Are you struggling to write a 2nd letter to a debt collector? Don’t worry, we’ve got you covered! In this blog article, we will share templates, examples, and samples of 2nd Letter To Debt Collector to make it easy for you to write any letter that you need to.

We understand that writing a letter to a debt collector can be overwhelming, especially if you are not familiar with the process. That’s why we have compiled a list of samples that you can use as a guide to write your own letter. We will also provide tips on how to write an effective letter and the do’s and don’ts of it.

Key Points:

– We will share samples of 2nd Letter To Debt Collector

– We will share how to write an effective letter

– We will provide the do’s and don’ts of writing a letter to a debt collector.

2nd Letter To Debt Collector

Dear [Debt Collector’s Name],

I am writing to you in regards to the debt that you have been pursuing from me. I received your previous letter and I appreciate the time you took to contact me. However, I would like to express my concerns about the way you have been handling this matter.

As I mentioned in my previous letter, I am going through a difficult financial situation and I am unable to pay the debt in full at this time. I have been trying my best to make some payments towards this debt, but it has been difficult to keep up with the payments due to my current financial situation.

I would like to request that you consider working with me to come up with a payment plan that is manageable for me. I am willing to make some payments towards the debt, but I need some time to get back on my feet. I hope that we can come to an agreement that works for both of us.

I would also like to request that you stop any further communication with me through phone calls. I would prefer to communicate with you through written correspondence only. I hope that you can respect my request and we can continue to work towards a resolution.

Thank you for your understanding and cooperation in this matter.

Sincerely,

[Your Name]

