Dealing with commercial insurance can be a headache. Sometimes, the premiums feel too high. A commercial insurance premium reduction request letter is your tool. Its purpose is simple: to ask your insurance provider for a lower rate. This can save your business money.

Want to lower your commercial insurance premiums? You’re in the right place. We’ve got you covered. This article offers helpful letter samples and templates. They will help you craft your own request letter. Reduce your insurance costs with ease.

We know writing can be tough. That is why we are providing you with various letter examples. These are easy to adapt. Use them as a starting point. Get ready to write a compelling insurance premium reduction request. Good luck, and save that money!

[Your Name/Your Company Name]

[Your Address]

[Your Phone Number]

[Your Email Address]

[Date]

[Insurance Company Name]

[Insurance Company Address]

Subject: Commercial Insurance Premium Reduction Request

Dear [Insurance Company Representative Name],

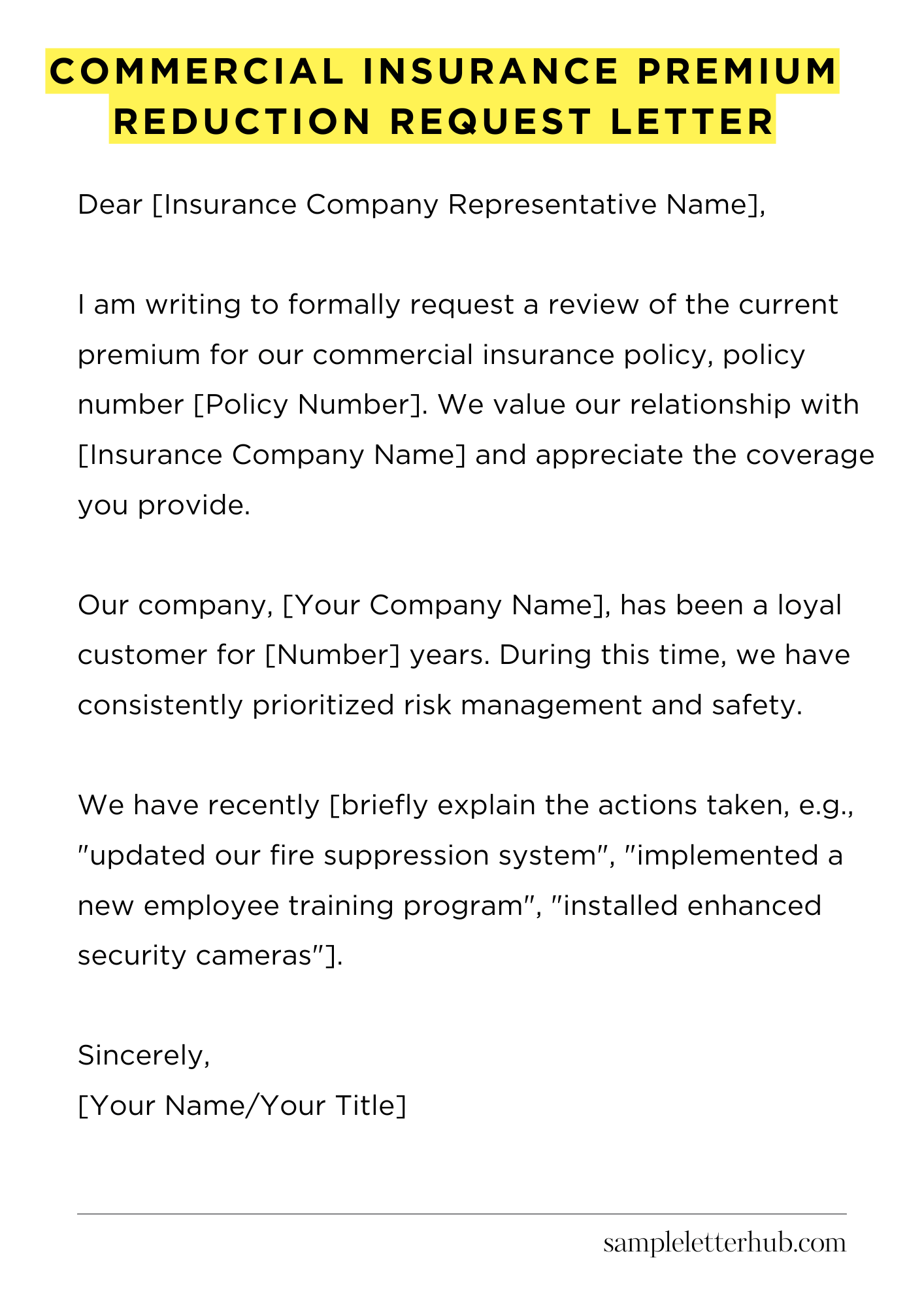

I am writing to formally request a review of the current premium for our commercial insurance policy, policy number [Policy Number]. We value our relationship with [Insurance Company Name] and appreciate the coverage you provide.

Our company, [Your Company Name], has been a loyal customer for [Number] years. During this time, we have consistently prioritized risk management and safety. We have implemented several measures to mitigate potential risks. These measures have demonstrably improved our safety record.

We have recently [briefly explain the actions taken, e.g., “updated our fire suppression system”, “implemented a new employee training program”, “installed enhanced security cameras”].

These improvements are designed to further reduce our exposure to potential claims. These updates have significantly lowered the potential risk of incidents.

