Need to know about your policy renewal? A Request for Policy Renewal Status Letter is your tool. It’s a formal way to ask your insurance provider for an update. You’ll get information about your policy renewal status.

This article is here to help. We’ll provide you with sample letters. Need to check your insurance policy renewal? You are covered. These templates can guide you. They make crafting your own letter easy.

We understand writing letters can be tricky. Don’t worry, we got you. Use our sample letters for your convenience. Get the information on policy renewal you need. Write a letter with confidence.

[Your Name/Company Name]

[Your Address]

[Your Phone Number]

[Your Email Address]

[Date]

[Insurance Company Name]

[Insurance Company Address]

Subject: Request for Policy Renewal Status – Policy Number [Your Policy Number]

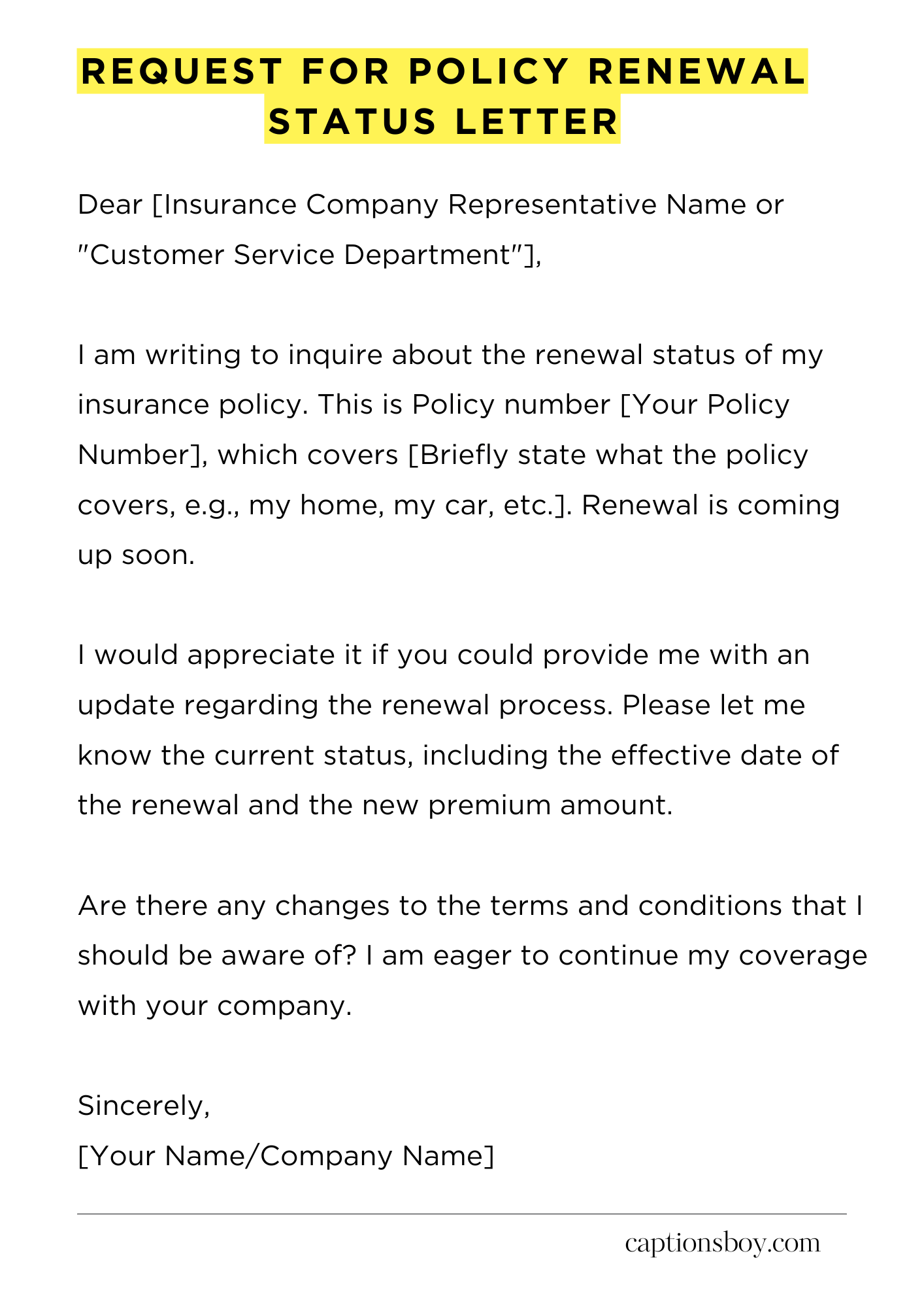

Dear [Insurance Company Representative Name or “Customer Service Department”],

I am writing to inquire about the renewal status of my insurance policy. This is Policy number [Your Policy Number], which covers [Briefly state what the policy covers, e.g., my home, my car, etc.]. Renewal is coming up soon.

I would appreciate it if you could provide me with an update regarding the renewal process. Please let me know the current status, including the effective date of the renewal and the new premium amount. Are there any changes to the terms and conditions that I should be aware of? I am eager to continue my coverage with your company.

