Life happens. Sometimes, you need a little extra time. A Health Coverage Payment Extension Request Letter is your tool. It formally asks your insurance provider for more time. Its purpose? To avoid coverage cancellation.

Need to draft one? You’re in the right place! We’ve got you covered. We’re sharing templates and examples. Need a sample Health Coverage Payment Extension Request Letter? We have them! We will provide them. These examples help with writing your own.

Our Health Coverage Payment Extension Request Letter templates make it easy. We know writing these letters can be stressful. We hope our samples help. Get your insurance payments sorted today.

[Your Name/Company Name]

[Your Address]

[Your Phone Number]

[Your Email Address]

[Date]

[Insurance Company Name]

[Insurance Company Address]

Subject: Request for Health Coverage Payment Extension

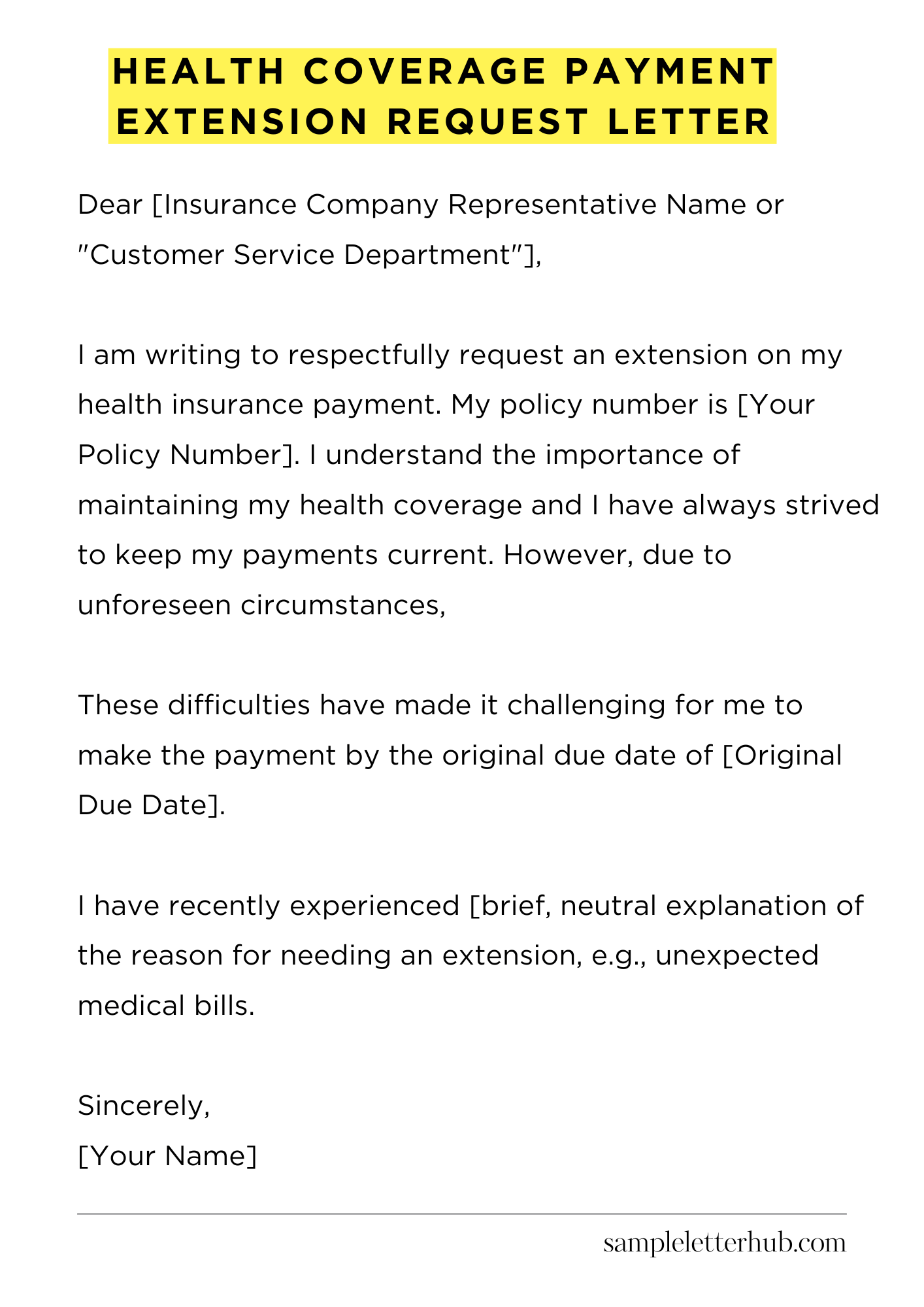

Dear [Insurance Company Representative Name or “Customer Service Department”],

I am writing to respectfully request an extension on my health insurance payment. My policy number is [Your Policy Number]. I understand the importance of maintaining my health coverage and I have always strived to keep my payments current. However, due to unforeseen circumstances, I am currently facing some temporary financial difficulties.

These difficulties have made it challenging for me to make the payment by the original due date of [Original Due Date]. I have recently experienced [brief, neutral explanation of the reason for needing an extension, e.g., unexpected medical bills, a temporary reduction in work hours]. This situation is temporary and I am actively working to resolve it.

I would be incredibly grateful if you would consider granting me an extension of [Number] days/weeks. This would allow me the time needed to bring my account up to date. I am confident that I will be able to make the full payment by [Proposed New Due Date]. I value my health insurance policy and the protection it provides.

