A hardship letter due to loss of income is a formal document that explains your financial situation and requests assistance from a lender or creditor. It is typically written when you are unable to make payments on a loan or bill due to a sudden loss of income.

In this article, we will provide you with templates, examples, and samples of hardship letters due to loss of income. These letters are designed to make it easy for you to write your own letter and request assistance from your lender or creditor.

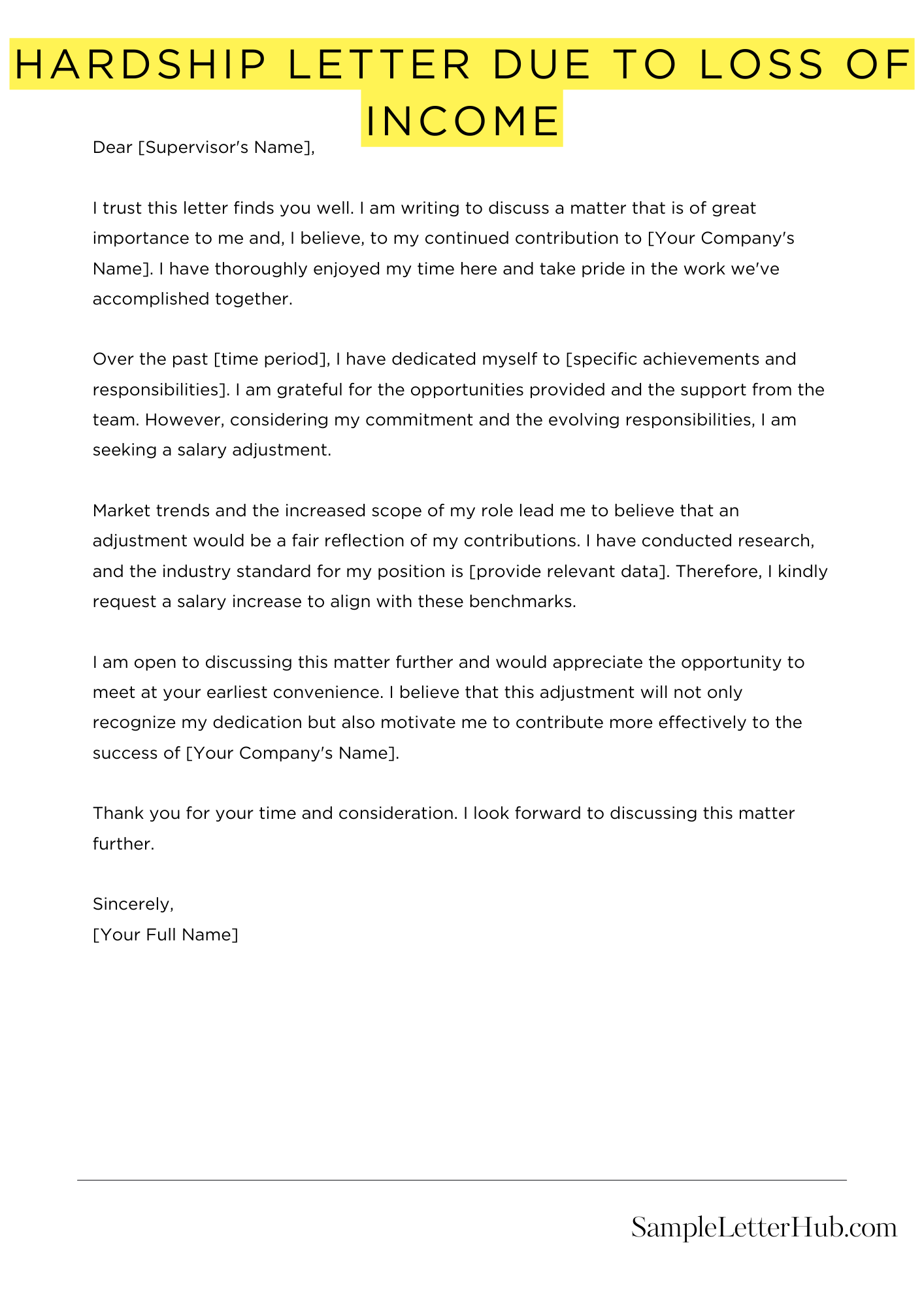

Hardship Letter Due to Loss of Income

Dear [Recipient Name],

I am writing to request a temporary hardship adjustment to my [type of bill or payment]. I have recently experienced a significant loss of income due to [reason for loss of income].

As a result of this unexpected financial setback, I am facing difficulties in meeting my monthly expenses, including [list of expenses]. I have exhausted all other options to supplement my income and am now seeking assistance.

I have been a loyal customer of [organization name] for [number] years and have always made my payments on time. I am committed to fulfilling my financial obligations and would be grateful for any consideration you can provide.

I have attached documentation to support my claim, including [list of supporting documents]. I am available to provide any additional information or documentation that you may require.

Thank you for your time and understanding. I eagerly await your response and hope that you will be able to assist me during this challenging time.

Sincerely,

[Your Signature]

How to Write a Hardship Letter Due to Loss of Income

Losing your income can be a stressful and challenging experience. It can make it difficult to pay your bills, put food on the table, and keep a roof over your head. If you’re struggling to make ends meet, you may want to consider writing a hardship letter to your creditors or landlord.

What is a Hardship Letter?

A hardship letter is a formal letter that explains your financial situation and requests assistance from a creditor or landlord. It typically includes information about your income, expenses, and any extenuating circumstances that have led to your financial hardship.

When to Write a Hardship Letter

You may want to consider writing a hardship letter if you’re experiencing a temporary financial hardship due to:

- Loss of income

- Medical expenses

- Natural disasters

- Family emergencies

How to Write a Hardship Letter