Could you please also send me the necessary documents, such as the renewal offer, at your earliest convenience? The information will help me to review the policy details. Receiving this information promptly would be greatly appreciated.

Thank you for your time and attention to this matter. I look forward to hearing from you soon. I value your prompt response.

Sincerely,

[Your Name/Company Name]

How to Write Request for Policy Renewal Status Letter

Crafting a letter requesting the status of a policy renewal might seem like a straightforward endeavor. However, a well-constructed letter can expedite the process and ensure a clear, concise response. Let’s delve into the intricacies of composing an effective letter.

1. Initiate with Precise Salutation

The salutation sets the tone. Instead of a generic “To Whom It May Concern,” opt for a more personalized approach. Endeavor to identify the specific recipient—perhaps the underwriter, claims adjuster, or policyholder service representative. If their name is readily available, use it. For instance, “Dear Mr./Ms. [Last Name]” demonstrates consideration and enhances the likelihood of a prompt response. If the name is unknown, “Dear Policy Renewal Department” or a similar title is a more astute choice. The correct salutation is crucial to ensure your missive reaches the intended person.

2. Explicitly State Your Purpose

Clarity is paramount. Begin by unequivocally stating the purpose of your letter. This immediately orients the reader. The opening sentence should leave no room for ambiguity. For example: “This letter serves as a formal request for the renewal status of policy number [Policy Number].” This directness ensures the recipient understands the essence of your communication from the outset. Further expansion may then elaborate on the specific details of your inquiry.

3. Furnish Comprehensive Policy Details

Providing all relevant information is non-negotiable. Include all pertinent policy details to facilitate swift processing. This includes the policy number, the type of policy (e.g., auto, home, life), the inception date, and the renewal date. Supplying this information circumvents any need for the recipient to scavenge for the necessary data. If known, provide the named insured’s full name, address, and contact information. The more detail, the more efficient the response.

4. Articulate Your Specific Inquiry

Clearly define the information you are seeking. Are you looking to confirm the renewal has been processed? Are you inquiring about the premium amount or coverage changes? Perhaps you require a copy of the renewal documentation. Be precise. For example, instead of “Please let me know about my renewal,” try, “Could you please confirm whether my policy has been renewed, and if so, provide the renewed premium amount and effective date?” Succinctness contributes to responsiveness.

5. Integrate Supporting Documentation (If Applicable)

If you’re attaching supporting documentation—such as a copy of a previous invoice, a change of address form, or any other relevant document—explicitly mention it within the body of your letter. State the name and number of pages attached, which is often a helpful addition. This is particularly crucial if the documents are relevant to the renewal process. This provides a clear indication to the recipient of the added material.

6. Conclude with a Courteous Closing and Call to Action

A courteous closing and a clear call to action are vital. Express gratitude for the recipient’s time and attention. Provide your contact information, including your phone number and email address, and indicate how you wish to be contacted, if you have any preferences. End with a professional closing, such as “Sincerely,” “Respectfully,” or “Yours truly,” followed by your full name. This fosters a professional tone and facilitates follow-up communications.

7. Scrutinize and Proofread for Accuracy

Before dispatching your letter, subject it to a rigorous review. Scrutinize it for grammatical errors, spelling mistakes, and inconsistencies. Double-check all policy details, contact information, and dates. A polished, error-free letter reflects professionalism and significantly improves the likelihood of a satisfactory response. Proofreading is your final safeguard before it reaches the intended recipient.

FAQs about Request for Policy Renewal Status Letter

What information is typically included in a policy renewal status letter?

A policy renewal status letter generally includes details such as the policyholder’s name, the policy number, the type of insurance policy (e.g., auto, home, health), the current policy period, the renewal date, the premium amount for the upcoming term, and any changes in coverage or terms. It may also specify payment options and instructions for renewing the policy.

How do I request a policy renewal status letter?

The process for requesting a policy renewal status letter varies depending on the insurance provider. Typically, you can request it through several methods: online through a secure customer portal, by contacting your insurance agent or broker, or by calling the insurance company’s customer service line. Some providers may also accept requests via email or through a mailed request form.

What is the typical turnaround time for receiving a policy renewal status letter?

The turnaround time can vary. Generally, you can expect to receive the letter within a few business days of your request. Online requests are often fulfilled immediately, while mail requests may take longer. It’s advisable to check with your insurance provider for their specific processing times.

Why might I need a policy renewal status letter?

A policy renewal status letter serves several important purposes. You may need it to verify your coverage details, to provide proof of insurance to third parties (such as a lender or DMV), or to compare quotes from other insurance providers. It’s also helpful for your records, allowing you to have a clear understanding of your current policy and upcoming renewal terms.

What should I do if I disagree with the information provided in the renewal status letter?

If you find any discrepancies or disagree with the information in your renewal status letter, contact your insurance agent, broker, or the insurance company’s customer service department immediately. They will review your policy details, clarify any misunderstandings, and make necessary corrections. It’s important to resolve any issues before your policy renewal date.

Related:

Resignation letter due to rude boss

Resignation letter moving to another state

Resignation letter due to illness of family member

Resignation letter due to study

Resignation letter due to long commute