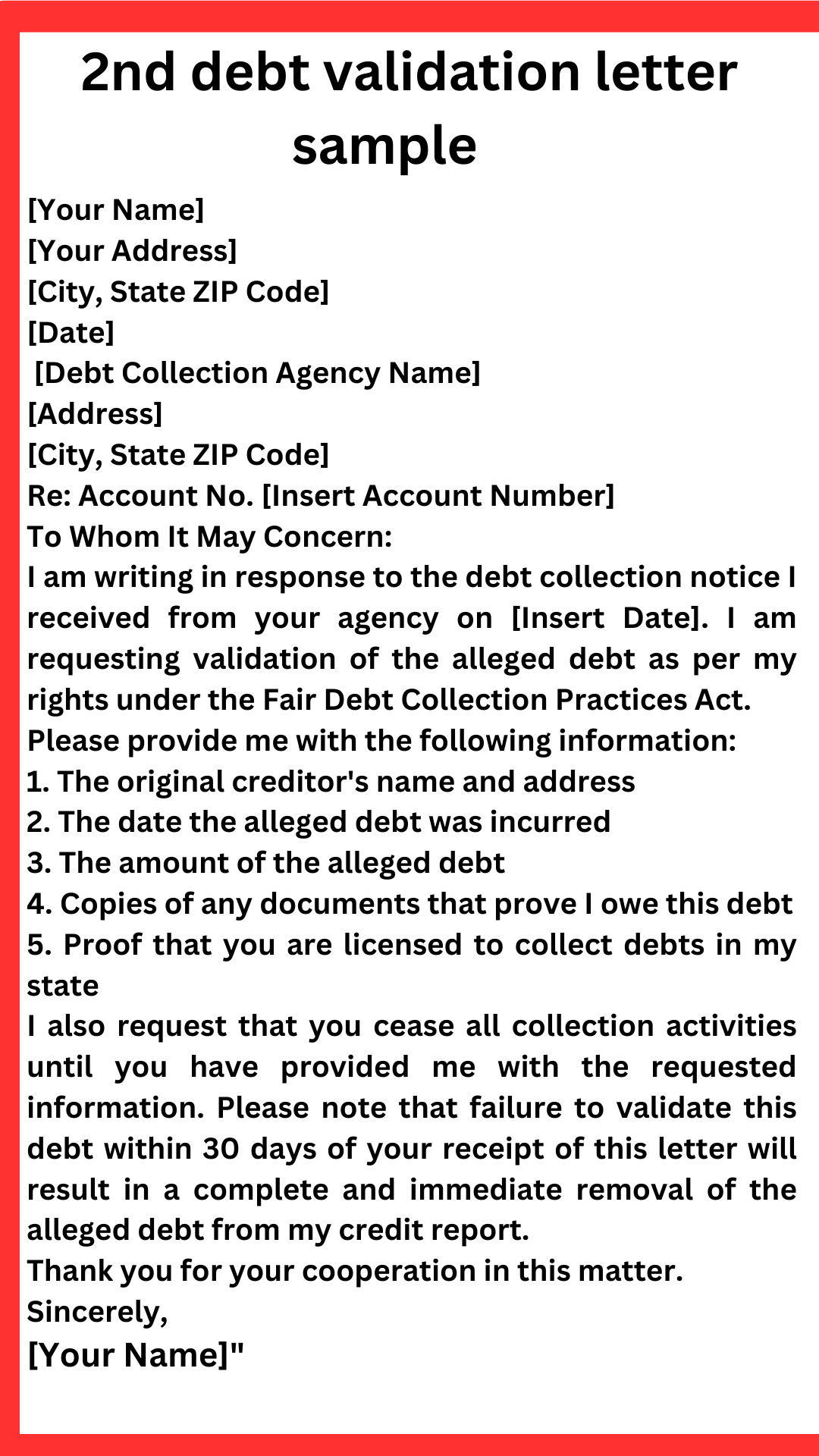

2nd debt validation letter sample

[Your Name]

[Your Address]

[City, State ZIP Code]

[Date]

[Debt Collection Agency Name]

[Address]

[City, State ZIP Code]

Re: Account No. [Insert Account Number]

To Whom It May Concern:

I am writing in response to the debt collection notice I received from your agency on [Insert Date]. I am requesting validation of the alleged debt as per my rights under the Fair Debt Collection Practices Act.

Please provide me with the following information:

- The original creditor’s name and address

- The date the alleged debt was incurred

- The amount of the alleged debt

- Copies of any documents that prove I owe this debt

- Proof that you are licensed to collect debts in my state

I also request that you cease all collection activities until you have provided me with the requested information. Please note that failure to validate this debt within 30 days of your receipt of this letter will result in a complete and immediate removal of the alleged debt from my credit report.

Thank you for your cooperation in this matter.

Sincerely,

[Your Name]”

2nd reminder letter To Debt Collector

Dear [Debt Collector],

I am writing to remind you that I have not yet received a response from you regarding my previous letter dated [date of first letter]. As I mentioned in my previous letter, I dispute the validity of the debt you claim I owe.

I would appreciate it if you could provide me with more information about the debt, such as the original creditor, the amount owed, and any documentation you have to support your claim. I also request that you cease any further communication with me until you can provide me with the requested information.

Please be aware that I am aware of my rights under the Fair Debt Collection Practices Act (FDCPA) and will take necessary legal action if you continue to harass me or fail to provide me with the requested information.

I look forward to hearing from you soon.

Sincerely,

[Your Name]”

2nd letter to debt collector about disputing debt

“Dear [Debt Collector],

I am writing to follow up on my previous letter regarding the debt you are attempting to collect from me. As I stated in my previous letter, I am disputing this debt and request that you provide me with verification of the debt.

I have not received any response from you regarding my dispute, and I am concerned that you may be continuing to pursue collection efforts without proper verification of the debt. As a consumer, I have the right to request verification of any debt that is being collected from me, and I expect that you will comply with this request.

Please provide me with all documentation related to this debt, including the original creditor, the amount owed, and any interest or fees that have been added to the debt. I also request that you provide me with a copy of the signed agreement or contract that establishes my obligation to pay this debt.

I am willing to work with you to resolve this matter, but I cannot do so until I have received proper verification of the debt. I look forward to hearing from you soon.

Sincerely,

[Your Name]”

2nd dispute letter to debt collector

“[Your Name]

[Your Address]

[City, State ZIP Code]

[Date]

[Debt Collection Agency Name]

[Address]

[City, State ZIP Code]

Re: Account Number [Insert Account Number]

Dear Sir/Madam,

I am writing in response to your recent communication regarding the above-referenced account. I am disputing the validity of this debt and request that you provide me with proof of this debt.

According to the Fair Debt Collection Practices Act, I have the right to request validation of the debt that you are attempting to collect from me. I am requesting that you provide me with the following information:

- A copy of the original signed contract or agreement between myself and the original creditor.

- Proof of the amount of the debt, including any interest or fees that have been added.

- A copy of the original creditor’s charge-off statement.

- Proof that you are authorized to collect this debt.

If you are unable to provide me with this information, I request that you remove this debt from my credit report and cease all collection efforts.

Please be advised that I am aware of my rights under the Fair Debt Collection Practices Act and will not hesitate to take legal action if necessary.

Thank you for your prompt attention to this matter.

