Dealing with business insurance can sometimes feel like navigating a maze. One key aspect is understanding your premiums. A Business Insurance Premium Refund Request Letter is your tool to ask for money back. It’s used when you believe you’ve overpaid or are owed a refund. This could be due to policy changes or cancellations.

Need to draft a refund request? We’ve got you covered. We’ll share templates, examples, and samples of these important letters. Writing a business insurance premium refund request can be straightforward. Our goal is to make it easy for you. Get ready to learn and adapt these to suit your situation.

We provide these sample letters for various scenarios. Whether you’re a seasoned business owner or just starting out, we aim to simplify the process. These samples will guide you. They’ll help you craft a clear and effective refund request letter. Consider it your cheat sheet for insurance woes!

[Your Name/Business Name]

[Your Address]

[Your Phone Number]

[Your Email Address]

[Date]

[Insurance Company Name]

[Insurance Company Address]

Subject: Request for Business Insurance Premium Refund

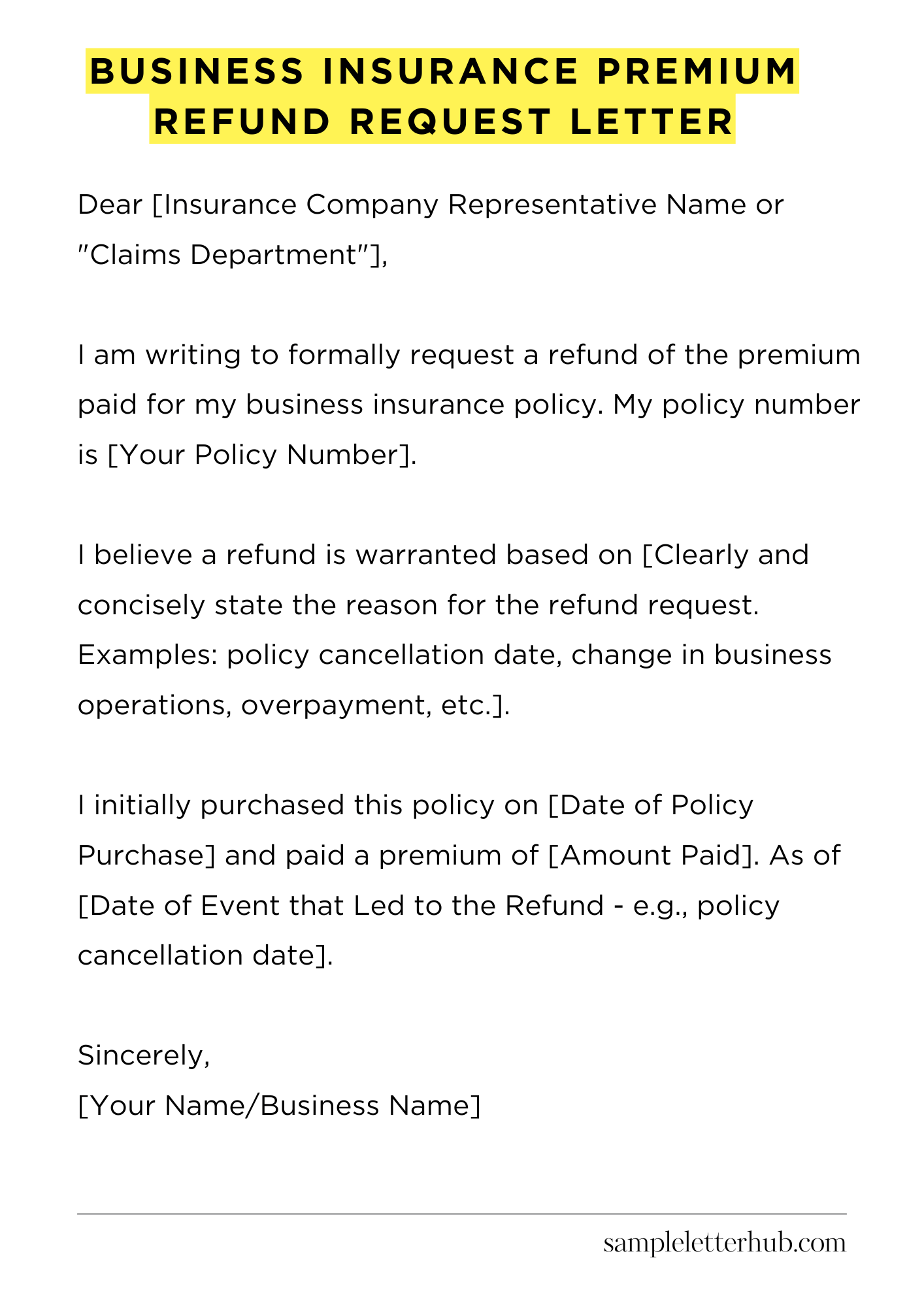

Dear [Insurance Company Representative Name or “Claims Department”],

I am writing to formally request a refund of the premium paid for my business insurance policy. My policy number is [Your Policy Number]. I believe a refund is warranted based on [Clearly and concisely state the reason for the refund request. Examples: policy cancellation date, change in business operations, overpayment, etc.].

I initially purchased this policy on [Date of Policy Purchase] and paid a premium of [Amount Paid]. As of [Date of Event that Led to the Refund – e.g., policy cancellation date], the policy is no longer active because of [Brief, clear reason for the policy no longer being active]. This change significantly impacts the coverage required.

