Are you struggling to write a letter to your insurance company? Do you need a little help getting started? Look no further than our 21 Day Letter To Insurance Claims guide.

In this article, we will provide you with templates, examples, and samples of 21 Day Letter To Insurance Claims. Our goal is to make it easy for you to write any letter that you need to write. Whether you’re dealing with a car accident, property damage, or a denied claim, we’ve got you covered.

Key points of this article:

– We will share samples of 21 Day Letter To Insurance Claims

– We will share how to write a letter effectively

– We will provide Do’s and Don’ts to help you avoid common mistakes.

21 Day Letter To Insurance Claims

Dear Sir/Madam,

I am writing to you regarding the claim that I submitted to your company on [insert date]. It has been 21 days since I submitted my claim and I have yet to receive any updates or communication from your end.

I understand that processing claims can take time, but I would appreciate it if you could provide me with an update on the status of my claim. As per the terms and conditions of my insurance policy, I am entitled to a prompt and fair resolution of my claim.

I would also like to remind you that under the California Fair Claims Settlement Practices Regulations, insurance companies are required to acknowledge and respond to claims within 15 days. As it has been more than 21 days since I submitted my claim, I urge you to take immediate action and provide me with a response.

I have attached all the necessary documents and information required to process my claim. If there is any additional information that you require, please let me know and I will provide it promptly.

I hope to hear from you soon regarding the status of my claim. Thank you for your attention to this matter.

Sincerely,

[Your Name]

21 Day Authorization Letter To Insurance Claims

[Your Name]

[Your Address]

[City, State ZIP Code]

[Date]

[Insurance Company Name]

[Address]

[City, State ZIP Code]

Dear Sir/Madam,

I am writing this letter to authorize [Name of Authorized Person] to handle my insurance claims for the next 21 days. Due to some personal reasons, I will not be able to handle my insurance claims during this period, and I trust [Name of Authorized Person] to take care of any issues that may arise.

I am providing [Name of Authorized Person] with all the necessary documents, including my insurance policy details, medical records, and any other relevant information that may be required to process my claims. I hereby authorize [Name of Authorized Person] to act on my behalf and make decisions regarding my insurance claims.

I understand that this authorization will be valid for 21 days from the date of this letter, and after that, I will resume handling my insurance claims. In case of any emergency or unforeseen circumstances, I will notify the insurance company immediately.

I appreciate your understanding and cooperation in this matter. Please let me know if you require any further information or documentation.

Sincerely,

[Your Name]

