Sometimes, unexpected situations happen. You might face financial difficulties. A hardship letter to an insurance company can help. It explains your circumstances. Its main purpose is to request special consideration. This can be for payments, coverage, or other needs.

We understand navigating this can be tough. That’s why we’re here to help. This article provides you with hardship letter samples. Find hardship letter examples tailored for insurance companies. We’ll offer different hardship letter templates. This will make it easier for you to craft your own hardship letter.

Writing a hardship letter doesn’t have to be overwhelming. You can adapt these templates. We’ll guide you through it. Our goal is to make the process easier. You’ll be able to create a compelling letter. Get started today!

[Your Name]

[Your Address]

[Your Phone Number]

[Your Email Address]

[Date]

[Insurance Company Name]

[Insurance Company Address]

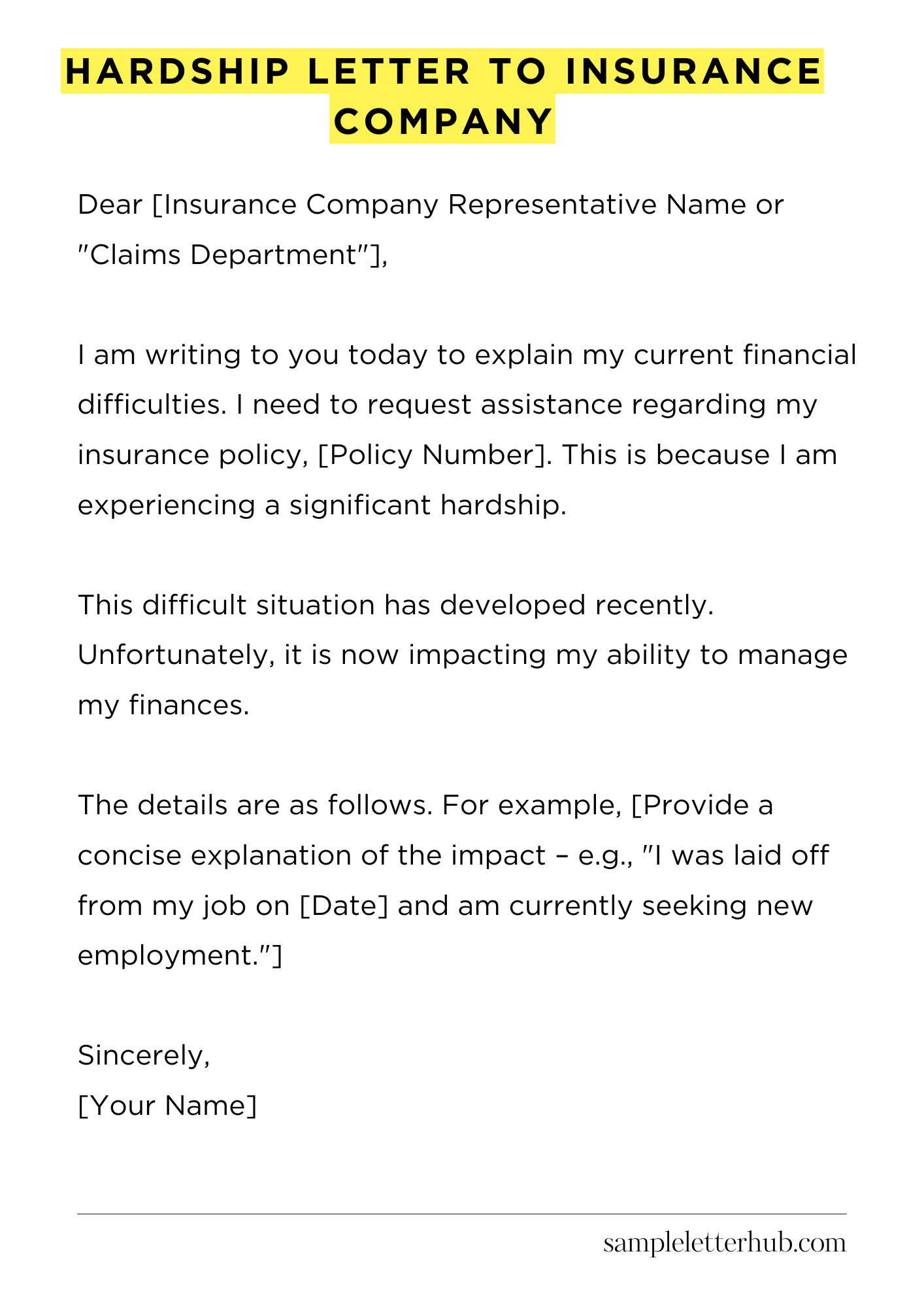

Dear [Insurance Company Representative Name or “Claims Department”],

I am writing to you today to explain my current financial difficulties. I need to request assistance regarding my insurance policy, [Policy Number]. This is because I am experiencing a significant hardship.

This difficult situation has developed recently. Unfortunately, it is now impacting my ability to manage my finances. The cause of this financial strain is [Briefly explain the reason for the hardship – e.g., job loss, unexpected medical expenses, etc.].

The details are as follows. For example, [Provide a concise explanation of the impact – e.g., “I was laid off from my job on [Date] and am currently seeking new employment.”]

Due to this unfortunate situation, I am finding it hard to meet my financial obligations. This includes paying my insurance premiums. I am requesting a review of my policy. I would like to explore any options the company may offer.

I would like to know if there is any way to reduce my monthly payments. Alternatively, perhaps a temporary payment plan could be arranged. I understand the importance of keeping my insurance active. It is important to me to have coverage.

