A Goodwill Letter To Remove Repossession is a letter written to a lender to request the removal of a repossession from your credit report. This can be done if you have made all of the payments on your loan and have not missed any payments in the past 12 months.

In this article, we will provide you with templates, examples, and samples of Goodwill Letters To Remove Repossession. These letters will help you to write a letter that is specific to your situation and that will increase your chances of success.

We understand that dealing with a repossession can be a difficult and stressful experience. We hope that this article will help you to take the first step towards repairing your credit and moving on from this experience.

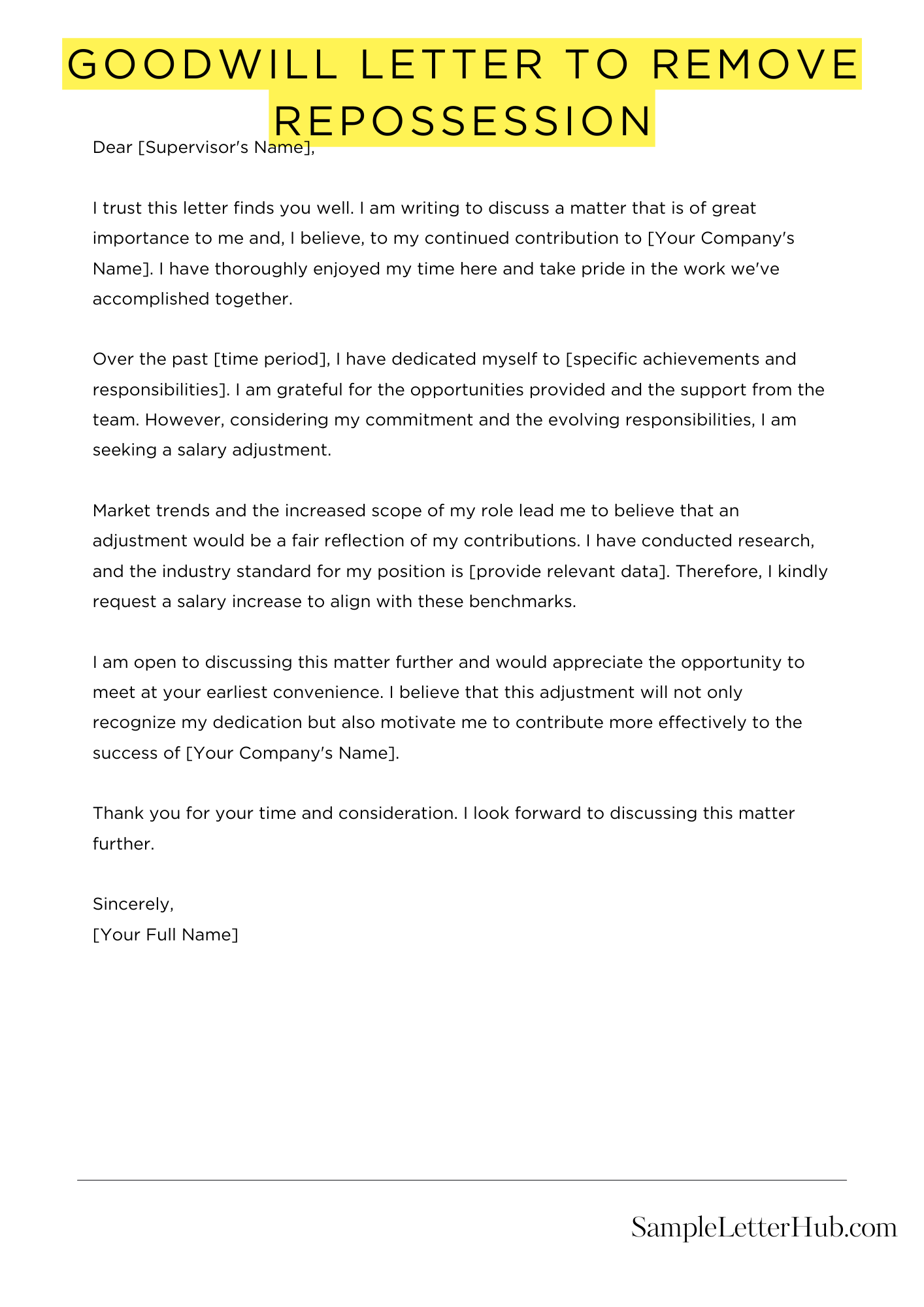

Goodwill Letter To Remove Repossession

Dear [Creditor’s Name],

I am writing to request your assistance in removing a repossession from my credit report. I understand the seriousness of the situation and take full responsibility for my past actions.

In [Month, Year], my vehicle was repossessed due to financial hardship. I was going through a difficult time and made some poor financial decisions. I have since taken steps to improve my financial situation and have been making consistent payments on all of my other debts.

I have been a loyal customer of your company for many years and have always made my payments on time. I am confident that I can continue to be a valuable customer and would appreciate the opportunity to prove myself.

I understand that removing a repossession from my credit report is not an easy task. However, I am willing to do whatever it takes to make things right. I am open to discussing a payment plan or any other options that may be available.

I would be grateful if you would consider my request. I am committed to rebuilding my credit and becoming a responsible borrower once again.

Thank you for your time and consideration.

Sincerely,

[Your Signature]

How to Write Goodwill Letter To Remove Repossession

A goodwill letter is a letter that you can write to a creditor to ask them to remove a repossession from your credit report. A repossession occurs when a lender takes back a vehicle or other property that you have failed to make payments on.

There are a few things that you should keep in mind when writing a goodwill letter. First, you should be polite and respectful. Second, you should be clear and concise in your request. Third, you should provide documentation to support your request.

Here are the steps on how to write a goodwill letter to remove a repossession:

1. Start with a formal salutation.

Begin your letter with a formal salutation, such as “Dear [Creditor Name].”

2. State your purpose.

In the first paragraph, state your purpose for writing the letter. For example, you could write, “I am writing to request that you remove the repossession from my credit report.”

3. Explain your circumstances.

In the next paragraph, explain the circumstances that led to the repossession. Be honest and forthright about your financial difficulties. However, do not make excuses for your behavior.

4. Provide documentation.

If you have any documentation to support your request, such as proof of income or a letter from a financial counselor, include it with your letter.

5. State your request.

In the final paragraph, state your request clearly and concisely. For example, you could write, “I am requesting that you remove the repossession from my credit report.”

6. Thank the creditor.

End your letter with a thank you to the creditor for their time and consideration.

7. Sign your letter.

Sign your letter with your full name and address.

Once you have written your goodwill letter, mail it to the creditor. Allow several weeks for the creditor to process your request.

FAQs about Goodwill Letter To Remove Repossession

What is a Goodwill Letter?

A goodwill letter is a formal request to a creditor asking them to remove a repossession from your credit report. It is typically written after you have paid off the debt or made arrangements to repay it.

What should I include in a Goodwill Letter?

Your goodwill letter should include your name, address, contact information, the date, the creditor’s name and address, the account number, the date of the repossession, and a brief explanation of why you are requesting the removal. You should also be polite and respectful in your letter.

How do I send a Goodwill Letter?

You can send your goodwill letter by mail or email. If you send it by mail, be sure to send it certified mail so that you have proof of delivery.

What are my chances of getting a repossession removed from my credit report?

Your chances of getting a repossession removed from your credit report depend on a number of factors, including the creditor’s policies, your credit history, and the reason for the repossession.

What should I do if my Goodwill Letter is denied?

If your goodwill letter is denied, you can try disputing the repossession with the credit bureaus. You can also try contacting the creditor again and asking them to reconsider your request.