Are you struggling to write a 2nd letter to a collection agency? Don’t worry, we’ve got you covered! In this blog article, we will provide you with templates, examples, and samples of 2nd Letter To Collection Agency that will make it easy for you to write any letter that you need to.

We understand that writing a letter to a collection agency can be a daunting task, especially if you don’t know where to start. That’s why we’ve compiled a list of samples that you can use as a guide to help you write your own letter. We’ll show you how to structure your letter, what to include, and what to avoid.

Key points:

– We will share samples of 2nd Letter To Collection Agency

– We will show you how to write the letter

– We will provide you with Do’s and Don’ts of writing the letter

2nd Letter To Collection Agency

Dear Sir/Madam,

I am writing this letter in reference to the outstanding debt that I owe to your collection agency. I understand that I have not been able to pay the amount due as per the agreed terms and conditions.

I want to assure you that I am not avoiding my responsibility to pay the debt. However, due to unforeseen circumstances, I am currently facing financial difficulties and I am unable to make the payment in full at this time.

I am willing to work with you to find a mutually beneficial solution to this issue. I request you to consider my situation and grant me some time to make the payment. I am willing to make regular payments towards the debt until it is fully paid off.

I understand that the debt has been reported to the credit bureaus, and it is affecting my credit score. I am working hard to improve my financial situation, and I hope that we can come to a resolution that benefits both parties.

Please let me know if there is any further information or documentation that you require from me to facilitate this process.

Thank you for your time and consideration.

Sincerely,

[Your Name]