21 Day Letter To Insurance Claims To Insurance Company

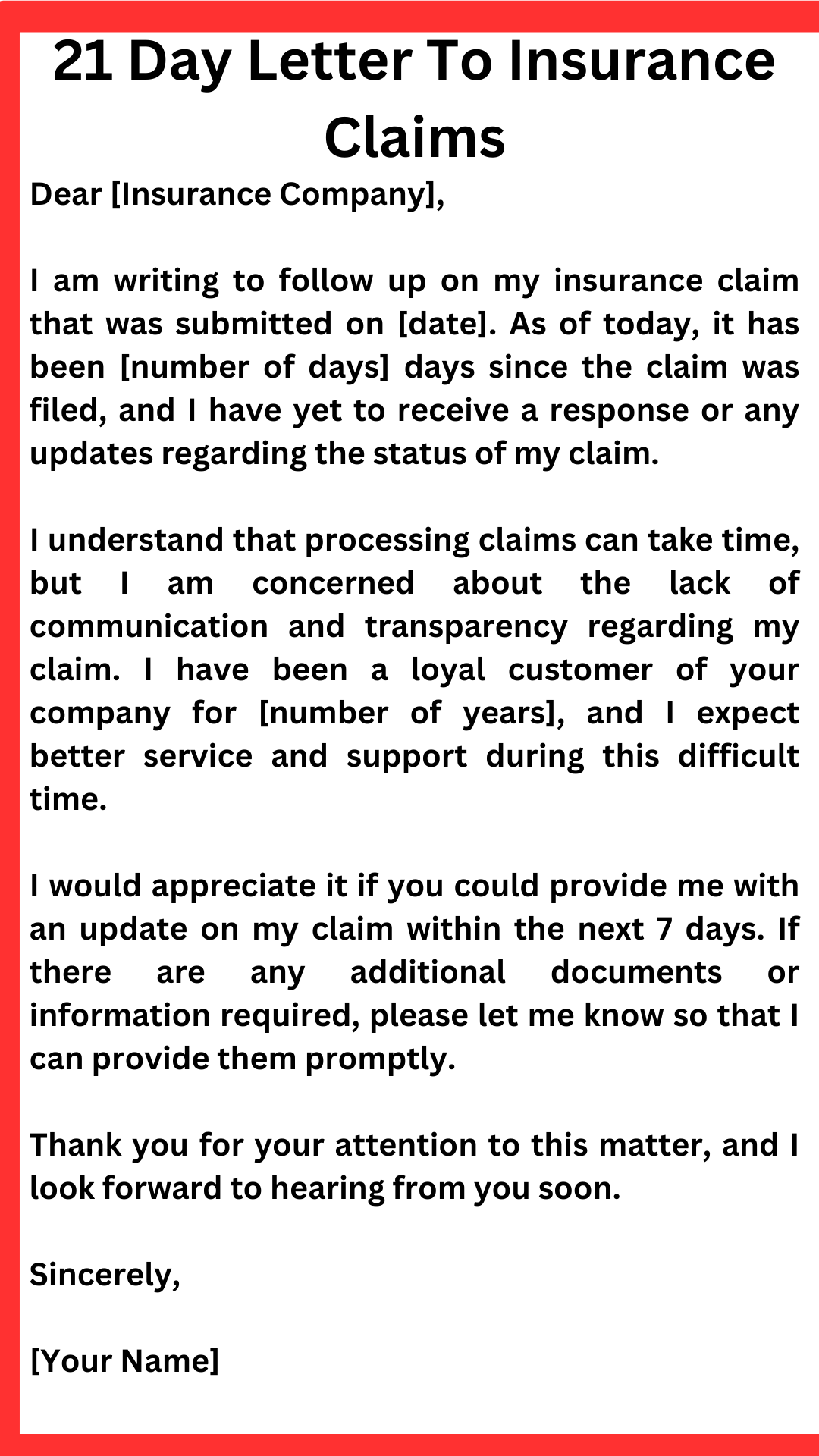

Dear [Insurance Company],

I am writing to you regarding my recent insurance claim for [insert reason for claim]. It has been 21 days since I submitted my claim, and I have yet to receive a response from your company.

As a policyholder, I am disappointed with the lack of communication and service provided by your company. I understand that processing claims can take time, but I would appreciate regular updates on the status of my claim.

I urge you to prioritize my claim and provide a prompt response. I have paid my premiums faithfully and expect to receive the coverage I am entitled to.

Please let me know the status of my claim as soon as possible. I look forward to hearing from you.

Sincerely,

[Your Name]

21 Day Letter To Insurance Claims For Car Accident

[Your Name]

[Your Address]

[City, State ZIP Code]

[Date]

[Insurance Company Name]

[Address]

[City, State ZIP Code]

RE: Claim Number [Insert Claim Number]

Dear Sir/Madam,

I am writing this letter to follow up on my car accident claim, which was filed with your company on [Insert Date]. It has been [Insert Number of Days] days since the accident, and I have not received any update on the status of my claim.

As per the terms and conditions of my insurance policy, I am entitled to timely and efficient service from your company. However, the lack of communication and delay in processing my claim has caused me significant inconvenience and financial hardship.

I would appreciate it if you could provide me with an update on the status of my claim and the estimated time frame for its resolution. I have attached all the necessary documents and information to support my claim.

I urge you to expedite the processing of my claim and settle it as soon as possible. I have been without a car for [Insert Number of Days] days, and the expenses for transportation and rental car are becoming unaffordable.

Please let me know if there is any further information or documentation required from my end to facilitate the claim process.

Thank you for your attention to this matter.

Sincerely,

[Your Name]

21 Day Letter To Insurance Claims Sample

[Your Name]

[Your Address]

[City, State ZIP Code]

[Date]

[Insurance Company Name]

[Address]

[City, State ZIP Code]

Re: Claim Number [Insert Claim Number]

Dear Sir/Madam,

I am writing this letter to follow up on my insurance claim that was filed on [Insert Date]. It has been 21 days since I submitted my claim, and I have not received any communication from your company regarding the status of my claim.

As per the terms of my insurance policy, I am entitled to receive a prompt and fair settlement of my claim. However, the lack of communication from your company has left me in a state of uncertainty and financial strain.

I request you to provide me with an update on the status of my claim and the estimated time frame for the settlement process. I have attached all the necessary documents and information required to process my claim.