I have attached supporting documentation. This includes [List any documents you are attaching – e.g., bank statements, proof of unemployment, medical bills]. These papers will help demonstrate the extent of my hardship. I am confident that these documents will help show my situation.

I would greatly appreciate your understanding and support in this matter. Please contact me at your earliest convenience. You can reach me at [Your Phone Number] or [Your Email Address]. Thank you for your time and consideration. I look forward to hearing from you soon.

Sincerely,

[Your Name]

How to Write a Hardship Letter to an Insurance Company

Navigating the complexities of an insurance claim, especially when financial constraints are involved, can be daunting. A hardship letter, meticulously crafted, serves as a persuasive instrument, amplifying your case and potentially influencing a favorable outcome. This guide will provide you with the essential steps to compose a compelling hardship letter.

1. Initiate: Grasping the Nuances of the Letter’s Purpose

Firstly, understand the bedrock of your letter: the core reason for its existence. Your hardship letter is an earnest plea to the insurance company, elucidating the significant financial or personal challenges you are currently facing.

These challenges are directly impacted by the denial, delay, or inadequacy of your insurance claim. Articulate your predicament with utmost clarity. Be precise, and avoid ambiguity. This preliminary phase sets the stage for a compelling narrative.

2. Formatting Fortitude: Structuring Your Letter with Precision

Your letter must exude professionalism. Begin by including your full name, address, phone number, and email address at the top left corner. On the right, note the date and the insurance company’s name and address.

Employ a formal salutation, such as “To Whom It May Concern” or, ideally, the name of the claims adjuster you have been corresponding with. The body of the letter is where you will expand on your situation in a structured format.

3. Proffering the Preamble: Stating Your Case Compellingly

The introductory paragraph is your pitch. It establishes the purpose of the letter and briefly outlines the problem. State the insurance claim details – the policy number, claim number, and the date the claim was filed. Briefly explain why you are writing this letter and what resolution you are seeking. This sets the framework for the subsequent paragraphs.

4. Amplifying the Anguish: Detailing Your Specific Hardships

This is the crux of your letter, where you flesh out the specific circumstances that constitute your hardship. Detail the financial implications of the insurance company’s decision. For example, were you unable to pay rent, mortgage, or medical expenses?

Provide verifiable documentation—bank statements, medical bills, utility bills, or any proof that demonstrates the validity of your claims. Be candid, yet composed.

5. Supporting Substantiation: Presenting Compelling Evidence

Evidence is the cornerstone of your argument. Attach copies of all supporting documentation that validates your hardship. These might include medical records, pay stubs, bank statements, eviction notices, or any documentation that underscores the financial strain. Organize your documents neatly and create a document list.

Be meticulous, and leave no stone unturned. The more evidence you can provide, the stronger your case becomes.

6. The Concluding Cadence: Re-iterating Your Plea with Poignancy

In the concluding paragraph, summarize the essence of your request. Reiterate the financial and personal impact the insurance company’s denial or delay has had on you. Express your hope for a favorable outcome and politely request reconsideration of your claim. Sign the letter, and type your name below your signature. It’s important to stay polite.

7. Polishing and Persuasion: Reviewing and Refining Your Rhetoric

Before dispatching your letter, thoroughly proofread it for any grammatical errors, typos, or inconsistencies. Ensure the language is clear, concise, and professional. Is your tone persuasive but not aggressive?

Does the letter leave no room for misunderstanding? Seek a second opinion. A fresh pair of eyes can often catch mistakes you may have overlooked. Your well-crafted letter can dramatically improve the chances of a positive outcome.

FAQs about Hardship Letter to Insurance Company

What is a hardship letter and why would I need to write one to my insurance company?

A hardship letter is a formal document you submit to your insurance company to explain circumstances that have made it difficult for you to pay your premiums or adhere to your insurance policy terms. You might need to write a hardship letter due to unexpected financial difficulties, such as job loss, medical expenses, or the death of a primary wage earner.

This letter is crucial as it requests consideration from the insurance company, potentially to modify payment plans, waive late fees, or temporarily suspend coverage.

What information should I include in a hardship letter?

Your hardship letter should clearly identify your policy details (policy number, etc.). It should also include a detailed explanation of your hardship, including specific dates, amounts, and relevant documentation to support your claims.

The letter should clearly state the relief you are seeking from the insurance company, such as a temporary payment reduction, a payment plan, or a delay in coverage termination. Ensure to include your contact information.

What kind of documentation should I include with my hardship letter?

Supporting documentation is critical to substantiating the hardship you are claiming. This may include documents like: Layoff notice, unemployment benefits documentation, medical bills, bank statements (demonstrating loss of income or increased expenses), death certificates (if applicable).

How should I format and submit my hardship letter?

The format of your hardship letter should be professional and clear. Use formal language and ensure the letter is easy to read. You can draft the letter yourself, but ensure it is well organized.

Send the letter via certified mail, return receipt requested, or electronic mail with a delivery receipt, and keep a copy for your records. This provides proof of delivery and receipt by the insurance company. Ensure all communication is documented.

What happens after I submit my hardship letter?

After submitting your letter, the insurance company will review your request and supporting documentation. They will typically respond within a set timeframe, usually specified in your policy or state regulations. The response might include an approval of your requested relief, a counter-offer, or a denial.

The decision will depend on your specific circumstances, the terms of your policy, and the company’s policies regarding hardship. If you disagree with the decision, you may have the option to appeal, which involves providing further information or seeking assistance from consumer protection agencies.

Related:

Resignation letter due to rude boss

Resignation letter moving to another state

Resignation letter due to illness of family member

Resignation letter due to study