If you’re dealing with debt collectors, you may have heard of a “”609 letter.”” This type of letter is a request for validation of a debt, and it’s named after the section of the Fair Credit Reporting Act that outlines your rights as a consumer.

The purpose of a 609 letter is to ask the debt collector to provide proof that they have the legal right to collect the debt, and to verify that the amount they’re claiming is accurate.

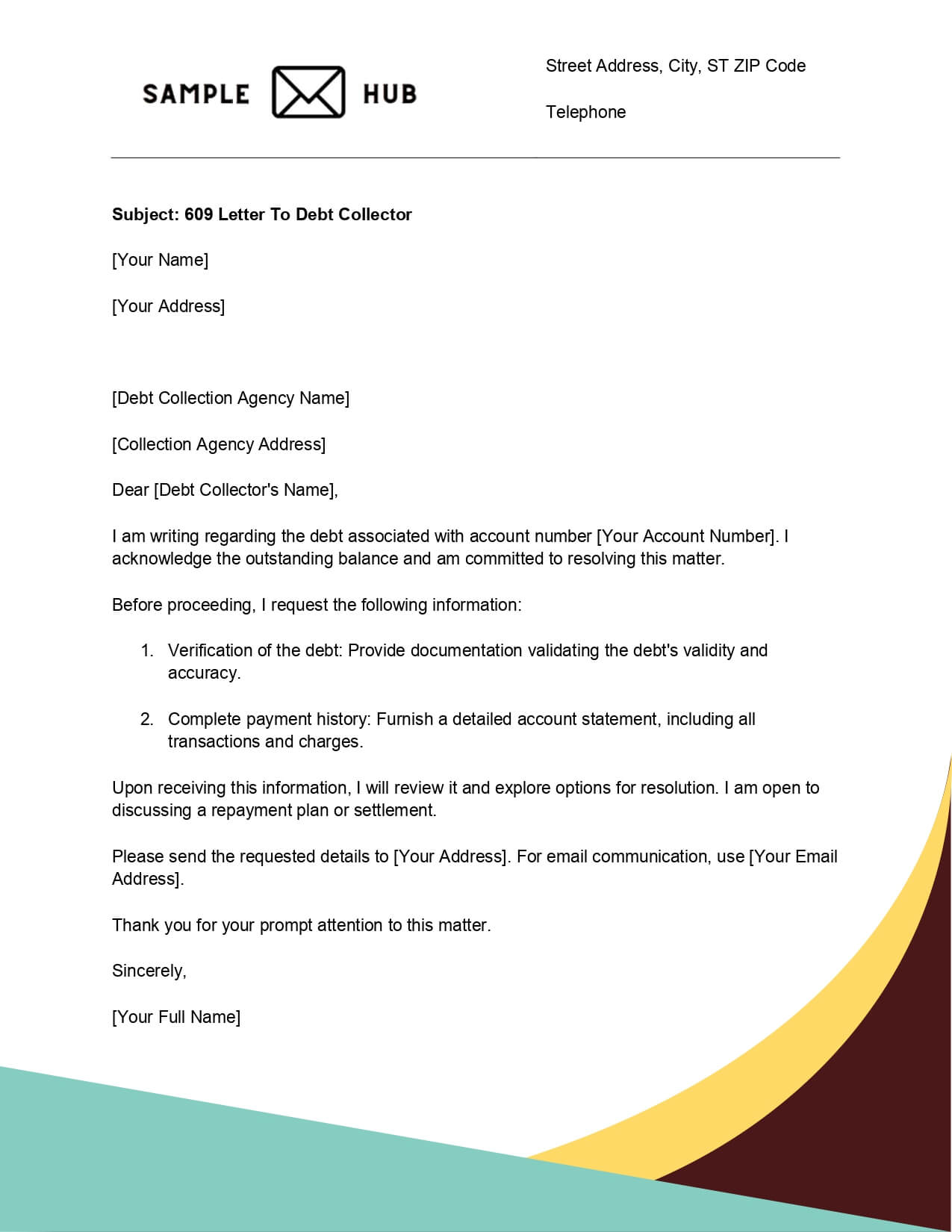

In this blog article, we’ll be sharing templates and examples of 609 letters to debt collectors. These samples will make it easy for you to write your own letter, whether you’re disputing a debt or simply trying to get more information about it.

We understand that dealing with debt collectors can be stressful and confusing, so we want to provide you with the tools you need to assert your rights as a consumer and protect your credit score.

By using our templates and examples, you’ll be able to customize your 609 letter to fit your specific situation.

We’ll provide you with guidance on what to include in your letter, how to format it, and what to do if the debt collector doesn’t respond.