I would also like to state that I will be able to make a partial payment of [Amount of Partial Payment, if applicable] by [Date of Partial Payment, if applicable] while waiting for the full extension approval.

Keeping my coverage active is very important to me, which is why I’m seeking this extension. Please let me know if there is any additional documentation you require to support my request.

Thank you for your time, consideration, and understanding in this matter. I appreciate your assistance. I can be reached at the phone number and email address listed above if you require anything further.

Sincerely,

[Your Name]

How to Write Health Coverage Payment Extension Request Letter

Unexpected circumstances can sometimes disrupt the best-laid financial plans. When you encounter a predicament that makes it difficult to settle your health coverage premiums, crafting a compelling extension request letter becomes paramount. This guide provides a detailed walkthrough to help you formulate a cogent and persuasive missive.

1. Commence with Proper Salutations and Identification

Begin your letter with a formal salutation. Address the appropriate party, typically the insurance provider’s billing department or a designated claims specialist.

Be meticulous, and ensure you have the correct name and title to personalize your communication. Immediately after the salutation, furnish your full name, policy number, and any other pertinent identifying information. This facilitates prompt processing and prevents confusion.

2. Clearly Articulate Your Request for an Extension

The core of your letter must explicitly state your request: a payment extension. Be unequivocal. Specify the exact period of time you require, whether it is one week, two weeks, or a month.

This should be a definite number. Avoid ambiguity. The reader should immediately understand the precise nature of your need. This is the cornerstone of your appeal, so get it right.

3. Furnish a Succinct Justification for the Deferment

The essence of a persuasive letter resides in your explanation. Provide a concise, yet comprehensive, explanation for why you cannot meet the original payment deadline. Examples might include a temporary loss of employment, a surge in medical expenses, or an unforeseen financial burden. Substantiate your claims with evidence.

A meticulously explained situation adds credence to your plea. Ensure your argument has its basis on fact. Avoid hyperbole and maintain a professional tone.

4. Submit Supporting Documentation, if Applicable

Whenever possible, reinforce your case with documentation. Are you unemployed? Include a copy of your termination letter. Do you have unanticipated medical bills? Attach a copy of the statements.

This material validates your claims and bolsters your request’s legitimacy. Remember, documentation serves as objective evidence of your circumstances.

5. Convey a Commitment to Reimbursement

Reassure the insurance provider of your unwavering intention to settle the outstanding balance. Affirm your commitment to paying the premium in full by the new, proposed deadline. This demonstrates your reliability and willingness to honor your financial obligations. Express your gratitude for their consideration.

6. Conclude with a Professional Closing and Contact Details

End your letter with a professional closing, such as “Sincerely” or “Respectfully.” Below your closing, provide your full name, address, phone number, and email address. This offers multiple avenues for the provider to contact you with questions or to confirm the approval of your request. These details are indispensable.

7. Proofread and Dispatch the Letter with Celerity

Before mailing or emailing your letter, meticulously proofread it for any grammatical errors or typos. Ensure the tone is polite, professional, and free of any ambiguity.

Then, depending on your provider’s protocol, send the letter via certified mail or through their secure online portal. Dispatch it promptly to ensure timely consideration of your request. Act quickly! Timeliness is crucial.

FAQs about Health Coverage Payment Extension Request Letter

What is a health coverage payment extension request letter, and why is it needed?

A health coverage payment extension request letter is a formal document written to your health insurance provider. It asks for additional time to pay your premium. Individuals may need to request an extension due to temporary financial hardships, unexpected expenses, or payment processing delays.

It is important to request an extension because failure to pay premiums on time can result in cancellation of your health insurance coverage, leaving you without essential medical benefits.

What information should be included in a health coverage payment extension request letter?

The letter should include your full name, policy number, and contact information. Clearly state the reason for requesting the extension, such as a temporary financial hardship. Specify the amount you owe, the original due date, and the new date you are requesting to pay by.

It is also good to mention any steps you are taking to resolve the situation and maintain your coverage. Providing supporting documentation, such as a doctor’s bill or proof of financial difficulty, can strengthen your request.

How should I format and submit a health coverage payment extension request letter?

The letter should be professional and concise. Start with a formal salutation (e.g., “Dear [Insurance Company Name]”). Clearly state your request and the relevant details. Keep the tone polite and respectful. Include your contact details (phone number, email, and address).

You should submit the letter according to your insurance provider’s preferred method, typically online portal, email, or mail. Check your policy documents or contact customer service for specific instructions.

What are the possible outcomes of sending a health coverage payment extension request letter?

The insurance provider will review your request and may approve, deny, or offer a modified extension. If approved, you will receive confirmation of the new due date. Denial may occur if the provider has specific policies against extensions or if the reason provided is not sufficient.

In some cases, the provider might offer a payment plan. If your request is denied, you may need to explore other options, such as seeking financial assistance or exploring alternative coverage options. Always follow up with the insurance provider to confirm the outcome of your request.

Are there any alternatives to requesting a health coverage payment extension?

Yes, several alternatives to requesting a payment extension exist. You can explore a payment plan with your insurance provider, consider a short-term loan, or look for financial assistance programs.

Another option is to shop around for more affordable health coverage or adjust your existing plan to lower premiums (though this might change your benefits). You can also seek assistance from consumer protection agencies or non-profit organizations that offer assistance.

Related:

Resignation letter due to rude boss

Resignation letter moving to another state

Resignation letter due to illness of family member

Resignation letter due to study