2nd Letter To Collection Agency Sample

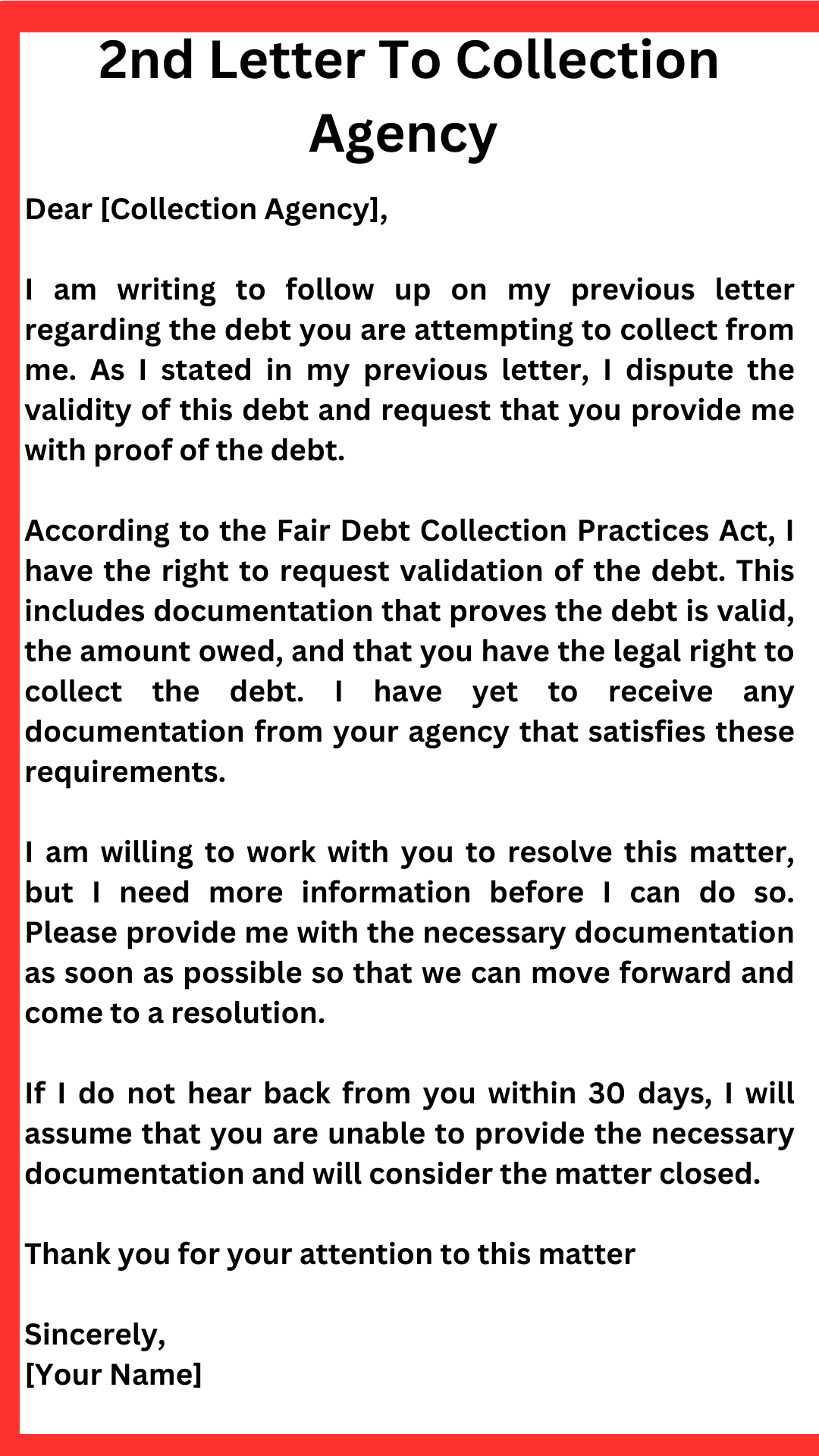

Dear [Collection Agency],

I am writing to follow up on my previous letter regarding the debt you are attempting to collect from me. As I stated in my previous letter, I dispute the validity of this debt and request that you provide me with proof of the debt.

According to the Fair Debt Collection Practices Act, I have the right to request validation of the debt. This includes documentation that proves the debt is valid, the amount owed, and that you have the legal right to collect the debt. I have yet to receive any documentation from your agency that satisfies these requirements.

I am willing to work with you to resolve this matter, but I need more information before I can do so. Please provide me with the necessary documentation as soon as possible so that we can move forward and come to a resolution.

If I do not hear back from you within 30 days, I will assume that you are unable to provide the necessary documentation and will consider the matter closed.

Thank you for your attention to this matter.

Sincerely,

[Your Name]

2nd Letter To Collection Agency Template

[Your Name]

[Your Address]

[City, State ZIP Code]

[Date]

[Collection Agency Name]

[Address]

[City, State ZIP Code]

Re: Account Number [Insert Account Number]

Dear Sir/Madam,

I am writing in response to your letter dated [Insert Date] regarding the above-mentioned account. I acknowledge that I owe the debt, but I am currently facing financial difficulties that have prevented me from making payments.

I would like to request that you work with me to come up with a payment plan that is affordable for me. I am willing to make regular payments to clear the debt as soon as possible. Please provide me with the necessary information to set up a payment plan.

I would also like to request that you stop any further collection activities until we have reached an agreement on the payment plan. I am hoping that we can resolve this matter amicably and avoid any legal action.

Please contact me at [Insert Phone Number] or [Insert Email] to discuss this matter further. I look forward to hearing from you soon.

Sincerely,

[Your Name]

2nd Notice Letter Sample To Collection Agency

[Your Name]

[Your Address]

[City, State ZIP Code]

[Date]

[Collection Agency Name]

[Address]

[City, State ZIP Code]

Re: Account Number [Insert Account Number]

Dear Sir/Madam,

I am writing this letter in reference to the above-mentioned account which has been placed with your agency for collection. This is the second notice letter that I am sending to you regarding this account.

I want to inform you that I have not received any communication from your agency regarding the status of this account. As per my records, the account is still showing an outstanding balance of [Insert Balance Amount]. I am willing to settle this account, but I need more information from your agency regarding the amount due and the payment options available.

I request you to provide me with a detailed statement of the account, including the principal amount, interest, and any other fees or charges. Also, please inform me about the payment options available and the deadline for making the payment.

I would appreciate it if you could respond to this letter as soon as possible, as I am eager to resolve this matter. If I do not receive a response from your agency within 10 days of receiving this letter, I will have no choice but to seek legal advice.

Thank you for your attention to this matter.

Sincerely,

[Your Name]

2nd Reminder Letter For Payment To Collection Agency

Dear [Debtor],

We are writing to remind you that your outstanding debt of [Amount] is still unpaid. This debt has been referred to our collection agency, [Agency Name], and we have been authorized to take further action to recover the amount owed.

