A letter to borrow money from employer is a formal request for a loan from your employer. It is a way to ask for financial assistance when you are in need.

In this article, we will share templates, examples, and samples of letters to borrow money from employer. These samples will help you write a clear and concise letter that will increase your chances of getting approved for a loan.

The samples we provide will cover a variety of situations, so you can find one that best fits your needs. We will also provide tips on how to write a strong letter and what to avoid.

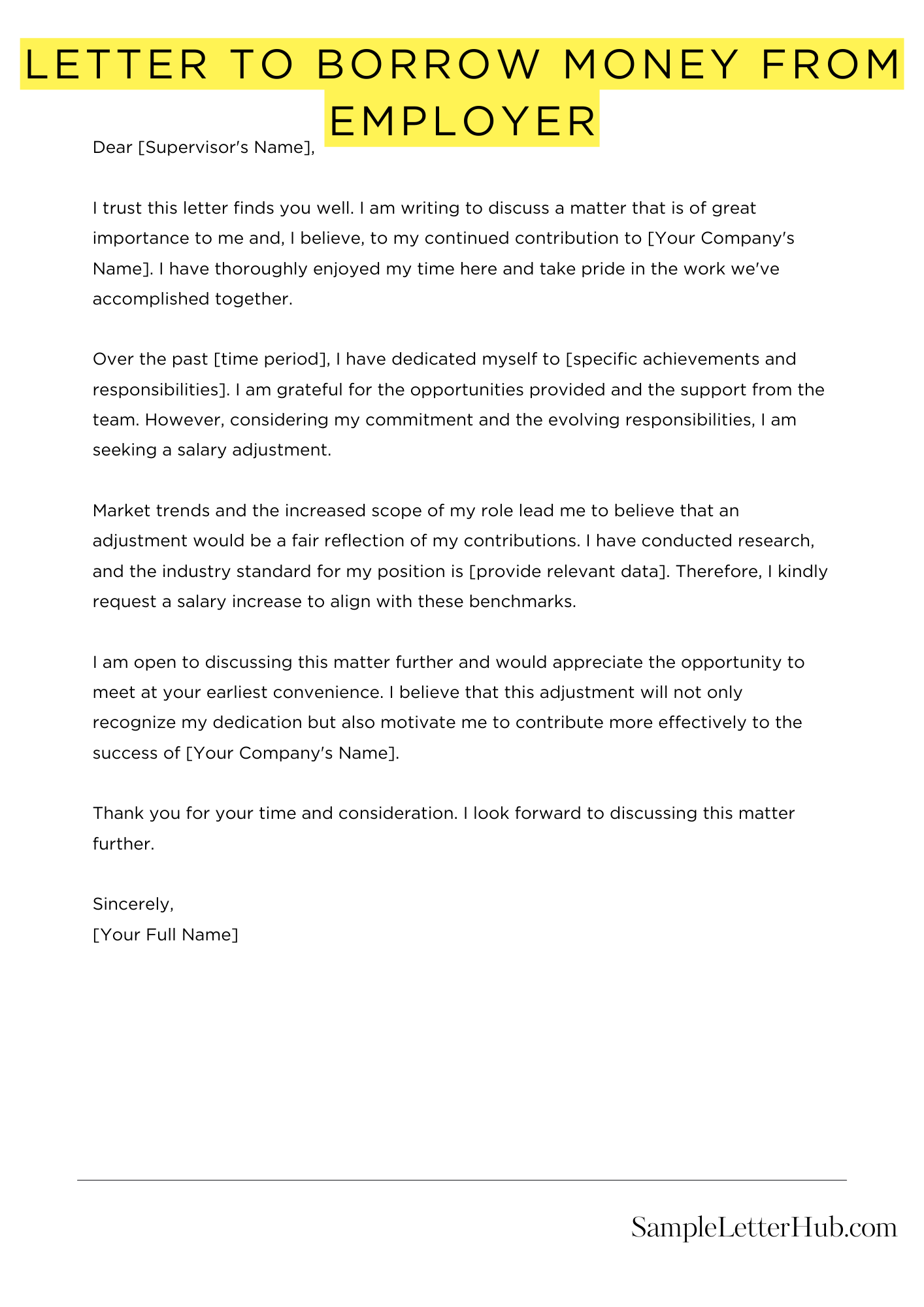

Request for Financial Assistance

Dear [Employer’s Name],

I hope this letter finds you well. I am writing to respectfully request a financial loan from the company.

I have been employed with [Company Name] for [Number] years, and I have always been a dedicated and hardworking employee. I have consistently exceeded expectations in my role and have received positive performance reviews.

Currently, I am facing an unexpected financial hardship due to [Reason for hardship]. I have explored other options for financial assistance, but I have been unable to secure the necessary funds.

I am confident that I can repay the loan within [Repayment period]. I am willing to provide a repayment plan that aligns with my financial situation.

I understand that this is an unusual request, but I am in a difficult position and would be grateful for your consideration. I am committed to continuing my employment with [Company Name] and believe that this loan would enable me to overcome this temporary financial challenge.

Thank you for your time and attention to this matter. I look forward to hearing from you soon.

Sincerely,

[Your Name]

Writing a letter to borrow money from your employer can be a daunting task. However, by following a few simple steps, you can increase your chances of getting the loan you need.

1. Start with a strong opening

The first sentence of your letter is crucial. It should grab your employer’s attention and make them want to read more. Start with a brief statement of your purpose, such as “I am writing to request a loan of $1,000 to help me cover unexpected expenses.”

2. Explain your financial situation

In the body of your letter, you need to explain why you need the loan. Be honest and upfront about your financial situation. Explain what expenses you need to cover and how the loan will help you.

3. State the amount you need to borrow

Be specific about the amount of money you need to borrow. Don’t ask for more than you need, and be prepared to explain how you will use the money.

4. Offer a repayment plan

Your employer will want to know how you plan to repay the loan. Offer a specific repayment plan that includes the amount of each payment and the date it will be due.

5. Be professional and respectful

Throughout your letter, maintain a professional and respectful tone. Avoid using slang or informal language. Proofread your letter carefully before sending it to make sure it is free of errors.

6. Follow up

After you have sent your letter, follow up with your employer to see if they have any questions. Be patient, as it may take some time for them to make a decision.

7. Be prepared to negotiate

It is possible that your employer will not be able to give you the full amount of money you requested. Be prepared to negotiate and compromise. You may be able to get a smaller loan or a longer repayment period.

FAQs about Letter To Borrow Money From Employer

What should I include in a letter to borrow money from my employer?

You should include your name, employee ID, department, and position. You should also include the amount of money you need to borrow, the repayment terms you are requesting, and the reason why you need the loan.

How much money can I borrow from my employer?

The amount of money you can borrow from your employer will vary depending on your company’s policies and your financial situation. Some companies have a maximum loan amount, while others may consider your salary, benefits, and other factors when determining how much you can borrow.

What are the interest rates on loans from employers?

The interest rates on loans from employers will vary depending on the company’s policies and your financial situation. Some companies offer loans at a low interest rate, while others may charge a higher interest rate. You should compare the interest rates offered by different companies before you decide which one to borrow from.

How long will it take to repay the loan?

The repayment period for a loan from your employer will vary depending on the amount of money you borrow and the repayment terms you agree to. Some companies offer short-term loans that must be repaid within a few months, while others offer long-term loans that can be repaid over several years.

What happens if I can’t repay the loan?

If you cannot repay the loan, your employer may take action to collect the debt. This could include garnishing your wages, taking legal action, or reporting the debt to a credit bureau.