Sincerely,

[Your Name]”

2nd debt collection dispute letter

“[Your Name]

[Your Address]

[City, State ZIP Code]

[Date]

[Debt Collection Company Name]

[Address]

[City, State ZIP Code]

Dear Sir/Madam,

I am writing in response to your letter dated [date] regarding the alleged debt of [amount] that you claim I owe to [creditor’s name]. I dispute the validity of this debt and request that you provide me with further information to substantiate your claim.

As per the Fair Debt Collection Practices Act, I have the right to request verification of the debt that you are attempting to collect from me. Therefore, I am requesting that you provide me with the following documents:

- A copy of the original contract or agreement with my signature on it, which shows that I am responsible for this debt.

- Copies of all statements and invoices from the original creditor, showing the balance owed and any interest or fees that have been added.

- Proof that you are authorized to collect this debt on behalf of the original creditor.

- Verification that the statute of limitations for this debt has not expired.

Please note that until you provide me with the requested information, I will not acknowledge this debt as valid. I also request that you cease all communication with me until you have provided me with the necessary documentation.

Thank you for your attention to this matter.

Sincerely,

[Your Name]”

2nd letter for debt collection

“Dear [Debtor],

I am writing to you once again regarding the outstanding debt that you owe to [Company Name]. Despite our previous attempts to contact you and resolve this matter, we have yet to receive payment for the amount owed.

We understand that unexpected financial circumstances can arise, and we are willing to work with you to create a payment plan that fits your current situation. However, we need to hear from you in order to come up with a solution.

Please contact us at your earliest convenience to discuss the outstanding debt and possible payment arrangements. Ignoring this matter will only lead to further consequences, such as legal action.

We hope to hear from you soon.

Sincerely,

[Your Name]

[Company Name]”

2nd letter to debt collector Letter sample

“Dear [Debt Collector’s Name],

I am writing to you regarding the letter I received from your office dated [Date of the letter]. I am aware of the debt that I owe, and I am willing to resolve this issue as soon as possible. However, I have a few concerns that I would like to address before proceeding.

Firstly, I would like to request for a detailed breakdown of the debt, including the principal amount, interest charges, and any other fees that have been added. I would also appreciate it if you could provide me with a copy of the original agreement or contract that I signed, as well as any other relevant documents that can help me understand the nature of this debt.

Secondly, I would like to request for some time to review the information you provide me before making any payment arrangements. I am currently facing some financial difficulties, and I would like to ensure that any payment plan we agree upon is feasible for me to sustain.

Lastly, I would like to request that you stop any further communication with me through phone calls. I would prefer to communicate with you through written correspondence, as this will allow me to keep track of our conversations and ensure that everything is properly documented.

I hope that we can work together to resolve this issue in a timely and amicable manner. Please let me know if you require any further information from me.

Thank you for your understanding.

Sincerely,

[Your Name]”

2nd debt validation letter to debt collector

“[Your Name]

[Your Address]

[City, State ZIP Code]

[Date]

[Debt Collector’s Name]

[Debt Collector’s Address]

[City, State ZIP Code]

Re: Account Number: [Insert Account Number]

Dear Sir/Madam,

This letter is in response to your letter dated [Insert Date], in which you claim that I owe a debt of [Insert Amount] to [Insert Creditor’s Name]. As I did not recognize the debt, I sent a debt validation letter to you on [Insert Date], requesting that you provide me with proof of the debt.

However, I have not received any response from you, and it has been more than 30 days since you received my initial request. Therefore, I am writing this letter to remind you of your obligation to validate this debt under the Fair Debt Collection Practices Act (FDCPA).

As per the FDCPA, you are required to provide me with the following information:

– The name and address of the original creditor

– The amount of the debt

– Verification of the debt

– Proof that you are authorized to collect the debt

If you fail to provide me with this information, I reserve the right to dispute the debt and request that you cease all collection activities. Additionally, any negative reporting to credit bureaus will be considered a violation of the Fair Credit Reporting Act (FCRA).

I request that you respond to this letter within 30 days and provide me with the requested information. If you cannot validate this debt, I demand that you cease all collection activities and remove any negative reporting from my credit report.

Thank you for your prompt attention to this matter.

Sincerely,

[Your Name]”

2nd notice letter to debt collector

“Dear [Debt Collector],

I am writing to you regarding the debt that you claim I owe. This is the second notice that I am sending to you in regards to this matter.

As I have previously stated in my first notice, I dispute the validity of this debt and request that you provide me with proof of the debt, including any documentation that shows that I have agreed to pay this debt.

I also request that you cease all collection activity until you have provided me with the requested information. Any further attempts to collect this debt without providing me with the necessary documentation will be considered a violation of the Fair Debt Collection Practices Act.