We understand that you may be experiencing financial difficulties, but we urge you to prioritize the payment of this debt as it is affecting your credit score and may result in legal action being taken against you.

Please take immediate action to settle this debt by making a payment to [Agency Name] at the address provided below or by contacting us to discuss alternative payment arrangements.

[Agency Name]

[Address]

[Phone Number]

[Email]

We hope to hear from you soon and appreciate your cooperation in resolving this matter.

Sincerely,

[Your Name]

[Your Company]

2nd Letter To Collection Agency Foe Payment

Dear [Collection Agency],

I am writing to follow up on my previous letter regarding the outstanding debt that I owe. As I mentioned in my previous letter, I am committed to resolving this debt as soon as possible.

Unfortunately, due to unforeseen circumstances, I have not been able to make the payment as planned. However, I am still committed to paying off this debt and would like to work with you to come up with a payment plan that is feasible for me.

Please let me know what options are available to me and what steps I need to take to move forward with the payment process. I am willing to work with you to find a solution that works for both of us.

Thank you for your understanding and cooperation in this matter. I look forward to hearing back from you soon.

Sincerely,

[Your Name]

2nd Letter For Unpaid Invoice To Collection Agency

Dear [Collection Agency],

I am writing to follow up on the unpaid invoice for [service/product] that was due on [date]. Despite multiple attempts to contact the client, they have failed to make any payment towards the outstanding balance.

As per our agreement, I have now assigned this debt to your agency for collection. I am requesting that you take immediate action to recover the amount owed to me.

The total amount due is [amount], which includes the original invoice amount plus any late fees or interest charges that have accrued. I have attached a copy of the invoice and any relevant documentation for your reference.

Please keep me updated on the progress of your collection efforts and let me know if there is any additional information I can provide to assist you in this matter.

Thank you for your attention to this matter.

Sincerely,

[Your Name]

2nd Delinquent Notice Letter To Collection Agency

[Your Name]

[Your Address]

[City, State ZIP Code]

[Date]

[Collection Agency Name]

[Address]

[City, State ZIP Code]

RE: Account Number [Insert Account Number]

Dear Sir/Madam,

I am writing in reference to the above-mentioned account that was referred to your agency for collection on [Insert Date]. Despite your initial efforts, I have yet to receive any communication from your agency regarding the status of the account.

As per my records, the balance on the account is [$Insert Amount]. This balance has been outstanding for [Insert Time Period], and I have not received any communication from you regarding the account. I am concerned about the lack of communication and the status of the account.

I have attempted to reach out to your agency on multiple occasions, but I have been unable to get through to anyone. I have left several messages, but I have not received any response. I am now left with no other option but to send a second delinquent notice letter to your agency.

I am requesting that you provide me with an update on the status of the account and an explanation as to why I have not received any communication from your agency. I would also like to request that you provide me with a payment plan that I can use to settle the outstanding balance.

Please note that I am willing to work with your agency to resolve this matter. However, I need your cooperation to do so. I hope to hear from you soon.

Sincerely,

[Your Name]

2nd Letter For Overdue Balance To Collection Agency

Dear [Collection Agency],

I am writing to follow up on my previous letter regarding my overdue balance. Despite my previous efforts to settle the account, the balance still remains outstanding.

I understand the importance of paying my debts and I am committed to resolving this matter as soon as possible. However, due to unforeseen circumstances, I am currently experiencing financial difficulties that have prevented me from making payment in full.

I am willing to work with you to establish a payment plan that is feasible for me. I would appreciate your assistance in finding a solution that works for both of us.

Please let me know what options are available to me and how we can move forward with resolving this issue. I look forward to hearing from you soon.

Sincerely,

[Your Name]

2nd Letter To Collection Agency To Remove From Credit Report

Dear [Collection Agency],

I am writing to follow up on my previous letter regarding the negative entry on my credit report. As I stated in my previous letter, I do not believe this entry is accurate and I am requesting that it be removed from my credit report.

I have reviewed my credit report and the entry in question is still present. I understand that it may take some time to investigate and make changes to my credit report, but I would appreciate an update on the status of my request.

Please provide me with written confirmation that the negative entry has been removed from my credit report. If you are unable to do so, please provide me with a detailed explanation as to why the entry cannot be removed.

