positive response and appreciate your help in rectifying this matter.

Sincerely,

[Your Name]

Goodwill Letter To Remove Charge-Off

I hope this letter finds you well. I am writing to you in the spirit of openness and resolution regarding an outstanding financial matter. I recently discovered that there is a charge-off entry on my credit report associated with my account, and I am seeking your assistance in addressing this issue.

I understand that the charge-off was a result of financial challenges I faced during a difficult period. I want to express my sincere commitment to resolving this matter and rebuilding a positive credit history. Since that time, I have taken significant steps to improve my financial situation and have successfully settled the outstanding balance in full.

With this letter, I kindly request your consideration in removing the charge-off notation from my credit report. I believe that this gesture would greatly contribute to restoring my creditworthiness and help me in achieving financial stability.

I want to assure you that I have learned valuable lessons from this experience and am dedicated to maintaining responsible financial habits moving forward. I understand the importance of a positive credit profile and am actively working towards a more secure financial future.

Thank you for your time and understanding. I genuinely appreciate your cooperation in this matter and look forward to a positive resolution that benefits both parties involved.

Sincerely,

[Your Name]

Goodwill Letter To Credit Bureau

Dear [Credit Bureau’s Name],

I hope this letter finds you well. I am writing to you regarding my credit report and the information listed under my name. I have been a responsible credit user for several years, and I recently discovered an entry that I believe does not accurately reflect my financial history.

The entry in question is [Specify the Account Information], which has been a part of my credit report. While I acknowledge the historical issues with this account, I want to bring to your attention the positive changes in my financial situation. I have taken significant steps to improve my creditworthiness, including [Mention any steps you have taken, such as paying off debts].

I understand the importance of accurate credit reporting, and I am reaching out to request your understanding and goodwill in considering the removal of the mentioned entry from my credit report. I believe that this adjustment would better reflect my current financial responsibility and contribute positively to my credit standing.

I appreciate your time and consideration in this matter. If necessary, I am more than willing to provide supporting documentation or further details to assist in your review process. Your cooperation in this regard will greatly impact my ability to achieve my financial goals.

Thank you for your attention to this matter. I look forward to a positive resolution and appreciate your assistance in maintaining the accuracy of my credit report.

Sincerely,

[Your Name]

Late Payment Goodwill Letter

Dear [Creditor’s Name],

I trust this letter finds you well. I am writing to you with the utmost respect and sincerity regarding my recent late payment on the account with reference number [Account Number]. I want to express my regret for the oversight and sincerely apologize for any inconvenience it may have caused.

Life took an unexpected turn, and during a challenging period, I unfortunately missed the payment deadline. I understand the importance of timely payments and how it reflects on my credit history. This occurrence is not a reflection of my usual financial responsibility, and I am committed to ensuring it does not happen again in the future.

In light of this, I kindly request your understanding and consideration for a goodwill adjustment regarding the late payment entry on my account. I have taken immediate steps to rectify the situation by making the overdue payment and implementing measures to prevent such delays moving forward.

I value the relationship we have had over the years, and I am hopeful that you may find it within your discretion to remove or adjust the late payment notation on my account. Your support in this matter would not only alleviate the impact on my credit but also reaffirm my commitment to maintaining a positive financial standing.

Thank you for your time and consideration. I appreciate your understanding and look forward to a positive resolution that benefits both parties involved.

Sincerely,

[Your Name]

How to Write a Goodwill Letter to a Collection Agency

If you have ever been in debt, you know how stressful it can be to receive calls and letters from collection agencies. These agencies are hired by creditors to collect unpaid debts, and they can be relentless in their pursuit of payment.

However, there is a way to potentially improve your credit score and your relationship with the collection agency: by writing a goodwill letter.

A goodwill letter is a letter that you write to a collection agency in an attempt to have them remove negative information from your credit report.

This can include late payments, charge-offs, and collections. While there is no guarantee that a goodwill letter will be successful, it is worth a try if you are looking to improve your credit score.

Here are the steps to writing a successful goodwill letter:

1. Start with a professional greeting

Begin your letter with a professional greeting, such as “”Dear [Collection Agency Name]””. This sets the tone for the rest of the letter and shows that you are serious about resolving the issue.

2. Explain your situation

In the first paragraph, explain your situation and why you were unable to make payments on time. Be honest and straightforward, but avoid making excuses. The collection agency is more likely to be sympathetic if you take responsibility for your actions.

3. Apologize for any inconvenience

In the second paragraph, apologize for any inconvenience that your late payments may have caused. This shows that you understand the impact of your actions and are willing to make amends.

4. Request that negative information be removed

In the third paragraph, request that the collection agency remove any negative information from your credit report. Be specific about which items you would like removed and why. Provide any supporting documentation that you have, such as proof of payment or a letter from your employer.

5. Explain why removing negative information would benefit both parties

In the fourth paragraph, explain why removing negative information from your credit report would benefit both you and the collection agency. For example, if you are able to improve your credit score, you may be more likely to make payments on time in the future. This benefits the collection agency by reducing the likelihood of future collections.

6. Thank the collection agency for their time

In the final paragraph, thank the collection agency for their time and consideration. Be polite and professional, even if you do not receive the response that you were hoping for.

FAQs About Goodwill Letter to a Collection Agency

1. What is a goodwill letter to a collection agency?

A goodwill letter is a written request to a collection agency to remove a negative item from your credit report. It is a way to ask the collection agency to forgive your debt and remove the negative item from your credit report.

2. Why should I write a goodwill letter to a collection agency?

You should write a goodwill letter to a collection agency if you want to improve your credit score. Removing a negative item from your credit report can have a positive impact on your credit score.

3. What should I include in my goodwill letter to a collection agency?

Your goodwill letter should include your name, address, and account number. You should also explain why you were unable to pay your debt and why you are now able to pay it. You should also ask the collection agency to remove the negative item from your credit report.

4. How do I send my goodwill letter to a collection agency?

You can send your goodwill letter to a collection agency by mail or email. Make sure to keep a copy of your letter for your records.

5. What should I do if the collection agency does not respond to my goodwill letter?

If the collection agency does not respond to your goodwill letter, you can follow up with a phone call or another letter. You can also contact a credit counseling agency for assistance.

6. Can a goodwill letter guarantee that the negative item will be removed from my credit report?

No, a goodwill letter cannot guarantee that the negative item will be removed from your credit report. However, it is worth a try as it has worked for many people in the past.

7. How long does it take for a goodwill letter to be effective?

It can take up to 30 days for a collection agency to respond to your goodwill letter. If they agree to remove the negative item from your credit report, it can take up to 45 days for the item to be removed.

Related:

- Physician Retirement Letter To Patients ( 5 Samples )

- Property Management Letter To Owners ( 5 Samples )

- Change Of Ownership Letter To Vendors ( 5 Samples)

- Letter To Extend Maternity Leave ( 5 Samples)

- Authorization Letter For Minor To Travel Without Parents (5 Samples)