Do you need to find out information about a life insurance policy? A “Letter Requesting Details of Life Insurance Policy” is the answer. This letter is a formal way to ask an insurance company for specific details. It helps you understand your life insurance policy better. You can also use it to get necessary documents.

Writing the perfect letter can be tricky. Don’t worry, we are here to help. We’ll share several letter request for policy details templates. These templates include helpful examples. Use our samples to craft your own life insurance details request letter.

We aim to simplify the process. Our samples cover various situations. Whether you are a beneficiary or the policyholder. Find the perfect wording for your letter requesting life insurance information.

[Your Name/Your Company Name]

[Your Address]

[Your City, Postal Code]

[Your Email Address]

[Your Phone Number]

[Date]

[Insurance Company Name]

[Insurance Company Address]

[Insurance Company City, Postal Code]

Subject: Request for Information Regarding Life Insurance Policy

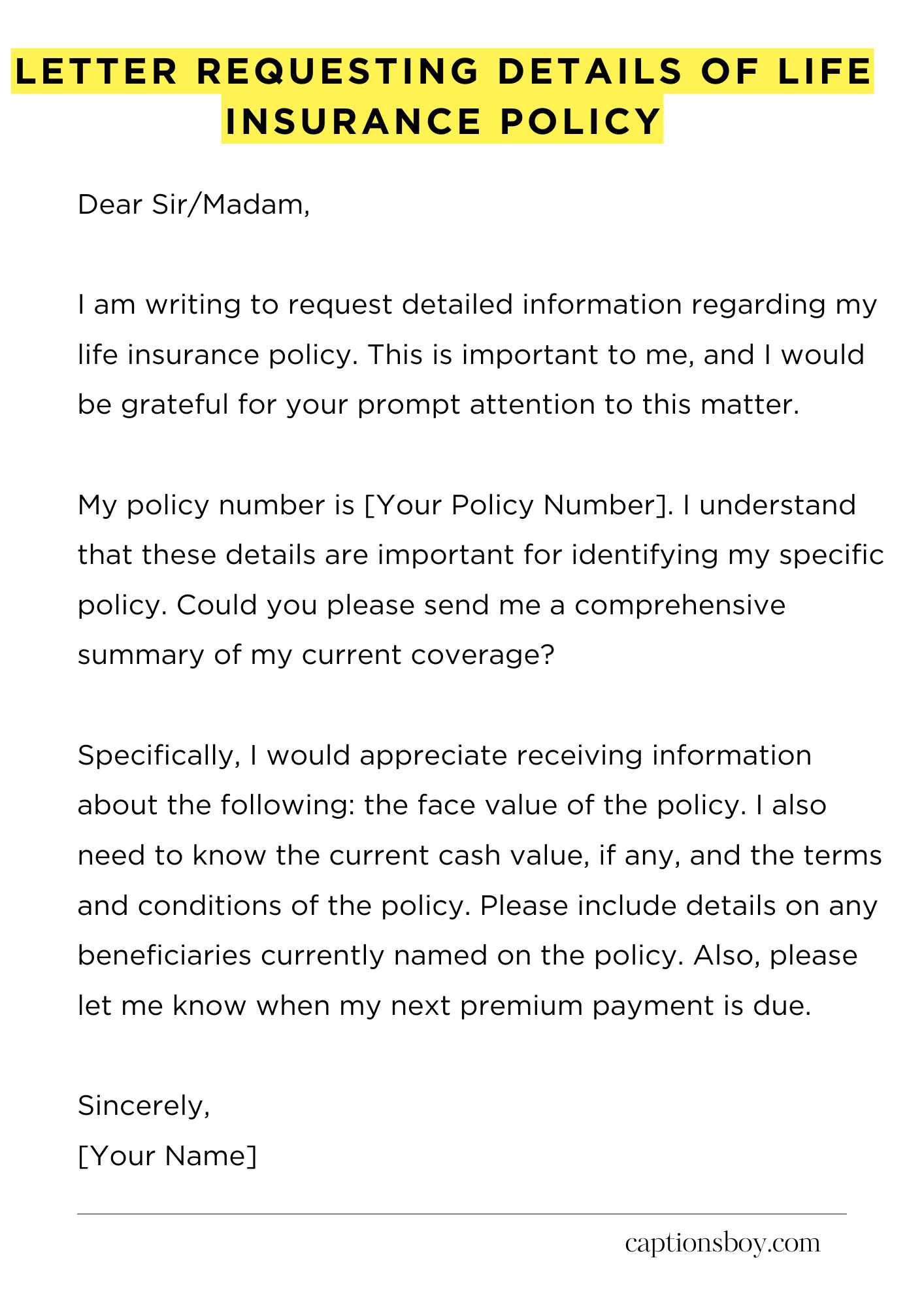

Dear Sir/Madam,

I am writing to request detailed information regarding my life insurance policy. This is important to me, and I would be grateful for your prompt attention to this matter.

My policy number is [Your Policy Number]. I understand that these details are important for identifying my specific policy. Could you please send me a comprehensive summary of my current coverage?