Therefore, a portion of the premium should be returned. I’ve attached copies of [List any supporting documents you are attaching, e.g., policy cancellation notice, proof of change in business, etc.]. These documents will help to clarify my request.

Could you please review my request and process the appropriate refund? I would appreciate it if you could calculate the refund amount based on [Specify how you would like the refund calculated – e.g., the remaining time on the policy, a revised risk assessment, etc.].

Please send the refund to [Your preferred method of refund – e.g., mailing address, account details, etc.]. This would be greatly appreciated.

I look forward to your prompt response and resolution to this matter. Thank you for your time and attention to this. I await your response with anticipation.

Sincerely,

[Your Name/Business Name]

How to Write Business Insurance Premium Refund Request Letter

Navigating the labyrinthine world of business insurance can be tricky. Occasionally, overpayment or policy adjustments necessitate a refund.

This guide provides a meticulously crafted framework for constructing an effective Business Insurance Premium Refund Request Letter, ensuring your reimbursement claim is handled with promptitude and precision.

1. Identify the Premise: Pinpointing the Root Cause

Before you even begin to pen your request, undertake a thorough examination of your policy and the circumstances warranting the refund. Ascertain the exact reason for the overpayment or eligibility for a refund.

Was there a policy cancellation, a change in coverage, or a simple accounting error? Clarifying this initial premise is paramount to a successful request.

2. The Salutation: A Formal Overture

Your letter should commence with a formal salutation. Employ a polite and professional tone. Address the insurance provider, or more specifically, the designated claims department, directly.

If a specific claims adjuster handles your account, address them by name. Something like, “Dear Claims Department,” or “Dear Mr./Ms. [Adjuster’s Last Name],” is appropriate.

3. Subject Matter: Concisely State Your Objective

The subject line is your first opportunity to command attention. It should immediately convey the purpose of your letter. A succinct subject line, such as “Business Insurance Premium Refund Request – Policy Number [Your Policy Number]” or “Request for Refund – Overpayment of Premium,” will efficiently alert the recipient to the letter’s intent.

4. Articulating the Core: The Body of Your Plea

The body of your letter is where you will elaborate on your request. Clearly state the policy number, the specific amount of the refund you are seeking, and the reasons supporting your claim.

Provide a detailed, chronological account of the events leading to the refund request. Include dates, specific policy terms, and any supporting documentation, like proof of payment or previous communications.

Use concise and unambiguous language; avoid ambiguity. Support your claims with concrete facts and data. The more clear you are, the better the chances of a favorable outcome. Avoid any unnecessary rhetoric that might obscure the central point.

5. Documentation: The Arsenal of Proof

Meticulously gather and attach all necessary supporting documentation. This may encompass copies of invoices, payment confirmations, policy amendments, previous correspondence, and any other evidence that substantiates your claim.

Ensure each document is legible and clearly referenced within your letter. This minimizes potential delays and underscores the gravity of your request. These are your essential corroborative instruments.

6. The Peroration: Formal Closing and Contact Information

Conclude your letter with a professional closing. Expressions such as “Sincerely,” “Respectfully,” or “Yours faithfully” are suitable. Provide your full name, contact information (phone number and email address), and the address to which the refund should be remitted. This minimizes any unnecessary follow-up.

You may also include a statement expressing your willingness to answer any questions or provide additional information.

7. Delivery and Follow-Up: Ensuring Expediency

Send your letter via certified mail with a return receipt requested. This provides proof of delivery and ensures a record of your correspondence. Keep a copy of the letter and all attached documentation for your records.

Allow a reasonable timeframe (typically 2-4 weeks) for the insurance provider to process your request. If you haven’t received a response after this period, follow up with a polite phone call or email, referencing your original letter and the relevant policy information.

FAQs about Business Insurance Premium Refund Request Letter

What is a business insurance premium refund request letter?

A business insurance premium refund request letter is a formal written document submitted to an insurance provider to request a return of previously paid insurance premiums. This is typically done when a policy is canceled before its expiration date or if an overpayment has occurred.

What information should I include in a business insurance premium refund request letter?

Your letter should include your business name, policy number, and the specific reason for the refund request (e.g., policy cancellation, overpayment). Provide dates, the amount of the refund requested, and your preferred method for receiving the refund. Include your contact information for the insurance provider to reach out to you.

What are the common reasons for requesting a refund?

Common reasons include policy cancellation (due to selling the business, closing down, or switching to a different insurer), overpayment of premiums, or the removal of a specific coverage or entity from the insurance policy. Changes in the business’s risk profile that affect the premium can also be a reason to request a refund.

How long does it typically take to receive a refund after submitting a request?

The processing time for a refund varies depending on the insurance provider and the complexity of the request. Generally, it can take anywhere from a few weeks to a couple of months. Ensure you follow up with the insurance provider if you don’t receive a response within a reasonable timeframe, to confirm the status of your request.

What is the best way to submit a refund request letter?

It is generally best to submit your refund request letter in writing, either by certified mail (for proof of delivery) or via email. Always keep a copy of the letter for your records, along with any supporting documentation. Confirm the insurance provider’s preferred method for submitting requests by checking your policy or contacting them directly.

Related:

Resignation letter due to rude boss

Resignation letter moving to another state

Resignation letter due to illness of family member

Resignation letter due to study