We believe these proactive steps warrant a review of our current premium. We are confident that we now present a lower risk profile. Therefore, we respectfully request a reduction in our commercial insurance premium.

We are available to provide any additional information you may require. We are happy to discuss our safety initiatives in more detail. We can also provide documentation to support our request.

Thank you for your time and consideration of this matter. We look forward to your positive response.

Sincerely,

[Your Name/Your Title]

How to Write Commercial Insurance Premium Reduction Request Letter

Negotiating your commercial insurance premiums can feel daunting, but a well-crafted letter can significantly improve your chances of securing a more advantageous rate. This guide provides a comprehensive roadmap for constructing a compelling premium reduction request letter.

1. Commence with Proper Salutation and Identification

Begin your missive with a formal salutation, addressing the appropriate underwriter, claims adjuster, or insurance representative by name. Research their precise title beforehand.

Subsequently, meticulously identify yourself and your business. Include your full legal business name, policy number, and the specific type of commercial insurance in question. This immediate clarification establishes the parameters of your request and aids in prompt processing.

2. Articulate the Rationale for Reduction

The core of your letter lies in persuasively presenting the reasons for a premium reduction. Bolster your argument by highlighting your company’s positive attributes.

Focus on demonstrable risk mitigation strategies implemented since the policy’s inception. This could encompass upgraded security systems, enhanced employee training programs, or a stellar loss history characterized by a dearth of claims.

Quantify these improvements whenever feasible; concrete data speaks volumes. For example, “Implementation of our new fire suppression system has reduced our fire-related risk by 40%.”

3. Provide Compelling Supporting Documentation

Amplify your claims by including irrefutable evidence. Attach copies of relevant documents, such as inspection reports, safety audits, training certifications, and any other materials that substantiate your assertions.

This provides an evidentiary base and strengthens your position. Ensure all attached documentation is clearly labeled and cross-referenced within the body of your letter for ease of review. Consider providing a comprehensive appendix if necessary.

4. Cite Relevant Policy Clauses and Benchmarks

Familiarize yourself with your existing policy’s stipulations. Reference specific clauses or provisions that support your request for a reduction.

Research industry benchmarks and statistics pertaining to your business type and the risk factors associated with it. If your loss history is demonstrably better than the industry average, explicitly state this, citing reliable sources to validate your claim.

5. Present a Clear and Concise Request

Explicitly state the premium reduction you are seeking. Be realistic and reasonable in your request. Do not overreach. You must be precise about the specific percentage or dollar amount of the reduction you desire.

If you are open to negotiation, you can also express this explicitly, stating, “We are hopeful for a significant reduction and are open to further discussion to reach a mutually agreeable solution.”

6. Showcase Professionalism and Express Gratitude

Maintain a professional and courteous tone throughout your letter. Refrain from accusatory language or demands. Thank the recipient for their time and consideration, expressing your appreciation for their business.

Demonstrate your commitment to maintaining a positive working relationship with your insurance provider. You may add a closing like: “We deeply value our partnership and look forward to a favorable response to this request.”

7. Conclude with Contact Information and Signature

Provide your contact information – including your name, title, business address, phone number, and email address – clearly and concisely. This facilitates a swift and efficient response from the insurance provider.

Sign the letter with your full name and title. If possible, consider having the letter reviewed by legal counsel or a seasoned insurance professional before dispatching it. This ensures that your communication is polished, persuasive, and legally sound, thereby optimizing your prospects for success.

FAQs about Commercial Insurance Premium Reduction Request Letter

What is the primary purpose of a commercial insurance premium reduction request letter?

The primary purpose is to formally request a decrease in the cost of your commercial insurance premiums. This letter is a crucial tool for policyholders to communicate their financial concerns, provide supporting documentation or evidence, and negotiate potentially more favorable rates with their insurance provider. The goal is to lower the overall insurance expenses.

What key information should be included in a commercial insurance premium reduction request letter?

A comprehensive request letter should include the policyholder’s contact information, the insurance policy details (policy number, effective dates), the specific reasons for the request, and supporting documentation.

Reasons might include improved risk management, loss history details, proof of upgrades or improvements, or a comparison of rates from other insurance providers. The letter should also clearly state the desired premium reduction and the effective date.

What types of documentation are typically needed to support a premium reduction request?

Supporting documentation can vary depending on the reason for the request. Common examples include updated safety reports, maintenance records, inspection reports, details of implemented loss prevention measures (e.g., security systems), and any modifications to the business operations that reduce risk.

In cases of a clean loss history, a loss run report from the insurance provider is essential. Comparative quotes from competing insurers can also be used as leverage.

What are the common reasons for requesting a premium reduction?

Common reasons include a good loss history (fewer or no claims), implementation of improved safety measures or risk management protocols, significant upgrades to the property or equipment, changes in business operations that reduce risk exposure, and a desire to obtain a competitive premium.

What is the typical timeframe for a response to a commercial insurance premium reduction request letter, and what steps should be taken if there is no response?

The response time can vary by insurer, but it is generally expected within 30 to 60 days. If there is no response within a reasonable timeframe, the policyholder should follow up with the insurance company.

This can be done via phone, email, or a follow-up letter. Documenting all communications is crucial. If the initial insurer remains unresponsive or the negotiations are unsatisfactory, it is essential to consider seeking quotes from other insurance providers and explore the option of switching insurers to obtain better terms.

Related:

Resignation letter due to rude boss

Resignation letter moving to another state

Resignation letter due to illness of family member

Resignation letter due to study