When writing a hardship letter, it’s important to be clear, concise, and honest. You should include the following information:

- Your name and contact information

- The name and address of the creditor or landlord you’re writing to

- The date

- A brief explanation of your financial hardship

- Documentation to support your hardship (e.g., a pay stub, medical bill, or letter from your employer)

- A request for assistance (e.g., a payment plan, reduced interest rate, or waiver of late fees)

Tips for Writing a Successful Hardship Letter

- Be honest and upfront about your situation.

- Provide documentation to support your hardship.

- Be specific about the assistance you’re requesting.

- Be polite and respectful.

- Follow up with the creditor or landlord after you’ve sent the letter.

Conclusion

Writing a hardship letter can be a daunting task, but it’s an important step if you’re struggling to make ends meet. By following these tips, you can increase your chances of getting the assistance you need.

FAQs about Hardship Letter Due To Loss Of Income

What is a hardship letter due to loss of income?

A hardship letter due to loss of income is a formal document that explains your financial situation and requests assistance from a creditor or other organization. It typically includes information about your income, expenses, and the reason for your loss of income.

What should I include in a hardship letter due to loss of income?

A hardship letter due to loss of income should include the following information:

- Your name and contact information

- The name and address of the creditor or organization you are writing to

- The date

- A brief explanation of your financial situation

- The reason for your loss of income

- A list of your income and expenses

- A request for assistance

How can I prove my loss of income?

You can prove your loss of income by providing documentation such as:

- A termination letter from your employer

- A pay stub showing a reduction in your hours or pay

- A bank statement showing a decrease in your deposits

What types of assistance can I request in a hardship letter?

The types of assistance you can request in a hardship letter due to loss of income include:

- A reduction in your monthly payments

- A temporary suspension of your payments

- A waiver of late fees

- A reduction in your interest rate

How do I submit a hardship letter due to loss of income?

You can submit a hardship letter due to loss of income by mail, fax, or email. It is important to keep a copy of your letter for your records.