With our help, you can take control of your finances and protect yourself from unfair debt collection practices.

609 Letter To Debt Collector

Dear [Debt Collector’s Name],

I am writing this letter in reference to the collection notice I received from your agency regarding the alleged debt associated with my account. I am formally requesting validation of this debt, as provided under Section 609 of the Fair Credit Reporting Act (FCRA).

Please provide the following information:

- The original creditor’s name and address.

- A detailed account of the alleged debt, including the amount owed.

- Verification that your agency is licensed to collect debts in my state.

- Proof of your authority to collect this debt on behalf of the original creditor.

- A complete payment history, including all charges and fees.

I understand that under Section 609, you are obligated to provide this information within 30 days of receiving this request. Failure to do so may result in the removal of this debt from my credit report, and I reserve the right to take legal action if necessary.

Kindly send the requested documentation to the address listed above. Please consider this as a formal request for the validation of the debt mentioned in your collection notice.

Sincerely,

[Your Full Name]

609 Dispute Letter

Dear [Credit Bureau’s Name],

I am writing to dispute certain information on my credit report that I believe to be inaccurate. This letter serves as a formal request for an investigation into the disputed items in accordance with Section 609 of the Fair Credit Reporting Act (FCRA).

The following items on my credit report are in dispute:

- [Item 1]

- [Item 2]

- [Item 3]

I request that you conduct a thorough investigation into these matters and provide me with the results within the statutory 30-day period. I believe that the information is inaccurate because [provide a brief explanation of why the information is incorrect].

Enclosed are copies of supporting documents that validate my position. I kindly request that you review these documents as part of your investigation.

I appreciate your prompt attention to this matter and the correction of any inaccuracies found during your investigation. Please send me a written confirmation of the investigation results, along with an updated copy of my credit report.

Thank you for your assistance in resolving this matter promptly.

Sincerely,

[Your Full Name]

609 Letter For Charge Off

Dear [Creditor’s Name],

I hope this letter finds you well. I am writing to formally request the validation of the charged-off account appearing on my credit report, as permitted under Section 609 of the Fair Credit Reporting Act (FCRA).

The account in question is [provide account details, including account number and any reference information]. I am seeking detailed information on the validity of this debt, including:

- The original amount of the debt.

- A breakdown of any interest, fees, or additional charges.

- Proof of the agreement and contractual obligation.

- Any documentation establishing your legal right to collect this debt.

According to Section 609, you are required to provide this information within 30 days of receiving this request. Failure to do so may result in the removal of this charged-off account from my credit report.

Please send the requested information to the address listed above. I appreciate your prompt attention to this matter and compliance with the FCRA regulations.

Sincerely,

[Your Full Name]

609 Letters For Student Loans

Dear [Loan Servicer’s Name],

I trust this letter finds you well. I am writing to formally request the validation of my student loan account as provided under Section 609 of the Fair Credit Reporting Act (FCRA).

The student loan account details are as follows:

- Loan Account Number: [Your Loan Account Number]

- Loan Amount: [Original Loan Amount]

- Date of Origination: [Loan Origination Date]

According to Section 609, I am entitled to detailed information on the validity of this debt, including:

- The original amount of the loan.

- A breakdown of any interest, fees, or additional charges.

- Proof of the agreement and contractual obligation.

- Any documentation establishing your legal right to collect this debt.

I kindly request that you provide this information within 30 days of receiving this letter. Failure to do so may result in the necessary actions to protect my rights under the FCRA.

Please send the requested information to the address listed above. I appreciate your prompt attention to this matter.

Sincerely,

[Your Full Name]

609 Credit Repair Letters

Dear [Credit Bureau’s Name],

I hope this letter finds you well. I am writing to dispute and request an investigation into the accuracy of information on my credit report, as allowed under Section 609 of the Fair Credit Reporting Act (FCRA).

The following items on my credit report are in dispute:

- [Item 1]

- [Item 2]

- [Item 3]

I am seeking a thorough investigation into these matters and request the removal or correction of any inaccuracies found. Enclosed are copies of supporting documents for your review.

As per the FCRA, I kindly request that you complete the investigation within 30 days and provide me with the results. Please send a written confirmation of the changes made to my credit report.

I appreciate your prompt attention to this matter and your compliance with the FCRA regulations.

Sincerely,

[Your Full Name]

How to Write a 609 Letter to a Debt Collector

If you’re dealing with a debt collector, you may feel overwhelmed and unsure of what to do next. One option you have is to write a 609 letter, which is a request for validation of the debt.

This letter can help you verify that the debt is legitimate and ensure that the debt collector is following the law. Here’s how to write a 609 letter to a debt collector.