Thank you for your attention to this matter.

Sincerely,

[Your Name]

How to Write 2nd Letter To Collection Agency

Introduction

Writing a letter to a collection agency can be a daunting task, especially if you are not familiar with the process. However, it is essential to know how to write a second letter to a collection agency as it can help you resolve your debt issues and improve your credit score. In this article, we will discuss the steps to write a second letter to a collection agency.

Understand Your Rights

Before writing a second letter to a collection agency, it is crucial to understand your rights as a consumer. The Fair Debt Collection Practices Act (FDCPA) protects consumers from abusive debt collection practices. You have the right to dispute the debt, request validation of the debt, and ask the collection agency to stop contacting you.

Review Your First Letter

Before writing a second letter, review your first letter to the collection agency. Make sure you have included all the necessary information, such as your name, account number, and the amount of debt you owe. Also, check if you have requested validation of the debt and asked the collection agency to stop contacting you.

Include New Information

In your second letter, include any new information that you may have received since your first letter. For example, if you have received a response from the collection agency, include that in your letter. Also, if you have made any payments towards the debt, mention that in your letter.

Be Clear and Concise

When writing a second letter to a collection agency, be clear and concise. Explain your situation and the reason for writing the second letter. Avoid using complex language or industry jargon. Keep your letter simple and easy to understand.

Request for a Settlement

In your second letter, you can request a settlement from the collection agency. Offer to pay a lump sum amount or negotiate a payment plan. Be realistic with your offer and make sure you can afford to pay the agreed amount.

End the Letter Professionally

End your second letter to the collection agency professionally. Thank the agency for their time and consideration. Provide your contact information and request a response from them. Also, make sure to keep a copy of the letter for your records.

Conclusion

Writing a second letter to a collection agency can be stressful, but it is essential to resolve your debt issues. Make sure to understand your rights, review your first letter, include new information, be clear and concise, request for a settlement, and end the letter professionally. By following these steps, you can increase your chances of resolving your debt issues and improving your credit score.

Mistakes to Avoid When You Write 2nd Letter to Collection Agency

Introduction

Writing a letter to a collection agency can be a daunting task, especially if it’s your second letter. It’s important to remember that the way you write your letter can have a significant impact on the outcome of your situation. In this article, we will discuss the common mistakes people make when writing their second letter to a collection agency and how to avoid them.

Mistake #1: Being Rude or Aggressive

One of the biggest mistakes people make when writing their second letter to a collection agency is being rude or aggressive. It’s important to remember that the person reading your letter is just doing their job, and being rude or aggressive will not help your situation. Instead, try to be polite and professional in your tone. Explain your situation and ask for their help in resolving it.

Mistake #2: Not Being Clear and Concise

Another mistake people make when writing their second letter to a collection agency is not being clear and concise. It’s important to clearly explain your situation and what you are requesting from the collection agency. Use short and simple sentences to make your point. Avoid using complex terminology that may confuse the reader.

Mistake #3: Not Including Relevant Information

When writing your second letter to a collection agency, it’s important to include all relevant information. This may include your account number, the amount owed, and any previous correspondence you have had with the collection agency. By including all relevant information, you can help the collection agency better understand your situation and work towards a resolution.

Mistake #4: Not Proofreading Your Letter

Before sending your second letter to a collection agency, it’s important to proofread it for errors. Spelling and grammar mistakes can make you appear unprofessional and may hurt your chances of resolving your situation. Take the time to read through your letter carefully and make sure it is error-free.

Mistake #5: Not Following Up

After sending your second letter to a collection agency, it’s important to follow up. If you don’t hear back from the collection agency within a reasonable amount of time, follow up with a phone call or another letter. This shows that you are serious about resolving your situation and can help move the process forward.

Conclusion

By avoiding these common mistakes, you can increase your chances of resolving your situation with a collection agency. Remember to be polite and professional, include all relevant information, proofread your letter, and follow up if necessary. With these tips in mind, you can write an effective second letter to a collection agency.

Related:

2nd Grade Welcome Letter To Parents (10 Samples)

Authorization Letter To Claim Passport (10 Samples)

Authorization Letter To Claim Money (10 Samples)