I would appreciate it if you could expedite the settlement process and provide me with a prompt resolution to my claim. If I do not receive a response from your company within the next five business days, I will have no choice but to escalate this matter to the relevant regulatory authorities.

Thank you for your attention to this matter.

Sincerely,

[Your Name]

21 Day Letter To Insurance Claims To Insurance Office

[Your Name]

[Your Address]

[City, State ZIP Code]

[Date]

[Insurance Company Name]

[Insurance Company Address]

[City, State ZIP Code]

RE: Claim Number [insert claim number]

Dear Sir/Madam,

I am writing to follow up on my insurance claim, which was filed on [insert date]. As it has been 21 days since I filed the claim, I would like to request an update on the status of my claim.

I have provided all the necessary information and documentation to support my claim, and I trust that your team is diligently processing it. However, I would appreciate it if you could provide me with an estimated timeline for when I can expect to receive a decision on my claim.

I understand that the claims process can be complex and time-consuming, but I would appreciate your prompt attention to my claim. If you require any additional information or documentation from me, please let me know, and I will be happy to provide it.

Thank you for your time and attention to this matter. I look forward to hearing from you soon.

Sincerely,

[Your Name]

21 Day Letter To Insurance Claims Template

[Your Name]

[Your Address]

[City, State ZIP Code]

[Date]

[Insurance Company Name]

[Address]

[City, State ZIP Code]

RE: Claim Number [Insert Claim Number]

Dear Sir/Madam,

I am writing to follow up on my insurance claim, which was filed on [Insert Date]. It has been [Insert Number of Days] days since I filed my claim, and I have yet to receive a response from your company.

As per my policy, I am entitled to timely and efficient service from your company. However, the delay in processing my claim has caused me significant inconvenience and financial strain. I have attached all the necessary documents and information required to process my claim, and I kindly request that you expedite the process.

I would appreciate it if you could provide me with an update on the status of my claim within the next 7 days. If I do not hear from you within this timeframe, I will be forced to escalate the matter to the relevant regulatory authorities.

Thank you for your prompt attention to this matter.

Sincerely,

[Your Name]

21 Day Letter To Insurance Claims For House

Dear [Insurance Claims Department],

I am writing to follow up on my claim for damages to my home that occurred on [date of incident]. As per our policy agreement, I am entitled to receive compensation for the damages sustained to my property.

It has been [number of days] since I filed my claim, and I have yet to receive any updates or communication from your department. I understand that the process may take some time, but I would appreciate any information you can provide regarding the status of my claim.

I have attached all necessary documentation, including photos and estimates for repairs, to support my claim. I am available to provide any additional information or answer any questions you may have.

As a valued customer, I trust that your department will handle my claim with the utmost attention and care. I look forward to hearing from you soon regarding the status of my claim.

Thank you for your time and attention to this matter.

Sincerely,

[Your Name]

21 Day Letter To Life Insurance Claims

Dear Life Insurance Claims Department,

I am writing to inform you of the passing of my loved one and to initiate the claims process for their life insurance policy. The policy number is [insert policy number] and the insured’s name is [insert insured’s name].

The date of death was [insert date] and the cause of death was [insert cause of death]. I have attached a certified copy of the death certificate for your records.

As the beneficiary of the policy, I am requesting that the death benefit be paid out to me as soon as possible. The proceeds will be used to cover funeral expenses and to provide financial support for myself and any dependents left behind.

Please let me know if there are any additional forms or documents required to process the claim. I can be reached at [insert contact information] if you have any questions or need further information.

Thank you for your prompt attention to this matter.

Sincerely,

[Your Name]

21 Day Appeal Letter To Insurance Claims

Dear [Insurance Company],

I am writing to appeal the decision made regarding my insurance claim for [specific medical procedure or treatment]. I understand that the claim was denied due to [reason for denial], but I strongly believe that this decision was made in error.

I have been a loyal customer of your insurance company for [number of years], and I have always paid my premiums on time. I have never had to file a claim before, and I was shocked and disappointed to learn that my claim was denied.

I have consulted with my healthcare provider, who has recommended that I receive the medical procedure or treatment that was denied by your company. This procedure or treatment is essential to my health and well-being, and I cannot afford to pay for it out of pocket.

I have attached all relevant medical records and documentation to support my appeal, and I urge you to reconsider your decision. I am confident that with careful review of my case, you will see that this procedure or treatment is necessary and should be covered under my policy.

