Life throws curveballs. Sometimes, these curveballs lead to financial struggles. A “Hardship Letter to Request Temporary Relief” is a written appeal. Its purpose is to explain your situation. It asks for temporary leniency. It aims to ease financial burdens.

Struggling to write your own letter? Don’t worry. We’ve got you covered. We’re providing hardship letter samples. This article contains hardship letter templates. Use these hardship letter examples to craft your own letter for financial hardship. We aim to simplify the process.

We want to empower you. These samples cover various situations. From mortgage relief to debt relief, find what you need. Adapt them to fit your unique circumstances. Get started on writing that letter today.

[Your Name/Address]

[Your Phone Number]

[Your Email Address]

[Date]

[Name of Organization/Individual to Whom the Letter is Addressed]

[Address of Organization/Individual]

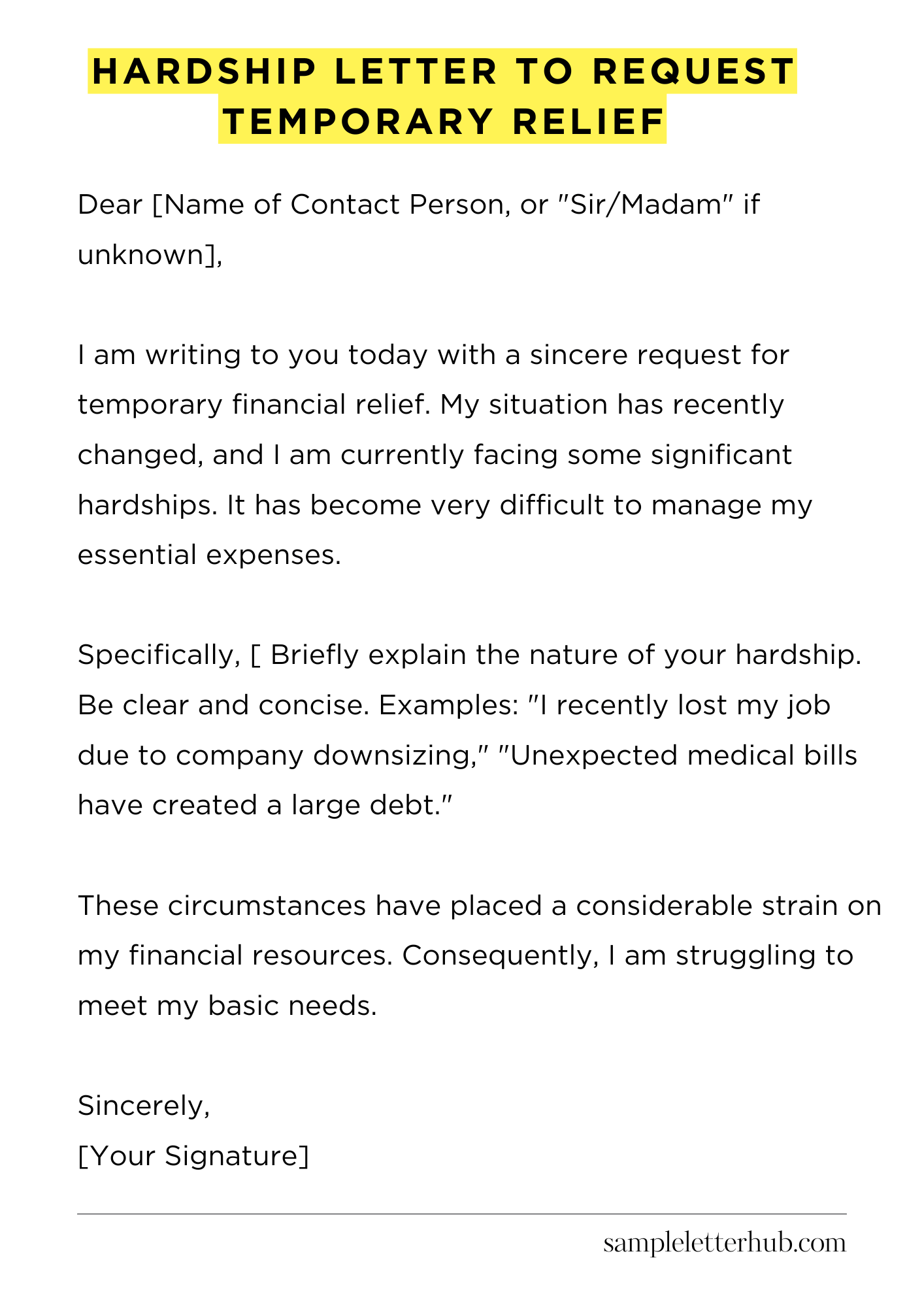

Dear [Name of Contact Person, or “Sir/Madam” if unknown],

I am writing to you today with a sincere request for temporary financial relief. My situation has recently changed, and I am currently facing some significant hardships. It has become very difficult to manage my essential expenses.

Specifically, [ Briefly explain the nature of your hardship. Be clear and concise. Examples: “I recently lost my job due to company downsizing,” “Unexpected medical bills have created a large debt,” “A major home repair was necessary”].

These circumstances have placed a considerable strain on my financial resources. Consequently, I am struggling to meet my basic needs.

I am requesting assistance in the form of [State the specific relief you are requesting. Examples: “a temporary reduction in my monthly payment,” “a deferral of payments for a period of time,” “a hardship grant”].

I understand that you have policies in place to help individuals experiencing these kinds of challenges, and I am hoping you can help me. I am committed to meeting my financial obligations once my situation improves.

To support my request, I have attached [List any supporting documentation you are including. Examples: “copies of my recent pay stubs,” “documentation of medical bills,” “a letter from my employer”]. These documents provide further detail about my current circumstances. I hope this information is helpful.