1. Understand the Purpose of a 609 Letter

A 609 letter is a request for validation of the debt. This means that you’re asking the debt collector to provide proof that the debt is legitimate and that they have the legal right to collect it. The Fair Debt Collection Practices Act (FDCPA) requires debt collectors to provide this information if you request it.

2. Gather Information

Before you write your 609 letter, you’ll need to gather some information. This includes the name and address of the debt collector, the amount of the debt, and any other relevant information. You may also want to review your credit report to ensure that the debt is accurate.

3. Write the Letter

When writing your 609 letter, be sure to include the following information:

– Your name and address

– The name and address of the debt collector

– The date

– A request for validation of the debt

– A statement that you’re disputing the debt

– A request that the debt collector stop all collection activities until they provide validation

– Your signature

Here’s an example of what your 609 letter might look like:

[Your Name]

[Your Address]

[City, State ZIP Code]

[Date]

[Debt Collector Name]

[Debt Collector Address]

[City, State ZIP Code]

Re: Account Number [Insert Account Number]

Dear Sir or Madam,

I am writing to request validation of the debt that you are attempting to collect. I dispute the debt and request that you provide proof that the debt is legitimate and that you have the legal right to collect it.

Please provide me with the following information:

– The name and address of the original creditor

– The amount of the debt

– A copy of the original contract or agreement

– Any other documentation that supports your claim that I owe this debt

I also request that you stop all collection activities until you provide validation of the debt.

Sincerely,

[Your Signature]

[Your Name]

4. Send the Letter

Once”

“Introduction:

If you have ever been in debt, you may have received a letter from a debt collector known as a “”609 letter.”” This letter is a request for validation of the debt, and it is important to understand what it means and how to respond. In this article, we will answer the 7 most frequently asked questions about 609 letters to debt collectors.

What Is a 609 Letter?

A 609 letter is a written communication that aims to dispute inaccurate or questionable information on your credit report. It is a tool that individuals can use to assert their rights under Section 609 of the Fair Credit Reporting Act (FCRA).

What is a 609 dispute letter?

A 609 dispute letter is a specific type of letter that you can send to credit bureaus or creditors to challenge the validity of certain items on your credit report. It is a way to request an investigation into the accuracy of the information being reported.

What Is Section 609?

Section 609 refers to a provision within the Fair Credit Reporting Act (FCRA) that outlines the rights of consumers regarding the accuracy and fairness of their credit reports. It grants individuals the right to request information about them and dispute any inaccuracies.

Does a 609 Credit Dispute Letter Actually Work?

While a 609 credit dispute letter can be a useful tool, its effectiveness may vary. It depends on the specific circumstances and the response of the credit bureaus or creditors.

It is important to note that a 609 letter alone may not guarantee the removal of disputed items, but it can initiate an investigation into the accuracy of the information.

FAQs About 609 Letter to a Debt Collector

1. What is a 609 letter to a debt collector?

A 609 letter is a written request for validation of a debt that has been sent to a debt collector. It is named after the section of the Fair Credit Reporting Act (FCRA) that outlines the consumer’s right to request validation of a debt.

2. Why would I send a 609 letter to a debt collector?

Sending a 609 letter to a debt collector is a way to request validation of a debt and ensure that the debt is legitimate. It is also a way to dispute any inaccuracies or errors in the debt collection process.

3. What information should be included in a 609 letter?

A 609 letter should include your name, address, and account number, as well as a request for validation of the debt. It should also include a statement that you are disputing the debt and a request for the debt collector to cease all collection activities until the debt is validated.

4. How should I send a 609 letter to a debt collector?

A 609 letter should be sent via certified mail with a return receipt requested. This will provide proof that the letter was received by the debt collector.

5. What happens after I send a 609 letter to a debt collector?

After you send a 609 letter to a debt collector, they are required to provide validation of the debt within 30 days. If they are unable to provide validation, they must cease all collection activities.

6. Can a 609 letter be used to remove negative information from my credit report?

No, a 609 letter cannot be used to remove negative information from your credit report. However, if the debt collector is unable to provide validation of the debt, they must cease all collection activities, which may result in the debt being removed from your credit report.

7. What should I do if the debt collector does not respond to my 609 letter?

If the debt collector does not respond to your 609 letter within 30 days, you may need to seek legal assistance to dispute the debt and protect your rights as a consumer.

Related:

- Letters To The President ( 5 Samples )

- Letter To The Bride Book ( 5 Samples )

- Authorization Letter To Bank ( 5 Samples )

- Day care Welcome Letter To Parents ( 5 Samples )

- Letter Of Appeal To Insurance ( 5 Samples )