I appreciate your time and attention to this matter, and I look forward to hearing a positive response from you soon.

Sincerely,

[Your Name]

How to Write a 21 Day Letter to Insurance Claims

Introduction

When it comes to filing an insurance claim, there are certain procedures that need to be followed. One of these procedures is writing a 21 day letter to the insurance company. This letter serves as a formal notice to the insurance company that you intend to take legal action if they do not respond to your claim within 21 days. In this article, we will guide you on how to write a 21 day letter to insurance claims.

Heading

The first step in writing a 21 day letter to insurance claims is to ensure that you have all the necessary information. This includes the date of the incident, the policy number, and the details of the claim.

Heading

The next step is to clearly state the purpose of the letter. This should be done in the first paragraph of the letter. You should state that you are writing to give notice to the insurance company that you intend to take legal action if they do not respond to your claim within 21 days.

Heading

In the second paragraph, you should provide a brief summary of the incident that led to the claim. This should include the date, time, and location of the incident, as well as any other relevant details.

Heading

The third paragraph should outline the damages that you have suffered as a result of the incident. This should include any medical expenses, lost wages, or other costs that you have incurred.

Heading

In the fourth paragraph, you should state the amount of compensation that you are seeking from the insurance company. This should be based on the damages that you have suffered as a result of the incident.

Heading

The fifth paragraph should state that you have already contacted the insurance company and that they have failed to respond to your claim within 21 days. You should also state that you have made attempts to resolve the matter amicably, but that these attempts have been unsuccessful.

Heading

In the final paragraph, you should state that if the insurance company fails to respond to your claim within 21 days, you will be forced to take legal action. You should also provide your contact information so that the insurance company can reach you if they have any questions or concerns.

Conclusion

Writing a 21 day letter to insurance claims can be a daunting task, but it is important to follow the proper procedures to ensure that your claim is taken seriously. By following the steps outlined in this article, you can write a clear and concise letter that will protect your legal rights and help you get the compensation that you deserve.

Mistakes to Avoid When You Write 21 Day Letter To Insurance Claims

Introduction

Writing a letter to an insurance company can be a daunting task, especially when it comes to the 21-day letter. This letter is crucial because it serves as a legal document that can help you get the compensation you deserve. However, there are common mistakes that people make when writing this letter that can jeopardize their chances of getting the compensation they deserve. In this article, we will discuss the mistakes to avoid when writing a 21-day letter to insurance claims.

Mistake 1: Failing to Provide Complete Information

One of the biggest mistakes people make when writing a 21-day letter to insurance claims is failing to provide complete information. This information includes the date and time of the accident, the location, the names and contact information of any witnesses, and a detailed description of the damages and injuries sustained. Failing to provide complete information can delay the processing of your claim or even result in a denial.

Mistake 2: Not Being Specific About Damages and Injuries

Another common mistake people make when writing a 21-day letter to insurance claims is not being specific about the damages and injuries sustained. It is important to provide a detailed description of the damages and injuries, including the extent of the damage and the severity of the injuries. This information will help the insurance company accurately assess the value of your claim.

Mistake 3: Using Emotional Language

When writing a 21-day letter to insurance claims, it is important to avoid using emotional language. Emotional language can make it difficult for the insurance company to take your claim seriously. Stick to the facts and avoid using language that can be perceived as aggressive or confrontational.

Mistake 4: Not Seeking Legal Advice

Another mistake people make when writing a 21-day letter to insurance claims is not seeking legal advice. A lawyer can help you understand your rights and ensure that your claim is handled properly. They can also help you avoid common mistakes that can jeopardize your claim.

Mistake 5: Not Following Up

Finally, it is important to follow up on your claim after you have submitted your 21-day letter to insurance claims. This will help ensure that your claim is being processed and that you are receiving the compensation you deserve. If you do not follow up, you may miss important deadlines or opportunities to provide additional information that can help your claim.

Conclusion

Writing a 21-day letter to insurance claims can be a complex process, but avoiding these common mistakes can help ensure that your claim is handled properly. By providing complete information, being specific about damages and injuries, avoiding emotional language, seeking legal advice, and following up on your claim, you can increase your chances of getting the compensation you deserve.

Related:

24 Hour Visletter Tovietnam (10 Samples)

24 Hour Fever Letter To Parents From School (10 Samples)

24 Hour To Comply Letter (10 Samples)