I would be very grateful if you would consider my request. I am eager to work with you to find a solution. I am available to discuss this further at your earliest convenience. You can reach me by phone or email. Thank you very much for your time, consideration, and understanding.

Sincerely,

[Your Signature]

How to Write a Hardship Letter to Request Temporary Relief

A hardship letter is a powerful tool. It’s an impassioned plea, a meticulously crafted narrative detailing the adversities you’re currently facing. It serves as a formal communication to an institution or individual, requesting temporary relief from a financial obligation or other burdens.

1. Grasping the Nuances of a Hardship Letter

Before you begin, fully understand the purpose of your missive. It’s not a mere sob story; rather, it’s a concise and compelling exposition of your predicament.

The letter seeks to demonstrate your genuine inability to meet your current commitments due to unforeseen circumstances. Consider your audience. Tailor your tone and vocabulary to suit the recipient and the situation. Your objective is not to elicit pity but to evoke empathy and prompt action.

2. Pre-Writing Preparations: The Blueprint for Success

Thorough preparation is paramount. Begin by gathering all pertinent documentation. This may include, but is not limited to, medical bills, unemployment notices, bank statements, and any other evidence that substantiates your claims. Subsequently, undertake a meticulous analysis of your financial situation.

Clearly delineate your income, expenses, and outstanding debts. This detailed overview will inform your narrative and lend credibility to your request.

3. Structuring Your Hardship Letter: A Framework of Clarity

The structure of your hardship letter is crucial. It dictates how effectively your message resonates. Here is a generally accepted format you can adhere to:

- The Salutation: Address the recipient with formality. Use their title and name (e.g., “Dear Mr. Smith”). If the specific individual is unknown, use a more general salutation like “To Whom It May Concern.”

- Introduction: State your purpose unequivocally. Briefly identify yourself and what you are requesting relief from.

- Explanation of Hardship: This section is the heart of your letter. Detail the specific circumstances causing your hardship. Be specific, factual, and avoid excessive emotional language. Present the facts in a chronological order.

- Impact and Consequences: Explain the impact your hardship has on your financial obligations and/or personal life. If you do not meet these obligations what will be the effect?

- Proposed Solution: Clearly state the relief you are seeking. Be specific about what you are asking for (e.g., a temporary payment reduction, a payment plan modification, etc.).

- Supporting Documentation: Mention the attached documents that support your request.

- Closing: Express gratitude for their consideration and understanding.

- Signature: Sign your name and include your contact information.

4. Crafting Compelling Content: The Art of Persuasion

The words you choose have the power to influence the reader. Use clear, concise, and professional language. Steer clear of jargon or overly complex sentences. Be truthful and transparent.

Provide concrete details and evidence to support your claims. While maintaining a professional tone, express your genuine concern and emphasize your desire to resolve the situation.

5. Evidencing Your Claims: The Power of Supporting Documentation

Your letter is only as strong as the evidence you provide. Attach copies of all relevant documentation to substantiate your claims. This may include medical records, employment termination notices, bank statements, and any other material that validates your situation.

Ensure that all documents are clearly legible and organized. Reference these documents throughout your letter to reinforce your arguments.

6. The Art of Review and Revision: Polishing Your Prose

Once you’ve completed your first draft, set it aside. Return to it later with fresh eyes. Proofread carefully for any errors in grammar, spelling, and punctuation.

Ensure the language is clear, concise, and professional. Ask a trusted friend or family member to review the letter. Seek their feedback on the clarity of your arguments and the overall tone of the letter.

7. Delivery and Follow-Up: Ensuring Your Voice is Heard

How you submit your letter can impact the response. If possible, send it via certified mail with return receipt requested. This ensures proof of delivery.

If submitting electronically, keep a copy of your sent email. Regardless of the method, consider a follow-up. Within a reasonable timeframe (e.g., a week or two), contact the recipient to confirm receipt and inquire about the status of your request. This proactive approach demonstrates your commitment to resolving the situation.

FAQs about Hardship Letter to Request Temporary Relief

What is a hardship letter, and when is it necessary?

A hardship letter is a formal written request explaining a difficult financial or personal situation that is impacting your ability to meet financial obligations, such as loan payments, rent, or other debts.

It is necessary when you anticipate or are already experiencing difficulty making payments due to unforeseen circumstances, such as job loss, medical emergencies, or other significant life events that have reduced your income or increased your expenses.

What should I include in a hardship letter?

A comprehensive hardship letter should include: your contact information, the date, the name and address of the creditor or institution you are writing to, a clear explanation of your hardship (be specific and honest), supporting documentation (pay stubs, medical bills, bank statements, etc.)

What type of relief can I request in a hardship letter?

The type of relief you can request varies depending on the type of debt and the policies of the lender or creditor. Common requests include: a temporary payment reduction, a payment plan modification.

How do I write a compelling hardship letter?

To write a compelling letter, be clear, concise, and honest about your situation. Provide specific details about your hardship and its impact on your ability to pay. Attach supporting documentation to back up your claims. Maintain a respectful tone and express your commitment to repaying the debt when you’re able. The letter should be well-organized and easy to read.

What happens after I send a hardship letter?

After you send your letter, the lender or creditor will review it and any supporting documentation you’ve provided. They may contact you for additional information or clarification.

The time it takes to receive a response and a decision can vary. If approved, the lender will outline the terms of the relief granted. If denied, they will usually explain the reasons for the denial. It is important to follow up on your letter if you haven’t heard back within a reasonable timeframe.

Related:

Resignation letter due to rude boss

Resignation letter moving to another state

Resignation letter due to illness of family member

Resignation letter due to study