Please respond to this letter in writing within 30 days, providing me with the requested information. Failure to do so will result in further action on my part, including reporting your company to the appropriate authorities.

Sincerely,

[Your Name]”

How to Write 2nd Letter To Debt Collector

Introduction

Debt collection can be a daunting task, but it is essential to deal with it effectively. Writing a letter to a debt collector is one way to address the issue. In this article, we will discuss how to write a second letter to a debt collector.

Understand Your Rights

Before you start writing your second letter, it is essential to understand your rights as a debtor. The Fair Debt Collection Practices Act (FDCPA) outlines your rights, such as the right to dispute the debt and request verification. Knowing your rights can help you avoid being taken advantage of by debt collectors.

Review Your First Letter

It is crucial to review your first letter to the debt collector before writing the second one. This will help you identify any mistakes or omissions that need to be corrected. Additionally, it will give you a chance to reiterate any points that you made in your first letter.

Be Clear and Concise

When writing your second letter to the debt collector, it is essential to be clear and concise. State your purpose for writing the letter in the first paragraph. Explain your position and any relevant information that supports it. Avoid using complex language or industry jargon that may be difficult for the debt collector to understand.

Provide Evidence

If you have any evidence that supports your position, include it in your letter. This could be a receipt, a bank statement, or any other documentation that proves your case. Be sure to make copies of any evidence you send, and keep the originals for your records.

Offer a Solution

In your second letter, it is essential to offer a solution to the debt collector. This could be a payment plan or a settlement offer. Be sure to include the terms of the agreement and any deadlines that need to be met. Remember, debt collectors are more likely to work with you if you are willing to find a solution that works for both parties.

End on a Positive Note

In your closing paragraph, thank the debt collector for their time and consideration. Express your willingness to work with them to resolve the issue. End on a positive note, and be sure to include your contact information.

Conclusion

Writing a second letter to a debt collector can be nerve-wracking, but it is an essential step in resolving the issue. By understanding your rights, reviewing your first letter, being clear and concise, providing evidence, offering a solution, and ending on a positive note, you can increase your chances of success. Remember, debt collectors are people too, and treating them with respect can go a long way.

Mistakes to Avoid When You Write 2nd Letter To Debt Collector

Introduction

If you have ever received a letter from a debt collector, you know how stressful it can be. It can be even more stressful when you have to write a letter back to them. When writing a second letter to a debt collector, it is important to avoid certain mistakes that could hurt your chances of resolving the debt. In this article, we will discuss five common mistakes to avoid when writing a second letter to a debt collector.

Mistake #1: Ignoring the Debt Collector’s First Letter

One of the biggest mistakes you can make when writing a second letter to a debt collector is ignoring their first letter. Debt collectors are required by law to send you a written notice within five days of their first contact with you. If you do not respond to their first letter, they may take legal action against you. It is important to respond to their first letter and address the debt as soon as possible.

Mistake #2: Failing to Provide Documentation

When writing a second letter to a debt collector, it is important to provide documentation to support your dispute. This could include copies of canceled checks, bank statements, or any other evidence that supports your claim. If you fail to provide documentation, the debt collector may continue to pursue the debt.

Mistake #3: Making Threats

Making threats in a letter to a debt collector is never a good idea. Threatening to file a complaint or take legal action against the debt collector will not help resolve the debt. Instead, it may escalate the situation and make it more difficult to reach a resolution. Keep your tone professional and avoid making threats.

Mistake #4: Admitting to the Debt

When writing a second letter to a debt collector, it is important to avoid admitting to the debt. Admitting to the debt could reset the statute of limitations, making it easier for the debt collector to take legal action against you. Instead, focus on disputing the debt and providing evidence to support your claim.

Mistake #5: Not Seeking Professional Help

If you are struggling to resolve a debt with a debt collector, it may be time to seek professional help. A debt settlement company or credit counselor can help you negotiate with the debt collector and find a solution that works for you. Ignoring the debt or trying to handle it on your own may only make the situation worse.

Conclusion

When writing a second letter to a debt collector, it is important to avoid certain mistakes that could hurt your chances of resolving the debt. By responding to their first letter, providing documentation, keeping your tone professional, avoiding admitting to the debt, and seeking professional help if needed, you can increase your chances of reaching a resolution. Remember, the goal is to resolve the debt and move on with your life.

Related:

Authorization Letter To Claim Passport (10 Samples)

Authorization Letter To Claim Money (10 Samples)

Authorization Letter To Claim Documents (10 Samples)