A letter requesting payment deferment is a formal way to ask for a temporary break from paying your bills. Its purpose? To give you some breathing room when you’re facing financial difficulties. Life throws curveballs. Unexpected expenses happen. This letter helps you communicate your needs. It can be a lifeline.

Need to write a payment deferment request letter? We’ve got you covered. We’ll share letter request payment deferment templates and examples. Need a deferment letter sample? Look no further. This article offers various payment deferral letter samples. Our goal is to make it simple. We want to empower you.

We want to help. Choose the right letter for payment deferment for your situation. Adapt the templates. Make them your own. Writing this letter can feel daunting. We aim to ease the process. Prepare your payment deferment letter with confidence.

[Your Name]

[Your Address]

[Your Phone Number]

[Your Email Address]

[Date]

[Creditor’s Name]

[Creditor’s Address]

Subject: Request for Payment Deferment

Dear [Creditor’s Name],

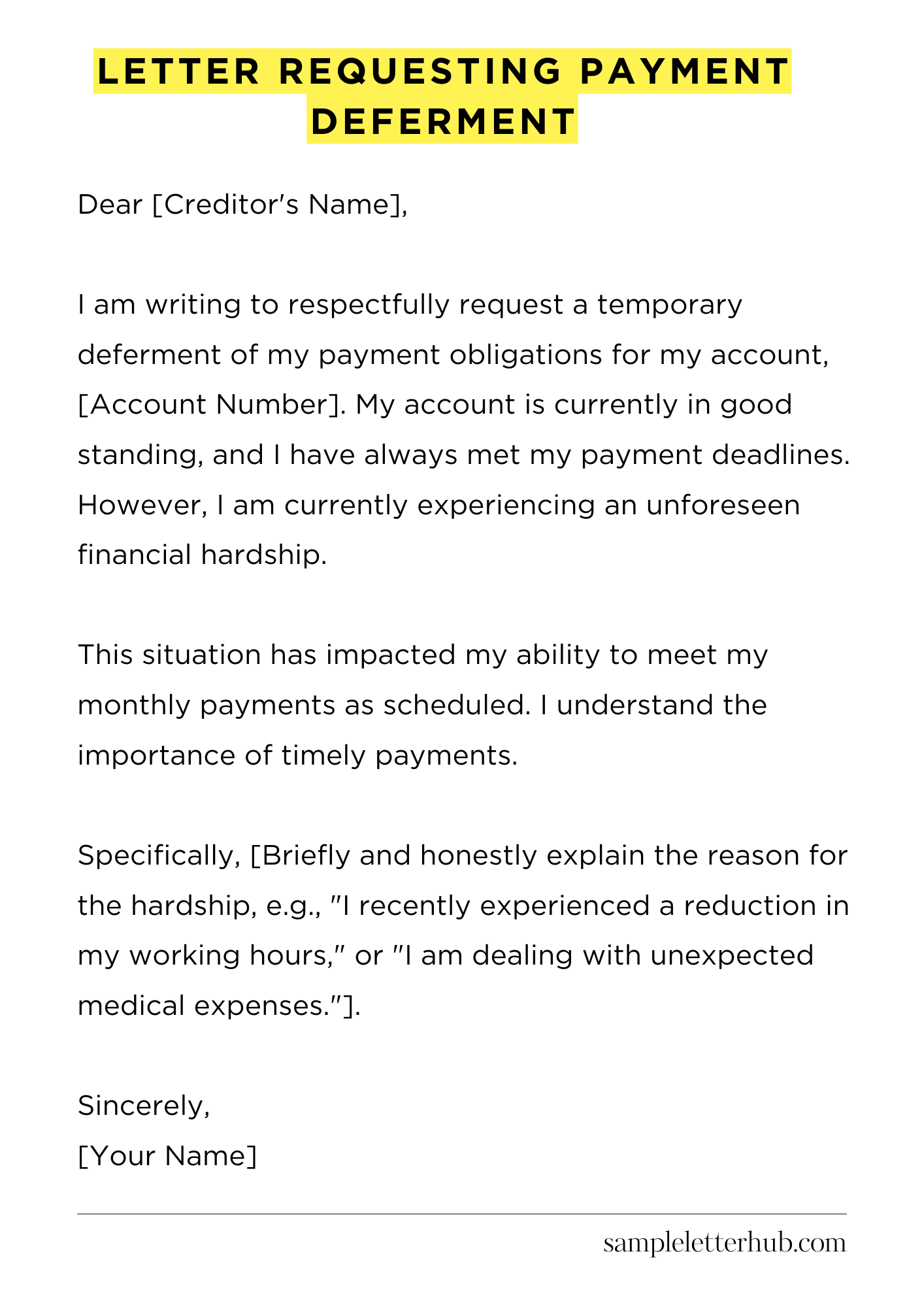

I am writing to respectfully request a temporary deferment of my payment obligations for my account, [Account Number]. My account is currently in good standing, and I have always met my payment deadlines. However, I am currently experiencing an unforeseen financial hardship.

This situation has impacted my ability to meet my monthly payments as scheduled. I understand the importance of timely payments, and I have always prioritized fulfilling my financial commitments. Unfortunately, due to recent circumstances, I am finding it difficult to manage my finances effectively.