Specifically, I would appreciate receiving information about the following: the face value of the policy. I also need to know the current cash value, if any, and the terms and conditions of the policy. Please include details on any beneficiaries currently named on the policy. Also, please let me know when my next premium payment is due.

It would be most helpful if you could provide this information in writing. This will ensure I have a complete and accurate record for my reference. I also have some other questions that I would like answered.

I would prefer to receive this information within [Number] business days. Please feel free to contact me if you require any further information from my side. You can reach me by email or phone.

Thank you for your time and assistance with this request. I look forward to hearing from you soon.

Sincerely,

[Your Name]

How to Write Letter Requesting Details of Life Insurance Policy

Obtaining information about a life insurance policy can be a crucial undertaking, especially when navigating the intricacies of estate planning or seeking clarity on existing coverage. Knowing the correct approach is vital. This guide will help you draft a compelling letter to procure the details you need.

1. Identifying the Insured Party and Policy Details

Your missive should commence with unambiguous identification of the insured individual. Include their full legal name, date of birth, and any known policy numbers. If the policy number remains elusive, provide alternative identifiers, such as the Social Security number or any previous policy documentation. This initial stage is crucial to prevent erroneous disclosure of protected information to unauthorized individuals.

2. Determining Your Relationship to the Policy

Next, delineate your specific connection to the policy. Are you the beneficiary, the executor of the estate, or perhaps the insured individual themselves? State your role clearly and unequivocally. Include any supporting documentation, like a death certificate (if applicable) or letters testamentary, to substantiate your claim. This is a critical step in establishing your legitimate right to access the policy information.

3. Specifying the Information Requested

Be explicit about the precise data you require. Are you seeking the current death benefit, the cash value (if any), premium payment history, or a copy of the original policy documents? Provide a meticulous list. The more precise your requests, the more efficiently the insurance company can respond. Avoid ambiguity; vagueness can lead to delays or incomplete responses.

4. Offering Contact Information and Preferences

Include your comprehensive contact details: mailing address, phone number, and email address. Indicate your preferred method of communication. If you desire the information in a particular format – for example, a PDF sent electronically or a hard copy delivered by mail – specify it. This facilitates a swift and seamless exchange of data.

5. Utilizing the Correct Salutation and Professional Tone

Begin with a formal salutation. “Dear Sir/Madam” or, if you know the name of the recipient, “Dear Mr./Ms. [Last Name]” is appropriate. Maintain a professional and respectful tone throughout the letter. The verbiage should be clear, concise, and devoid of colloquialisms or unnecessary jargon. Your tone is a representation of yourself and should convey respect for the addressee.

6. The Art of Closure: Sign-off and Supporting Documentation

Conclude your missive with a professional closing, such as “Sincerely” or “Respectfully.” Before signing, print your name below your handwritten signature. Be sure to enumerate any attachments (supporting documents) you’ve included, for instance, “Enclosures: Death Certificate, Letters Testamentary.” This aids the recipient in verifying the completeness of your submission. Make a copy for your records.

7. Delivery and Follow-Up: Dispatching Your Letter

Send your letter via certified mail with a return receipt requested. This provides proof of delivery and ensures that you receive confirmation the insurance company has received it. Allow a reasonable timeframe for a response (typically 30-45 days), and follow up if you haven’t heard back. Persistent yet polite follow-up demonstrates your commitment and can expedite the process. Do not let the information remain unanswered.

FAQs about Letter Requesting Details of Life Insurance Policy

Here are some frequently asked questions regarding letters requesting details of a life insurance policy:

What specific information should I include in my letter?

Your letter should clearly state your request for information regarding a specific life insurance policy. Include the policyholder’s full name, date of birth, and policy number if known. It is also helpful to include your relationship to the policyholder (e.g., beneficiary, executor) and any relevant contact information like your phone number and email address.

Who should I send the letter to?

The letter should be sent to the insurance company that issued the life insurance policy. If you are unsure of the insurance company, you can often find this information on the policy documents. Addresses can usually be found on the company’s website, or sometimes on the policy itself. It is also wise to send the letter via certified mail with a return receipt requested to confirm delivery.

What kind of information can I expect to receive?

The information you may receive can vary depending on your relationship to the policy and the specific request. You may receive the policy’s face value, current cash value (if applicable), beneficiary information, premium payment details, and any outstanding loans against the policy. If you are a beneficiary, you will receive claim forms.

How long does it typically take to receive a response?

The timeframe for receiving a response from the insurance company can vary. However, you should expect to wait anywhere from a few days to several weeks. Factors that can affect the response time include the complexity of the request, the insurance company’s workload, and the completeness of the information you provided in your letter.

What if I don’t know the policy number or insurance company?

If you don’t have the policy number, you can still request information, but it may take longer. Provide as much identifying information about the policyholder as possible, such as their full name, date of birth, and last known address. You can also include any other relevant details, such as the approximate date the policy was taken out or any known affiliations the policyholder had (e.g., employer, association). To find the insurance company, you can review the policy holder’s old records and documents.

Related:

Resignation letter due to rude boss

Resignation letter moving to another state

Resignation letter due to illness of family member

Resignation letter due to study

Resignation letter due to long commute