Specifically, [Briefly and honestly explain the reason for the hardship, e.g., “I recently experienced a reduction in my working hours,” or “I am dealing with unexpected medical expenses.”]. I anticipate this hardship will continue for approximately [Number] months.

I am requesting a payment deferment for a period of [Number] months. During this time, I would like to explore options to temporarily postpone my monthly payments.

I am confident that once my financial situation improves, I will be able to resume my regular payments without any problems. I value my relationship with your company, and I am committed to resolving this issue.

I am also open to discussing alternative payment arrangements, such as a reduced payment plan, if a complete deferment is not possible. I would be grateful if you could consider my request.

Thank you for your time, understanding, and consideration of this matter. Please contact me at your convenience to discuss this further. I look forward to hearing from you soon.

Sincerely,

[Your Name]

How to Write Letter Requesting Payment Deferment

Life throws curveballs. Sometimes, these curveballs impact your finances. When you find yourself in a fiscal bind and are unable to meet your payment obligations, a payment deferment might be your lifeline. But how do you go about requesting one? Here’s a breakdown.

1. Commence with Proper Salutation

Begin your missive with a formal salutation. Address the letter to the appropriate entity, the lender or creditor. “Dear [Name of Lender/Creditor],” is typically appropriate. Avoid casual greetings; professionalism is key in this situation. Ensure you are addressing the correct department or individual who handles deferment requests.

2. The Art of Precise Identification

Subsequently, identify yourself and the specific account. Include your full name, address, and account number. This crucial information allows the recipient to immediately recognize and locate your account. It streamlines the processing of your request. Omission of these details may lead to processing delays or even rejection.

3. Articulate Your Predicament (Explication of Circumstances)

The core of your letter lies in explaining your circumstances. Concisely and candidly describe the reason for your financial hardship. Be straightforward, providing relevant details without unnecessary embellishment.

Include dates, when applicable. Explain how the current situation is impeding your ability to fulfill your payment commitments. The creditor needs to understand your perspective. Honesty builds trust.

4. The Specific Request: Define the Terms

Clearly state your request for a payment deferment. Specify the precise length of the deferment you require. Is it for one month, three months, or some other duration?

Detail what, if any, payment you can manage during the deferment period. Suggesting an alternative, even if it’s partial payment, demonstrates a proactive approach. Make sure your request is unambiguous and leaves no room for misinterpretation.

5. Furnish Supportive Documentation

To bolster your request, consider including supporting documentation. This could encompass medical bills, layoff notices, or other pertinent evidence substantiating your claims.

Copies are generally sufficient; always retain the originals. Evidence bolsters the credibility of your application. These documents provide the requisite validation.

6. The Concluding Politesse

Conclude your letter with a polite and professional closing. Express your gratitude for their consideration of your request. Include your contact information (phone number and email address) for ease of communication. “Sincerely,” or “Respectfully,” is often used. This final flourish leaves a positive impression, signaling your commitment to resolving the issue.

7. Proofreading and Submittal (the Final Gambit)

Before dispatch, meticulously proofread your letter. Check for grammatical errors, spelling mistakes, and clarity. A well-written letter conveys professionalism. Verify that all information is accurate and complete.

Then, submit your letter via the appropriate channel, whether by mail, email, or a designated online portal. Keep a copy for your records, a prudent safeguard. Good luck!

FAQs about Letter Requesting Payment Deferment

What is a payment deferment, and why would someone request it?

A payment deferment is a temporary postponement of loan payments. Individuals request payment deferments for various reasons, including financial hardship, job loss, medical expenses, or other unforeseen circumstances that make it difficult to meet their payment obligations.

What information should be included in a letter requesting a payment deferment?

A well-crafted letter requesting a payment deferment should include the borrower’s full name, account number, the loan type, and the lender’s contact information. Clearly state the request for a deferment and the desired deferment period.

Specify the reasons for the request, providing supporting documentation if possible, and outline how the situation is temporary and explain the steps being taken to resolve the issue. Always maintain a professional and courteous tone throughout the letter.

How does requesting a payment deferment affect my credit score?

The impact of a payment deferment on your credit score depends on the specific terms of the loan and how the deferment is reported by the lender. A deferment might negatively impact your credit score if the loan goes into default.

However, a deferment, if agreed upon, will stop the reporting of late payments during the deferment period and will help you to avoid defaulting on your loan. Always ensure the lender explicitly agrees and documents the deferment terms to protect your credit history.

What are the potential drawbacks or consequences of a payment deferment?

The main drawbacks of a payment deferment include continued interest accrual during the deferment period, which can increase the overall cost of the loan. In addition, the deferment might extend the loan’s repayment term, and deferment is not always guaranteed.

How do I submit a letter requesting a payment deferment, and what is the typical response time?

A letter requesting a payment deferment can typically be submitted via mail, email, or through the lender’s online portal, depending on the lender’s policies. The specific method for submission should be explicitly stated in the loan agreement, so review it carefully.

The typical response time can vary widely by lender, but it can range from a few days to several weeks. Borrowers should keep a copy of the letter and any supporting documentation for their records and follow up with the lender if they do not receive a response within a reasonable timeframe.

Related:

Resignation letter due to rude boss

Resignation letter moving to another state

Resignation letter due to illness of family member

Resignation letter due to study